Cryptocurrency in general promised to make money and payments universally accessible to anyone, no matter where they are in the entire world. The Decentralized Finance (DeFi) takes that promise a step further with its invention. Think about a global, open alternative to all financial service we use around the world today which include savings, loans, trading, insurance and more are made accessible to anyone in the world with a smartphone and internet connection.

This is now possible on smart contract blockchains, like Ethereum. “Smart contracts” are programs running on the blockchain that can execute automatically when certain conditions are met. These smart contracts enable developers to build far more sophisticated functionality than simply sending and receiving cryptocurrency. Lets now take a look at one important platform in the DeFi worlf , which is the Knit Finance.

What is Knit Finance

KnitFinance is an unique decentralized protocol that combines synthetics across multiple chains, Bridges, and real world markets with yield, lend, trade and margin services through smart contracts. This also gives cross chain liquidity aggregation in a Completely transparent 100% verifiable. Community led initiative, a project for the community

KNIT.Finance is the next generation of DeFi protocol that aims to bridge multiple non-Ethereum chains with ERC20 in Phase 1. Any digital, lockable asset can be leveraged with KNIT.Finance by generating equivalent synthetic tokens in a 1:1 ratio, hence unlocking billions of dollars and trade access which can be censor proof. ERC-20 standard has proven to be the go-to for decentralized lending, borrowing, and yield farming, etc. However, this leaves out the participation of other assets of independent blockchains. These assets and their hodlers have a huge barrier to entry into DeFi. KNIT.finance solves this problem in one fell swoop.

The ERC-20 standard has proven to be an ideal choice for decentralized lending, borrowing, farming, etc. However, the involvement of other independent blockchain assets is not taken into account. These assets and their guardians pose a huge barrier to entry for DeFi. KNIT.finance solved this problem in an error.

KNIT.Finance opens the entire cryptocurrency ecosystem for DeFi using cross-chain and bridging synthesis. Existing DeFi protocols define which tokens and which projects will participate. KNIT Finance's decentralized protocol uses smart contracts to pair the DeFi team with billions of non-ERC-20 asset chains. By creating a standard for non-ERC-20 coins to be converted into synthetic ERC-20 tokens, KNIT Finance is opening up a whole new world of possibilities.

Any coin or token on a blockchain can be converted into an equivalent synthetic ERC-20 token. Native tokens and aggregated tokens represent each other in a ratio of 1: 1. Conversely, ERC-20 tokens can also be aggregated on other blockchains on a 1: 1 scale with the help of KNIT. In addition to cryptocurrencies, there may be real assets aggregated with KNIT Finance such as fiat, gold, and stocks.

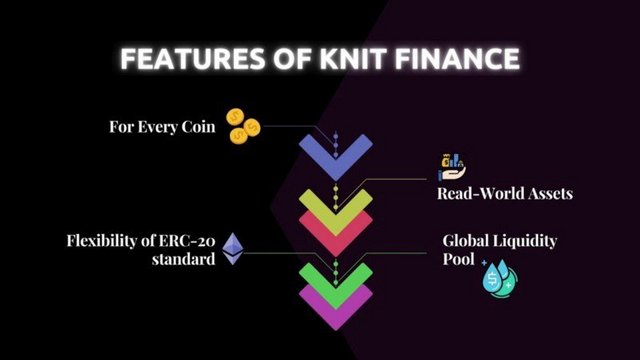

Every Coin

For every coin hodler, we provide an option to trade and leverage their coins in the DeFi space. Coins (E.g.: LTC) that were previously out of DeFi’s scope will now have complete access to all of DeFi’s features.

Flexibility of ERC-20 standard

ERC-20 standard is known to be flexible, possessing the highest transferability and accessibility with the world’s second-largest blockchain network. Every coin now has the opportunity to leverage Ethereum’s flexibility.

Global Liquidity Pool

A global liquidity pool is being opened to Ethereum and vice versa.

Read-World Assets

Stocks, Gold, and Fiat can be synthesized to trade on Decentralized Exchanges, essentially decentralizing centralized assets, giving more power to the trader.

Community-Driven

100% governance of these tokens will be through the community.

DAPPs

DAPPs can now access tokens on other blockchains using only their Ethereum nodes via KNIT’s synthetic tokens. They can also receive payments in these tokens

Partnership with Nuls

Knit Finance and Nuls partnership give Nuls holders the ability to use their $NULS as a payment instrument in their marketplace and also have access to multiple chains via Knit Finance infrastructure.

Nuls

NULS is an open-source, enterprise-grade, adaptive blockchain platform that offers fast-track business solutions for developers. Featuring microservices, smart contracts, cross-chain interoperability, and instant chain-building, NULS sets a new industry standard in streamlining blockchain adoption.

The microservice-layer design of NULS makes it easy for developers to quickly create modules for anything. NULS provides fluid, cost-effective, time-saving solutions for developers with minimum blockchain experience.

The Partnership Entails

Knit Finance gives $NULS holders the ability to use the token as a payment instrument in their marketplace.

Nuls will use KnitFinance’s multi-chain solution for getting NULS tokens on multiple chains.

Knit Finance Partnerships

Their vision is that decentralized finance (DeFi) would be available to all. Nonetheless, DeFi (decentralized account) is now multidimensional subject to ERC-20 tokens. This is a major barrier since the ERC-20 standard has proven to be the go-to for decentralized lending, investing, and yield farming, among other things. Currently, UNOS.finance is working with knit finance to resolve this hurdle. All can now overcome this problem by using Knit finance management. They'll look at how it's resolved and what gains can come from it at this stage.

Elrond and Knit Finance: Interoperable Synthetics

Crypto synthetics are virtual properties that preserve their fundamental nature, and the method of linking them is known as tokenization. This technology has impacted multiple industries, including real estate and finance. Consider a stock, land, cryptocurrency, or even fiat currency that has been tokenized in the same way that stablecoins have. Tokenization confers global supply, fractional control, investing, lending, smart contract locking, and ease of transition on these properties. Tokenization enables asset owners to connect with value through blockchain technologies that are currently available. Interactions are restricted to the blockchain upon which the asset is released. Knit Finance is now collaborating with Elrond to acquire new assets in the Crypto, Capital, and Bullion asset groups, as well as to allow tokenization.

USEFUL LINKS

Website: https://knit.finance/

Telegram: https://t.me/knitfinance

Facebook: https://www.facebook.com/KnitFinance-106586011273309

Linkedin: https://www.linkedin.com/company/ knitfinance

Twitter: https://twitter.com/KnitFinance

Author: Pflyer78

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=3235228

Telegram username: @pflyer

ETH ADDRESS: 0x1E4C331d8dC510622f997b55520d877349741256