Decentralization means that in a given computer system all operations are carried out by a distributed network of nodes rather than a centralized server. There is no single computer that controls this network — control is shared equally by all participants. This is the main difference of blockchain-based cryptocurrencies from centrally governed enterprise servers: they are fully transparent for any third-party observer, immutable (once data is in the blockchain, it stays there forever), and there is no single point of failure.

Let’s consider why decentralization is important for crypto and what risks it may bear.

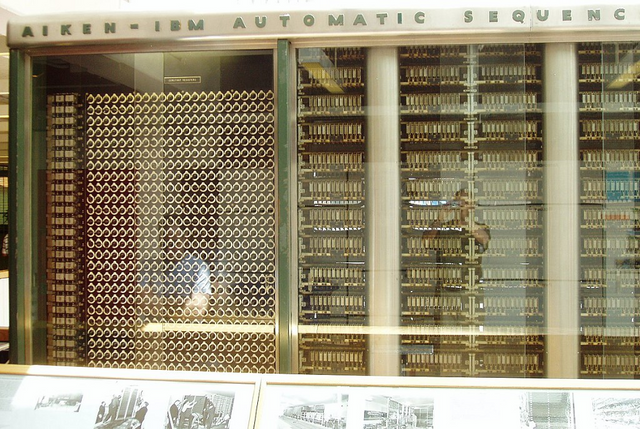

Predecessors to Today’s Decentralization

The computing era began when Harvard Mark I was invented by IBM in the early 1940s — a machine designed to help the U.S. in World War II. A 2.5-meter-high and 15 m-wide giant was an embodiment of centralization, and this was what the computing hardware remained to be until the late 1980s. In 1989, a British scientist Tim Berners-Lee, a child of mathematicians who worked on Mark I, invented the world wide web — and that was a huge step towards decentralizing the information technologies. By 2010, 80% of Americans had an internet connection.

Harvard Mark I

However, some attempts to decentralize computation had been made even before 1989. Ten years earlier, American computer scientist David Chaum introduced a decentralized protocol called Mix Network. He described his work in a paper titled “Untraceable electronic mail, return addresses, and digital pseudonyms”, which was a part of his Master’s degree thesis. Mix Network was not only designed to connect computers, but also to enable hard-to-trace communication, which is exactly what some of today’s cryptocurrencies do.

In 1983, David Chaum launched eCash — anonymous electronic cash that is considered a direct predecessor to Bitcoin, the first cryptocurrency invented only 25 later. Since then, the decentralization of the internet is one of the hottest topics in IT. But why exactly is it so important?

How Blockchain Decentralized Finance

In 2008, the world was struck by the global financial crisis. Banks, mutual funds, and governments have gone too far in their reckless gambling on the U.S. housing market, which resulted in a collapse of the international financial system. Millions of people lost billions of dollars, jobs, and houses — and that was the strongest recession since the Great Depression.

The 2008 crisis was the context in which Satoshi Nakamoto was developing Bitcoin. His goal was to invent a currency that no central institution could control and wreck. This is how Bitcoin emerged — decentralized peer-to-peer money that follows the previously set rules in its code and is controlled by a big network of nodes simultaneously. No single central authority such as a government or a bank has power over it — they can’t withhold a transaction, freeze a wallet, or change the rules of the currency.

One of the reasons for the financial crisis was mismanagement — and Nakamoto implemented some immunity to that either. In Bitcoin’s code, there is a programmable scarcity: there will never be more than 21 million Bitcoins, and new ones are issued according to a clear predefined rule. No organ could change the monetary policy at their will, which makes Bitcoin much more resistant to poor management. A central bank or Federal Reserve can print as much money as they want at their will thus devaluing the currency, while in Bitcoin, this is impossible, which makes the asset inflation-proof. Bitcoin holders have been enjoying the rising purchasing power for 12 years so far.

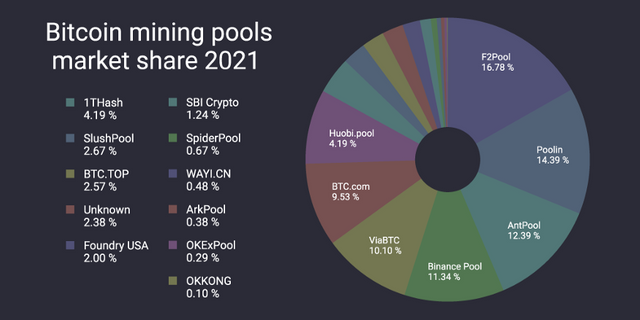

But how do you ensure the proper functioning of such a complex system with so many people involved? One of the key concepts that make Bitcoin’s decentralized network run is the Proof of Work consensus algorithm. The network’s participants (nodes) are incentivized to properly process transactions and fairly add new blocks to the blockchain, for which they get rewarded. Such a motivation structure makes many diverse types of decentralized networks run.

The major Bitcoin network nodes — mining pools and their shares.

Risks of Decentralization

Hampered traceability → use for illegal purposes

Fiat currency is stored in banks and is rarely anonymous, which is why banks can relatively easily trace and block illegal money flows. In cryptocurrency, this is much more difficult — although Bitcoin is a public ledger, it’s still complicated to control it and link funds to particular individuals. This is how Silk Road emerged — an online black marketplace where illegal goods and services were traded using Bitcoin. The market was closed a long time ago and the founder was put in jail, but Bitcoin has still not completely got rid of the reputation of an asset that is mostly traded by criminals.

Potential difficulties that we don’t yet realize

Traditional financial institutions such as central banks and treasuries are hundreds of years old, and we know well all their risks and negative phenomena that they can stimulate — inflation, corruption, incompetency, and so on. But cryptocurrency is a little over 10 years of age, and we can’t even possibly know all the potential risks that decentralization may bear.

If there’s a collapse in a centralized system, there’s always an authority that can take control and stabilize the situation. But is that possible in a blockchain? Every cryptocurrency has a team or a community of developers that manage it, but they don’t have absolute power over the network. If hackers find some critical vulnerability or simply perform a 51% attack, the coin’s community may not have enough resources to collectively reverse the blockchain to its older state in order to cancel the malicious changes in the database.

And this is only one of the possible risks. At the moment of a crisis, centralized governance is always preferred for taking back control. Given the decentralized nature of cryptocurrencies, doing so may be hard in the possible critical moments of the future.

Bottom Line

Decentralization is a new way to look at money and it can bring more trust, transparency, and inclusion to the global economy. Its first implementations are dating back to the before-internet era, and today, its development is especially active with the advent of blockchain.

On the global economy level, decentralization prevents mismanagement and helps avoid boosting inflation. On the world wide web level, it fosters the introduction of Web3 — a decentralized internet where services are offered not by gigantic corporations with enormous power but transparent decentralized applications where users control their digital identity and traffic. This means that both money and the internet are becoming less dependent on a small group of managers and are getting better controlled by a community interested in safe and secure resource storage for all its members.