The lending market is developing at a rapid pace in the conditions of a market economy, allowing a person to finance absolutely any transaction - the purchase of apartments, cars, consumer needs, etc. But the existing credit system has a number of shortcomings, both for borrowers and for creditors. The main problem facing a borrower is the large amount of overpayment for a loan. Even with an early repayment of a loan, a borrower first pays the amount of interest, and then the amount of the principal debt. This method of repaying a loan is called annuity. Banks refuse a differentiated way as automatic conversion of interest, depending on the remaining amount of debt, is unprofitable for them. As a result, a user receives the amount he/she needs with a significant overpayment, reaching about 25%. The decentralized Distributed Credit Chain system (abbreviated DCC) offers a credit system which eliminates banks as an intermediaries, and customers receive cash for available interest.

Key Features of DCC

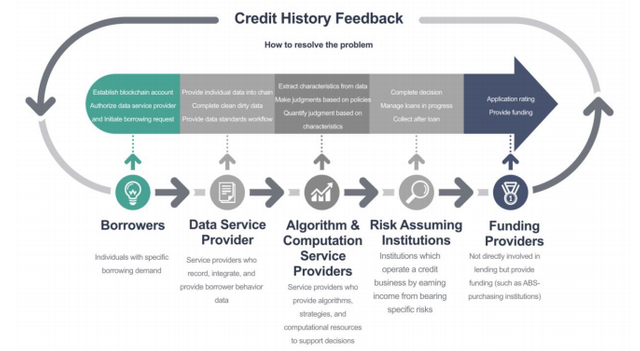

The main objective of the project is to create an ecosystem for suppliers and consumers of financial services around the world. DCC greatly simplifies the usual scheme of obtaining a loan. Now there is no need to collect a large number of documents. Terms for consideration of the application are also reduced due to the work of artificial intelligence, which, using patented algorithms, analyzes the current credit history of a borrower. The work of DCC provides the payment of interest only for the actual time using the loan, completely excluding the annuity model.

Advantages of DCC

The work of the platform is based on blockchain technology, which provides transparent and safe operation on the server. Each borrower is reliably protected from unilateral revision of the terms of the contract. The platform database cannot be hacked, because it does not have a single repository. All data is distributed over independent network nodes.

The work on the platform is carried out through the passage of a standard registration procedure with the subsequent choice of the direction of work - a creditor or a borrower. A borrower downloads the documents identifying him in the system. As each loan is repaid, a credit history is formed on a borrower, who gains the positive rating by the timely repayment. The rating is reliably protected from hacking, and a borrower cannot raise it by artificial methods.

The platform provides a wide range of services, not yielding to a bank. So, consumer loans, car loans, mortgages and the ability to get a credit card are among them. Rapid approval for the use of listed financial services is achieved through the use of artificial intelligence. The sequential transfer of information between a credit inspector, a security service, and a legal service is excluded. Artificial intelligence processes information from a financial and legal point of view in parallel, shortening time and eliminating the possibility of errors in analysis.

All transactions on the project are carried out using smart contracts, excluding hidden fees and increasing the speed of operations. Work on the project is beneficial to both lenders and borrowers. P2P payments allow reducing the excessive costs of paying intermediaries in the form of banks.

DCC cryptocurrency

DCC tokens are used to perform calculations on the project. The general release of cryptocurrency amounted to 10 billion tokens, of which 20% were directed for sale. The project’s crowdsale is already over. This is due to the high interest to the platform and the premature achievement of the required level of the hardcap. Now DCC can be purchased at the exchanges. There is no additional issue of cryptocurrency.

Summary

Thus, DCC project is the embodiment of a new innovative approach to lending. Decentralized blockchain allows conducting operations without intermediaries by means of P2P, increasing the income of a lender and reducing a borrower's expenses.

The project was launched at the beginning of last year, and the beta version of the platform has already been launched. By the end of the year, the project will implement the risk assessment option for creditors through loan portfolio analysis. A full set of analytical tools and an expanded list of financial services will be available by 2020.

Links:

Website: https://dcc.finance/

WhitePaper: https://dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/dccfinance_bot

Facebook: https://bit.ly/2LucSz6

Twitter: https://twitter.com/DccOfficial2018/

Medium: https://medium.com/@dcc.finance2018

ANN: https://bitcointalk.org/index.php?topic=3209215.0

Author: https://bitcointalk.org/index.php?action=profile;u=980049

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

Hi! One of the key features that sets Robinhood apart from traditional brokerage firms is commission-free trading. This means users can buy and sell stocks, ETFs, options, and cryptocurrencies without having to pay any fees. This is a game changer for many investors as trading fees can quickly add up and eat into potential profits, which is why many in robinhood reviews rate this app highly and are happy to use it as it is very profitable, especially for new investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit