What is foreign exchange delivery?

Foreign exchange delivery refers to the act of collecting and paying foreign exchange on the condition and date agreed upon by the parties after the foreign exchange sale and purchase. Modern telecommunications technology has greatly simplified the foreign exchange trading process, and it takes only a few seconds for the two parties to negotiate a foreign exchange transaction. Afterwards, the two parties sent a confirmation message to each other on the details of the transaction, and arranged specific matters for delivery. In the practice of foreign exchange transactions, due to the type of currency being delivered, the business day of the two places, etc., the effective time and place of the money transfer will be involved, and it needs to be explained by international common practice. The place where the money is transferred is usually referred to as the settlement location, and is represented by the name of a financial institution in a certain city of a certain country.

If the transaction currency is not the currency of the transaction, the settlement location may be inconsistent with the location of the transaction. Due to different customs and habits in different countries, holidays and business days may also be different, so different settlement locations will cause differences in settlement time. If the time difference between the funds transfer is too large, it will not only bring credit risk, but also generate interest problems. The delivery date is also called the settlement date or the value date. According to international practice, the value date must be the business day of the country in which the currency is traded (most countries open from Monday to Friday, unless there are holidays; Islamic countries are non-business days on Friday, and Saturday and Sunday are It is business day).

How to distinguish between foreign exchange spot trading and foreign exchange futures trading?

The foreign exchange spot market is the general term for the spot foreign exchange market. It refers to the market formed by the foreign exchange transactions that are immediately concluded and delivered within two business days.

Forex futures refers to the method of foreign exchange delivery that is delivered at the agreed exchange rate within the agreed expiration date of the contract after the transaction between the seller and the buyer. The buyer and the seller promise to be on a specific date in the future after the futures transaction is closed. To deliver a certain standard amount of foreign currency at the price currently agreed, that is, a contract between the buyer and the seller at the agreed quantity, price, and delivery date.

Liquidity comparison

In the foreign exchange market, the daily transaction volume is as high as 6 trillion US dollars, which is the largest and most liquid market in the world. The daily trading volume of the futures market is only 30 billion US dollars. The strong liquidity of the foreign exchange market enables the market position to be effectively settled, and the stop-loss order is executed smoothly, but the number of stop-loss orders will not drop significantly.

Trading place comparison

Foreign exchange spot is generally traded through interbank or forex brokers. The difference between the trading volume in the middle is actually the cost charged by the bank and the foreign exchange broker. The foreign exchange futures trading is carried out in the futures exchange, and the buyer and the seller reach the specified trading date, place, price and quantity of the contract transaction through open bidding. For example, the Chicago Board of Trade, the New York Mercantile Exchange, and so on.

Investor comparison

The volume of foreign exchange spot trading is huge, and traders are mainly transactions between banks, foreign exchange brokers and investors. Foreign exchange futures are different. It is a futures contract with exchange rate as the subject matter. It is mainly used by foreign trade industries and companies to hedge and avoid exchange rate risks. Individual speculators are only a small part of foreign exchange futures trading.

Transaction security and reliability

Foreign exchange futures are all part of the futures industry in various countries. They are strictly regulated by the regulatory authorities of various countries, and the security of transactions is high. However, foreign exchange spot trading, regulatory systems and regulations are not yet perfect, and no country has a perfect supervision mechanism. The supervision of it is generally based on the supervision and regulation of foreign exchange futures after the incident.

In terms of reliability, foreign exchange futures have specialized exchanges to organize transactions, so it is more reliable; and foreign exchange spot is the tacit agreement and self-issuance between banks. Once there are political factors or other factors, the quotation will inevitably be affected.

What is a Liquidity Provider (LP)?

In the foreign exchange market, a description of the liquidity supplier (LP) is often seen. The liquidity supplier is abbreviated as LP, the full name is Liquidity Provider.

The liquidity of the market is important for any transaction. It represents the ability of assets to be liquidated at a reasonable price. Simply put, a certain number of transactions are executed at the fastest rate. Higher liquidity means relatively lower transaction costs.

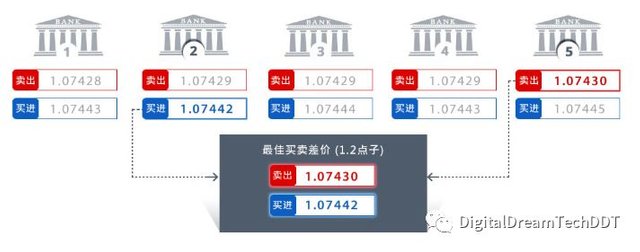

The foreign exchange market is the world's most liquid market, with large banks, central banks, institutional investors, currency speculators, companies, governments, other financial institutions and retail investors. In the past, banks, governments and companies were major players in foreign exchange transactions. With the development of the Internet platform, the proportion of retail investors has increased year by year.

Since foreign exchange transactions are OTC transactions, brokers or dealers can directly match each other, so there is no need to go through an exchange or clearing house. As a retail investor, you can trade through a platform vendor. In the actual foreign exchange trading, the customer's instructions may involve slippage, and sufficient liquidity and huge trading volume can avoid excessive slippage. A highly transparent platform is quite critical at this point.