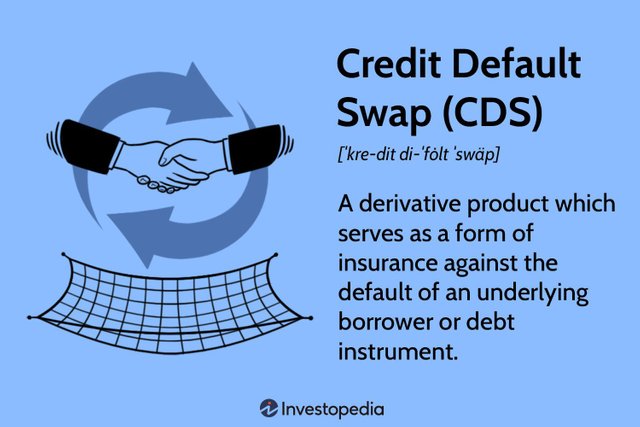

Credit default swaps (CDS) are financial instruments that allow investors to hedge against the risk of default on a particular debt instrument, such as a bond or loan. The price of a CDS is based on the perceived creditworthiness of the issuer of the underlying debt instrument.

When it comes to the United States, the credit default swap rates on US Treasuries are often seen as a barometer of investor confidence in the country's ability to pay its debts. If the CDS rates are high, it suggests that investors are concerned about the risk of default, while low CDS rates suggest that investors are confident in the country's ability to meet its financial obligations.

However, it's important to note that credit default swaps are not a perfect indicator of default risk. The prices of CDS can be influenced by a range of factors, including market sentiment, liquidity, and supply and demand dynamics. Additionally, CDS prices may not always reflect underlying credit risk accurately, especially in times of market stress or uncertainty.

Therefore, while credit default swaps can provide some insight into the perceived probability of US default, they should be considered alongside other indicators and factors when assessing credit risk.