In this piece we highlight the current state and future prospect of decentralized finance,the seemingly challenges it currently face and how DeFibox a DeFi solution on EOS solves all that.

DeFi craze

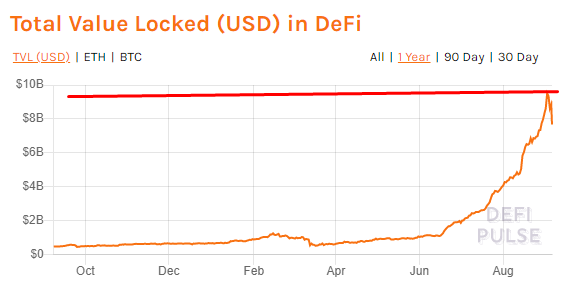

Decentralized Finance is taking the blockchain space by storm,earlier this total volume locked in various DeFi apps was less than $500M,today it’s more than $8b,DeFi is here to stay.

Recently the daily volume of Uniswap topped that of Coinbase,at over $1billion in trade volume,it exceeds the volume traded in all the centralized exchanges in South Korea.

“Decentralized finance entails all protocols,toolings,apps and solutions aimed at making available traditional financial tools and assets readily accessible on the blockchain in a permissionless,decentralized and cheap manner.”

Stablecoins,Lending & Borrowing,Payments & Remittances, Oracles, Market making,Derivatives,Portfolio management,insurance,Fund management,Real estate tokenization,staking,prediction etc are some of the DeFi solutions available right now.

Before now many coins were sitting idle and collecting dusts in many wallets but no more thanks to lending and borrowing made possible with DeFi,how about liquidity pools and the enormous benefits of creating an environment where one can exchange in a permissionless manner and earn rewards,access financial derivatives and guess what there is even insurance to cover your smart contract or dapp risks.

Have you heard about Yield Farming,the ability where one is able to optimise their strategies inorder to earn more percentage yield on their assets,friends there is a craze right now around DeFi.

How about the various projects bridging Bitcoin to the DeFi landscape,no more will we have to wait for price appreciation to make profits,we can now lend BTC,earn interest and be glad.

The interest in DeFi in 2020 currently exceeds that of the ICO boom of 2017,this is no joke,but with increasing opportunities comes increasing responsibilities.

The Threat

The DeFi was pioneered by Ethereum and a majority of DeFi solutions are built on Ethereum,Ethereum as a protocol excels in many fronts but we are true witnesses of the danger it poses to the DeFi ecosystem,certain factors associated with Ethereum may mean that if not happened with superior solutions may choke the life out of DeFi.

We will touch on 3 major problems

High gas prices:Ethereum is a global computer,it requires gas to run apps,it has betrayed one of the features of the DeFi movement which is cheaper transaction fees.

In the past few weeks,it’s clear that Ethereum high gas prices are a necessary evil that we as a people will have to live with.

Do you know that miners are making $500,000- $800,000 per hour on the Ethereum network,it’s a really crazy time right now,before you want to use decentralized applications,you will have to reason if the money you want to make is worth the fees. EOS dapps are do not charge any fee unlike Ethereum.

Scalability : Apart from high gas prices,Ethereum is extremely slow. It designs makes it so,every node will have to run every code in the network,currently there is no sharding on the network and many of its layer 2 scaling solutions are either not ready or not feasible for use.

There is a meme going around ETH 2.0 launch,many scaling blockchains are already live and running and an example is EOS,it’s designed by some of the best geeks on the planet,it can process around 8000 transactions per second,with EOS,your scaling worries are bygone.

Smart Contract issues : Lastly DeFi apps are permissionless which means they rely heavily on smart contracts. A great problem with many smart contracts is that they are poorly built and most times not audited. One major reason why Ethereum smart contracts are prone to errors is the solidity language,it’s a fairly new language by many standards and very few people understand it

EOS on the other hand uses existing languages that most developers are already familiar,this means the onboarding process is easier and better.

DeFiBox solution

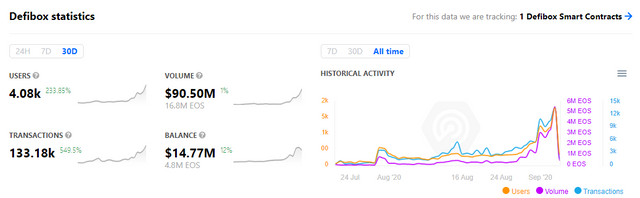

Many argue that DeFi only exists in Ethereum and they seem to support their argument on the fact that Ethereum has enough tooling,support and adoption,but Defibox is proving all that wrong.

DeFibox is positioning itself as the central hub for decentralized finance in EOS,built on EOS for the EOS ecosystem,it features a decentralized exchange like Uniswap,Liquidity pools,USN stablecoin and BOX staking.

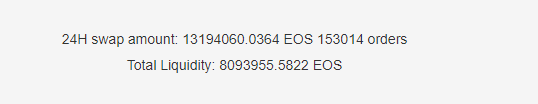

Swap(& transaction mining of BOX tokens)

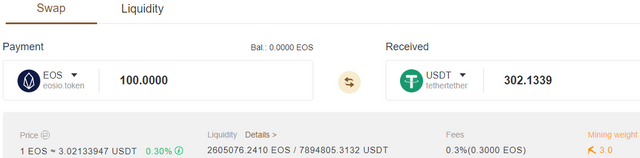

Friends,decentralized exchange are here to stay,the complexities and hurdles involved in setting up,running and using an exchange is pushing attention away from centralized exchanges to decentralized exchanges. Another reason for the increasing interest in decentralized exchange ecosystem is the easy integration it offers many DeFi apps,okay enough,let’s discuss the DeFibox swap,it offers users the opportunity to swap(trade) tokens in a decentralized manner.

Another reason is their swap feature is unique is that BOX tokens are emitted every single second and distributed to traders on the exchange according to the proportion of their trade.

Lastly DeFibox is built on EOS,that means unlike in Uniswap where users may a certain percent on the trade(charged in the tokens) and gas cost(charged in Ether),users will be exempted from paying gas costs,that is an amazing benefit EOS brings to the table.

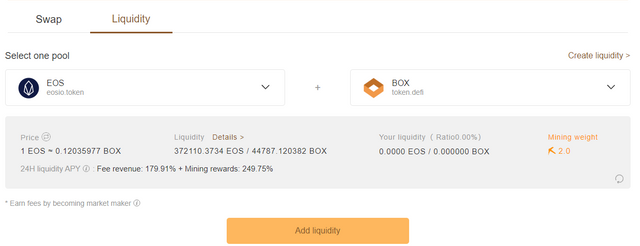

Liquidity(trading fees &liquidity mining(BOX tokens))

Before now,the major problem faced by decentralized exchanges was that of liquidity,demand can only be met if there is an equivalent supply.

Centralized exchanges were sucking life out of Decentralized exchanges not until the concept of liquidity pools were introduced.

Liquidity pools are basically a pool of tokens supplied for incentives by different users to help boost the capacity of an exchange in terms of liquidity.

the actions and inactions of a majority revolves around incentives

DeFiBox incentivizes liquidity pool providers by giving them trading fees and as well as rewarding them with BOX tokens.

USN stablecoin and BOX staking

The Defibox also features a stablecoin that is algorithmically controlled by code,you stake EOS to get USN in a 150%:100% ratio,meaning you will need to stake $150 worth of EOS to generate $100 worth of USN.

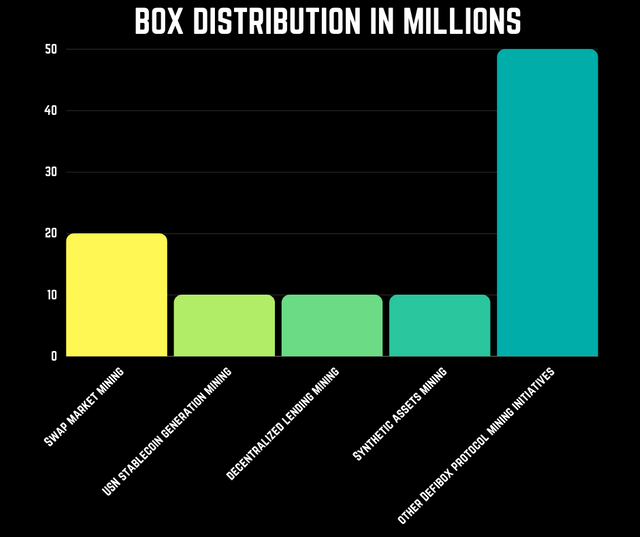

The BOX token can be generated either by buying it on an exchange,transactional mining(doing swaps and getting BOX) and liquidity mining(providing liquidity and getting BOX).

Apart from the Swap and Liquidity Pool functionalities,DeFiBox supports a stablecoin called USN,unlike DAI which is issued by creating a CDP by locking a collateral,USN is issued by staking BOX tokens. When you stake BOX tokens,you get USN tokens that you may use for services like swapping,providing liquidity pools etc.

Decentralized lending and Synthetic Assets

The goal of DeFibox is build a DeFi hub,it plans to develop decentralized lending and synthetic assets services.

BOX token

The BOX token is the main token of the DeFibox ecosytem,it’s mined by doing swaps,providing liquidity pools.

Apart from releasing funds to users(traders and stakers) as mining rewards,it releases certain amount to the DeFibox foundation and the Newdex foundation to help with sustainable development of the ecosystem.

DeFiBox foundation

It initiated the DeFiBox project,their function is to run the affairs and interests of DeFiBox,marketing,partnerships and all that it will gradually transition into a decentralized autonomous organization(BOXDAO).

In the BOXDAO,the governance and decision making process is in the hands of the token holders.

It is funded and supported by Newdex ,it will leverage Newdex reputation and success as well as seamless connect with other Newdex projects.

Security audits

The DeFiBox provided have been thoroughly audited and scrutinized for errors,it has PeckShield and SlowMistaudits

Also,it has a bug bounty that is still active,anyone can point out bugs,help the entire ecosystem and get rewarded for such effort.

Exchanges

You can get BOX tokens from the following exchanges BIKI,Gate.io exchange,Big One,Hoo,Newdex,DeFibox.

Learn more

DeFibox|Danchor|Newdex