The financial revolution is here: DeFi Total Value Locked reaches an impressive USD 124.49 billion

The Total Value Locked (TVL) in the Decentralized Finance (DeFi) sector closed the year 2024 with an extraordinary growth of 119.33%. It reached a total of USD 124.49 billion. This boom was mainly driven by the rise in the price of Bitcoin. The world's leading cryptocurrency had a positive impact on the crypto ecosystem and boosted interest in DeFi.

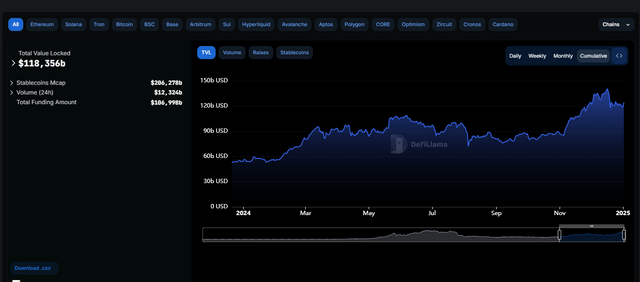

Since the start of 2024, DeFi TVL has continued to rise, especially following the launch of Bitcoin ETFs / DefiLlama

The influence of Bitcoin and the political environment on DeFi

Since the beginning of 2024, the TVL of DeFi has continued to rise, especially after the launch of Bitcoin exchange-traded funds (ETFs). This generated renewed optimism in the market. However, it was in November, following the US presidential election, that the sector saw a significant breakthrough. President-elect Donald Trump's victory increased demand for cryptocurrencies, with speculation that his administration would take a more favorable stance towards the crypto sector, including plans to create a Bitcoin reserve.

Booming transaction volume

Transaction volume on DeFi platforms also saw a notable increase towards the end of 2024. It surpassed USD 10 billion daily on multiple occasions and reached peaks of up to USD 20 billion. This period is the busiest recorded by Defillama, highlighting the phenomenon that some called the "Trump trade boom."

Leading platforms in the DeFi ecosystem

As for the most prominent DeFi platforms, LIDO is positioned as the leader with a TVL of USD 31.50 billion, followed by the AAVE lending platform with USD 20.36 billion. EigenLayer, a restaking protocol, comes in third with $14.34 billion. While Ether.fi and Binance Staked ETH round out the top five with TVLs of $8.21 billion and $6.28 billion, respectively. These figures reflect that a large portion of DeFi activity is focused on ETH staking and restaking.

Ethereum continues to dominate the DeFi market

Ethereum remains the blockchain network with the highest TVL, recording $64.79 billion, which represents more than half of the total TVL of the DeFi ecosystem. With over $122 billion worth of stablecoins circulating on its network, Ethereum generates daily fees of approximately $3.08 million, with earnings of $2.68 million in the past 24 hours. Solana follows with a TVL of 7.14% and Tron with 6.01%.

The continued growth in the DeFi sector not only indicates an increase in interest in cryptocurrencies, but also an expansion of the decentralized financial ecosystem. With an increasing influence of Bitcoin and pro-crypto political leadership, the outlook for the DeFi market in 2025 looks brighter than ever.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency and DeFi investments involve risks and may not be suitable for all investors.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit