The downfall of LUNA and FTX is still hurting the market. Although the total trading volume of crypto slightly rebounded at the beginning of the year, we have also heard bad news.

Gemini co-founder Cameron Winklevoss publicly requested DCG founder Barry Silbert to repay more than $900 million in debt. Moreover, Cameron revealed that DCG is also facing other outstanding debts and interests. Despite Barry’s denial on social media, back in late 2022, we were told that Genesis, a subsidiary of DCG, suspended withdrawals due to the fall of 3AC and FTX.

Some investors might not be familiar with DCG and its subsidiaries. Here’s a brief introduction:

DCG (Digital Currency Group) is a venture capital company investing in Bitcoin and blockchain technology, and both Genesis and Grayscale are DCG subsidiaries.

Most of you are no strangers to Genesis. Acclaimed as the world’s largest crypto lending platform, Genesis launched the first over-the-counter Bitcoin trading desk in the United States. In 2018, the company became the fifth company to obtain a Bit License from the Department of Financial Services (DFS), and its business scope covers transactions, lending, and custody.

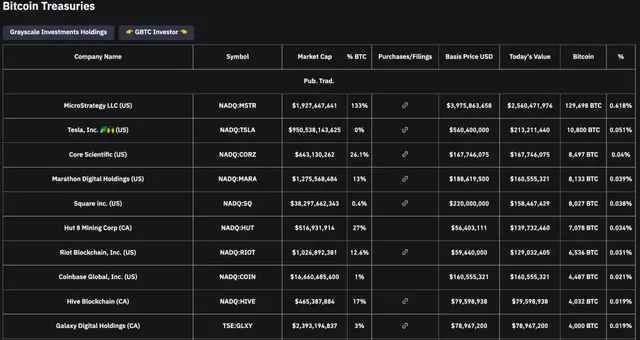

Most senior investors are familiar with Grayscale, a professional crypto trust company mainly offering GBTC securities. As a product less riskier than cryptocurrency, GBTC is favored by many traditional institutional investors, making it a key channel for traditional investors to invest in crypto. This is why Grayscale was once regarded as a barometer for crypto bulls.

Let’s go back to GBTC for a moment. Backed by the BTC holding of Grayscale, GBTC (Grayscale Bitcoin Trust) is a trust publicly traded on conventional exchanges. During the bull market, GBTC was always traded at a premium, which encouraged institutional investors in the space to purchase GBTC for arbitrage, which means that, simply put, investors subscribe to GBTC with their BTC holding and then lend out BTC by pledging the GBTC purchased with Genesis when there’s a premium, and they earn profits by repeating that same process.

It should be noted that users can get GBTC by purchasing BTC, but they cannot convert GBTC into BTC. Today, with 40,000 BTC, DCG is still the 10th largest listed company in the world in terms of Bitcoin holding.

How come this seemingly unassailable crypto giant is now publicly accused of not paying its debts?

Speaking of that, we must mention the two major crypto scandals in 2022. First, there was the fall of 3AC. Following the meltdown of LUNA and UST, 3AC also filed for bankruptcy, and the company also happened to be one of the many arbitrageurs. At the time 3AC owed Genesis about $2.36 billion after the market turned bearish and GBTC lost its premium advantage, a fact that remained unknown to the public until its liquidation.

As they say, it never rains but it pours. Before Genesis could fully recover from the 3AC bankruptcy, FTX went bust. The derivatives branch of Genesis not only owned $175 million in assets with FTX but also used SOL as one of the collaterals of the platform. Due to all kinds of factors, Genesis became trapped in a crisis.

Of course, there were feuds between the founders, but we won’t go into that. Right now, for most crypto investors, the top concern is whether DCG will also go bankrupt during the bear market. After all, as a GBTC creditor, DCG can apply for forced liquidation and then convert GBTC into BTC to cover its debt, and DCG’s fall is possible.

That said, no matter how it goes, eventually, investors are the ones who will have to bear the losses. Ponzi schemes are not the only factor behind the deleveraging last year. It also revealed that a number of crypto companies have misused user assets. Fortunately, following a series of events, the crypto market is becoming more open and transparent. Meanwhile, many first-rate crypto companies have stood out from the negative incidents.

CoinEx, a global crypto exchange that just celebrated its fifth birthday, is one of such outstanding players. Since its inception, the exchange has maintained a “zero-accident” record. Recently, CoinEx released its Merkel Tree proof (https://www.coinex.com/activity/market-maker) to help users clearly see the status of their assets, which significantly enhanced trust in CoinEx.

So far, the exchange has been recognized by over 4 million users in more than 200 countries and regions. We believe that the market will become more trustworthy as it goes through ups and downs. Meanwhile, CoinEx will earn more extensive user recognition with easy-to-use crypto trading products and services.

Disclaimer: This article offers no investment advice, and all statistics mentioned herein are for reference only. The information provided herein may not be relied upon for investment decisions, for which you will be fully liable.