A recent article on debt.com reveals some enlightening statistics about debt in American households. While these numbers represent the American issue, debt is very likely just as much of a problem worldwide as it is in the United States. The article in question can be found here.

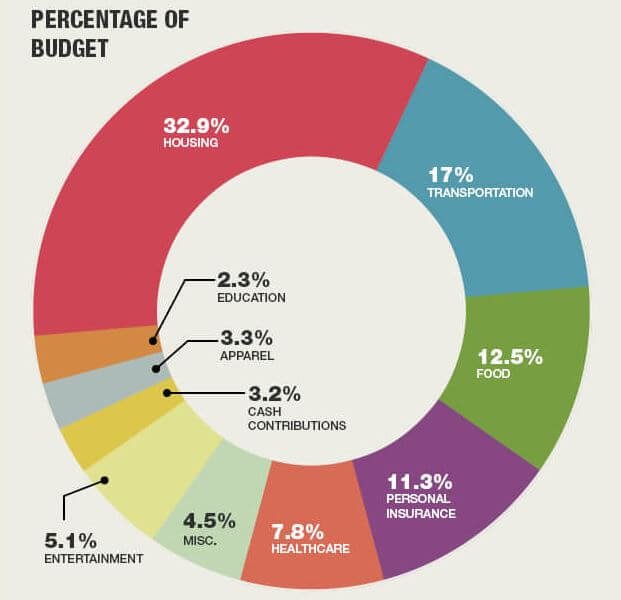

Using the numbers given for the 2015 average household earnings, we see that 80% of the earnings are used to cover the expenses as shown in the following graphic.

(From debt.com article)

If you’ve been following my series on the Seven Secrets to Accumulating Gold you may note that spending 80% on living expenses is already 10% more than one should spend to avoid falling behind and actually improving their lot in life. If you haven’t read them yet, you can read the ReCap First Four Secrets to Accumulating Gold and The Fifth Secret to Accumulating Gold to catch up.

The recent article describes the remaining 20% as “free cash flow”. While there will be some who try to save, you can just about be assured the the majority of people use the remaining 20% for vacations and other activities that are fun in the moment, but do not help their future.

Only 32% of Americans even keep a formal budget and half the households in the U.S. are living paycheck to paycheck. Top this by the report that over the last 13 years household incomes have increased by 28%, but the cost of living has increased by 30% during the same time. Those numbers plus time are a recipe for disaster unless something is done.

Did you get that?

The cost of living outpaced the increase of income by 2% over the last 13 years.

Simply dividing the total credit card debt in the U.S. by the total population over 18, the average amount of credit card debt for each person is $4,013. Using the same formula for non revolving debt is an average of $11,262 for a total of $15,275 per person over 18 years of age. This obviously isn’t the true division, but that’s a large number. And since I have no debt, my $15,275 would be added back into the total, as I’m sure would be the case for others who do not have debt. And this number does not include the debt on mortgages and student loans.

Americans, and likely the world, have been conditioned to consume. Debt is encouraged and taken for granted. But those who promote a consumer lifestyle don’t suffer. The only one(s) who will suffer the consequences of the consumer mentality and resulting debt load is/are the one(s) who do/does not see the writing on the wall and do something to change their life. Don’t let that be you.

Do you have debt you want to pay off? I want to start a debt elimination support posting/group, but I need to know if there is interest. Please let me know in the comments if you would like to participate in something that could help you get out of debt. It would be structured in such a way that you would not be putting up your personal details, but using percentages instead. I want people to be able to track their progress publicly and set goals and have accountability, but not be exposed in a personal way. Comment if you are interested!

I also want to include wealth accumulation principles as well for those who are out of debt and want to grow their wealth. This is where I am, debt free but wanting to grow wealth. This is also a next step for those who start participating to get out of debt and reach their goal. They will have developed the skills and mindset to continue. I also welcome your comments in this regard.

(Banner by @son-of-satire)

Important information. I am comfortable with the debt that I have, household mortgage and a small personal loan which I have almost paid off.

It is good that you are suggesting people look at their finances through the percentage. I had a challenge with one of my supervisors over a percentage pay rise. I was so use to saying it is $X more. The percentage gets to the heart of the issue.

8 ) infinity happiness

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, percentages can make things much more clear. Thanks for stopping by

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit