Debitum network is trying to create a platform which would allow small businesses to gain financing quite easily. It would utilize the Ethereum blockchain in order to do so. Moreover, the platform would be completely decentralized and especially for small and medium enterprises. Owing to this very reason, it would be easier for businesses to continuously raise money on the platform.

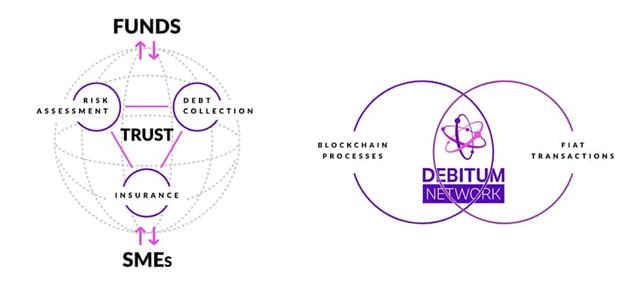

The platform would be operated using smart contracts. Owing to this very reason, it would be very easy for the companies to raise money. Moreover, not just the borrowers and lenders, the other stakeholders would be included in the platform as well. Some of these stakeholders would include document validators, insurance companies as well as other investors. Thus, the full-fledged platform would be easily created.

What challenge is Debitum addressing?

A $2.5 trillion gap of SEM funding. While the big financial institutions work with big players, many small and medium enterprises are left unbanked. Lack of available finance slows their growth while having negative impacts to on economy. SMEs are the backbones of our economies, most of the new jobs are created at SMEs. However, due to the lack of interest from big financial institutions like banks, this area is left without an available stream of credit. Funds are allocated for big players while

What is the scale of this challenge?

it is a global problem identified by the World Bank, traditional financing institutions like banks are failing on this issue hard. Job created and economic growth through the private sector development is a globally recognised issue. Global credit gap is felt basically all around world’s economies. According to World Bank, there are from 200 to 245 million formal and informal enterprises in the world which unserved or underserved.

How does Debitum turn this challenge into an opportunity?

Although, it is a big global challenge, but for fintech and alternative finances companies like Debitum that creates an opportunity to intervene and solve this problem. Technological solutions like blockchain allow us to design new ways to solve this problem.

Debitum Network will be a blockchain and trust based ecosystem joining various players (investors, risk assessors, document validators, insurers etc.) to complete end-to-end financing loop for SMEs. Debitum will allow small and medium enterprises to access financing from any investor around the globe.

Local infrastructure for assessing the risk, validating documents, collecting the debt etc. will be used while allowing global investors to participate.

We believe that we will create value for all the parties in ecosystem. For example, investors, like funds, will access a new credit class to allocate their funds. We do know from our experience that funds are actively looking for new markets to invest their money. Usually due-diligence for allocating investments in alternative finance projects takes months or even up to 1 year.

In the Debitum ecosystem the process will be facilitated due to transparency, speed and previous records of participants on the blockchain.

3rd parties like risk assessors, debt collectors, insurers etc. will benefit from being basically a local player specializing and knowing best local players, legal system, business culture etc. to becoming a global player by scaling and selling their services to wide variety of global investors.

Finally, SMEs will be provided an access to so much wanted capital. These additional funds may ensure their investments, growth and prosperity. SMEs are backbones of most of the world’s economies. Most of us work in SMEs, imagine that each SME could hire at least 5 new people after receiving money for their expansion, how valuable that would be for the entire economy?

In which jurisdictions will Debitum operate at first?

In the beginning, we are planning to operate firstly in the Eastern European countries like Poland, Czechia, Slovakia also The Baltic States. The reason for this is that the credit gap, according to World Bank, is biggest in these countries in Europe. Our core team comes from Lithuania so we do know these markets best.

What is the business process of Debitum?

It will be a community based various actors on blockchain. So, for example, SME in Poland is looking for acquiring funds, an institutional investor in London is looking where to allocate their funds. Then this process starts: local risk assessor in Poland assesses the risk, insurer in France insures the risk, UK fund invests and SME in Poland borrows. Everything is placed on blockchain, transparent and trustful. The participants of the system will be rated due to their performance record, the better record you have the more other parties would like to work with you.

How will loans be sourced?

Debitum Network itself will by the ecosystems facilitator. It will collect funds from investors and source them to the borrowers. The funds usually are too big to work with each borrower personally. It’s neither economical nor effective for , that’s why Debitum comes to be a facilitator of the ecosystem.

Conclusion:

As it is specifically geared towards the smaller companies that are not able to raise money quite easily from the traditional banking system, the platform definitely holds potential. Moreover, as the platform synchronizes many different stakeholders, you can be sure that the platform would be a huge success as well.

If you’re looking for a platform based on the blockchain technology which actually connects small and medium enterprises with the various companies which are ready to finance them, this one is a good opportunity for you. Moreover, since there is already need of such a platform, you can be sure that it would be able to gather the companies as well as the investors quite easily. This is one of the main reasons why this platform would actually be a huge success in the future and this would certainly increase the value of the token as well.