Money moves the world. Nearly all activities done are geared towards some profit made in terms of money or of assets of equal value. The recession in ’08 is a constant reminder of the power of money and how it can change the course of history in an instant. However, it is also a lesson that has opened up minds on how to safeguard what is already built. Part of the lesson learnt is that centralized institutions were a huge cause of the recession and other money problems plaguing the world. The creation of blockchain technology and the discovery of its uses opened up minds allowing the world the ability to see the great benefits of decentralized networks especially in the financial sector. Distribute Credit Chain or DCC is venturing into the credit scene through blockchain to provide a decentralized network that will serve financial solution providers globally. DCC aims to realize finance that is truly inclusive through technology and giving data ownership to individuals making up their network.

A toxic, centralized system

It may be a hard pill to swallow but it is the truth. The current financial system is riddled with problems for the users of financial services while great rewards are obtained by those who are at the helm or centers of this system. Take for example, the credit industry, which is the main focus of DCC, the aim is to have bad debts cleared up by those who are likely to pay back their debts. This is usually cushioned by interests but lately, in most economies, lending rates are through the roof while lenders receive peanuts from their input. This, in turn, reduces the number of those who can borrow, thus fewer investments are made. It makes the economy run in a dangerous situation where little or no new money is being created. This happens while top officials in centralized platforms mint hundreds of thousands in US$ yearly.

Moreover, financial institutions are becoming more of profit-making institution, serving the people only if profits are guaranteed. Most initiatives lean more on the profit side than on the service, the charges outweigh the services delivered to consumers.

Time is the other wasted resource in this system. A lot of time is spent running background checks on borrowers to determine whether they meet the set criteria for borrowing set by institutions. The amount of resources spent, apart from time, to maintain such a database and all other activities revolving around this data is also enormous.

Changing the norm

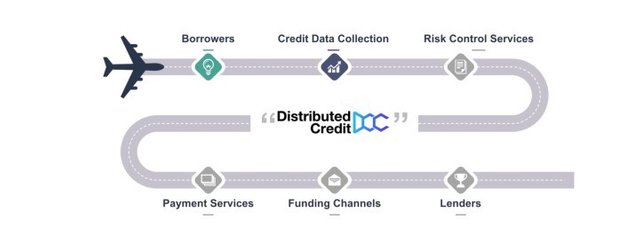

DCC will shake-up the credit industry by decentralizing the process of borrowing up to the consumer level. It plans to even feature C2C loans where borrowers are linked to willing lenders. The agreement between these two parties can be made offline before all the digital documents are signed and authenticated by both parties. DCC will also feature loaning options that provides anonymity as an option such that the entire process can be done without both parties ever knowing their partner.

Borrowing and Lending using DCC will go beyond the basic currency that traditional financial services provide. Borrowing and lending of digital assets will also be made available. This move may even help create liquidity for the digital asset market in the future.

The traditional financial markets are vigorously reliant on brought centralized banking establishments, with key client credit information and exchange information controlled by a bunch of super measured financial firms. By differentiate's, DCC will likely fill in as an open chain for distributed banking, setting up a decentralized financial exchanging framework. In DCC's structure, every individual has full control over their credit data.  Financial organizations are then ready to give numerous aggressive administrations to clients as indicated by their advanced credit information and there are no settled connections among foundations.

Financial organizations are then ready to give numerous aggressive administrations to clients as indicated by their advanced credit information and there are no settled connections among foundations.

DCC's client account framework depends on decentralized DCCID which guarantees that exchanges and credit information can't be messed with. Individual credit information reports are put away in the cloud, while all information transmissions are encoded for the largest amount of security. Blockchain's canny contract communication design effectively moves individual information from the grip of unified credit foundations to decentralized people.

The DCC framework is open design as well, which means any gathering can make astute contracts in light of open standard conventions or create DApps (decentralized applications) to extend the DCC condition.

DCC will eventually change the financial market structure, utilizing advancement to drive change from concentrated to distributed and decentralized.

For what reason do we require DCC?

The traditional financial industry is profoundly centralized.Financial exchanges depend vigorously on the underwriting and support of extensive financial establishments, with generous exchange charges paid out to these foundations. Monopolistic financial foundations have in truth raised loaning rates for borrowers and decreased the intrigue pay for banks. Now and again, go-betweens have even contorted the credit rating of borrowers for their own advantage, making it outlandish for loan specialists to precisely recognize chance, which can have a destabilizing impact on the market. The episode of the 2008 financial emergency, to a substantial degree, was the upshot of over the top avarice and an entire carelessness of market chance by a few noteworthy venture banks.

Open chains for distributed banking in light of blockchain innovation have now broken this restraining infrastructure. As the principal at any point distributed blockchain financial administration stage, DCC can basically annul exchange expenses and commissions while giving a safe and advantageous administration that is reasonable for traditional financial establishments. On DCC's open chain, every financial administration firms have rise to status, and they offer for clients in view of similar criteria. There are never again a monopolistic rare sorts of people who "control the entirety".

CONCLUSION

DCC aims to achieve these feats by improving on where traditional systems failed. Handling of user information, clear assessment of history, an updated platform technologically among other improvements are set to be realized through DCC’s platform. The decentralized approach may also lead to decentralized thinking in the market such that P2P transactions increase through DCC. All these changes proposed by DCC will meet the regulations set by various governing bodies to avoid any collisions with the law.

Disruption is inevitable wherever blockchain in involved. Change is coming in the credit scene!

Resources

Website

Whitepaper

Facebook

Telegram

ANN Bitcointalk

Written by lewis17

https://bitcointalk.org/index.php?action=profile;u=2181578

Nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post!

Thanks for tasting the eden!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @paulewis! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit