Lots of cryptocurrencies enthusiasts are being attracted to these DeFi applications. Many accept different DeFi projects can possibly turn into the following boom project, attracting crowds of new users by making financial applications more comprehensive and open to the people for blockchain adoption.

This financial innovation is new, test and isn't without issues, particularly as to security or versatility.

Lots of tech developers desire to end existing issues defi. Ethereum 2.0 could handle versatility worries through an idea known as shading, a method of splitting the hidden data base into more modest pieces that are more reasonable for users to use.

Loaning markets are one mainstream type of DeFi, which interfaces borrowers to banks of cryptographic forms of money. One famous platform, permits users to borrow token or coin their own credits. Users can bring in cash off of revenue for loaning out their token. Accumulate sets the loan costs algorithmically, so if there's more popularity to get a coin or token, the loan fees will be pushed higher.

DeFi loaning is guarantee based, which means to apply for a line of credit, a user needs to set up collateral – regularly ether that powers Ethereum. That implies users don't give out their personality or related credit rating to apply for a new line of credit, which is the way ordinary, non-DeFi advances work.

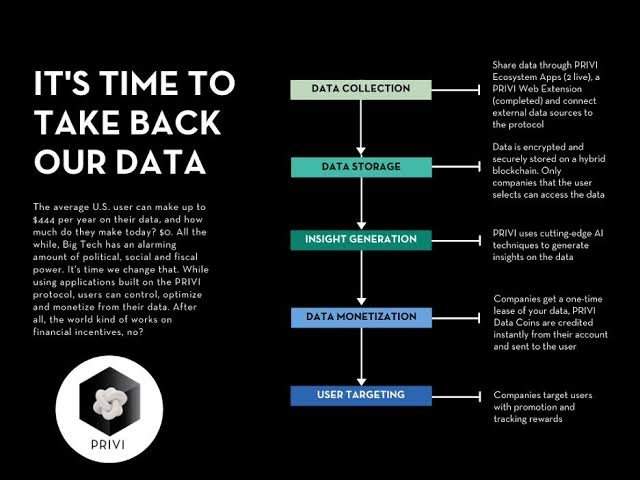

PRIVI Protocol is a disrupting ecosystem platform for decentralized (DEFI). It utilizes a condition of craftsmanship innovation and cautiously consolidate this new innovation into previously existing decentralized platform. It permit users to customize a social platform with effectively unique financial instruments that ease financial operations. It additionally make another social chain of community where networks can leverage.

With PRIVI protocol, individuals can make their own social community platform and change the local area to suit their longing, on every financial community activities are facilitated. Community has its own special social and financial instrument for use on the platform. The people create a working DAO that settles on choices for the community activities.

Data Collection Encryption and Storage

Data Processing on privi protocol

This presents the choice cycle including the KYC affirmation, the restriction of delicate KYC records in an essentially guaranteed about what's more, ensured data set with great security, transparent and network protection advancement and the constraint of less data with its encryption through the PRIVI Blockchain technology.

Data Collate

The various sources and frameworks acknowledged to drive the extraction of client's data and its blended breaking point on the Cloud Database by methods for the PRIVI Blockchain.

A customer fills the vital data and updates the KYC records through Mobile or Web Applications compelled by PRIVI or a PRIVI Partner. This data is dispatched off the Back-end Application by strategies for a guaranteed about API.

DAO

PRIVI Protocol is a multifaceted ecosystem platform that consist of unique solution on the Blockchain. PRIVI protocol will achieve DAO with adaptable instruments for every community. Every group will actually want to mint their tokens and figures out what goes on their group.

Pods Creation

Users will actually want to make units by collateralizing their physical and digital asset. Thusly, the units could be showcased to the group, different people, loved ones as a way to created required asset and the Decentralized Insurance are accessible to assume responsibility for protecting the resources for security reason.

Data Privacy

The Back-end Application reestablishes the Public ID key to the Application. PRIVI Protocol as a reformist game plan

The PRIVI Protocol gets best class progresses and blends them wisely into another biological system which conveys new responses for the issues as of late introduced.

The PRIVI Protocol relies upon two focus blockchain-based protocols;

Data Protocol is a blockchain structure that empowers customers to share and adjust from their data. Essentially, the Data Protocol is a rehashing system that keeps upgrading time. The Data Protocol incorporates 6 focus rehashing platforms:

Data is collection,

Encoded and

Set aside,

Explored by AI counts for understanding age of the data

Offered to advertisers and companies for business promotion.

Target and dispatch promotion campaigns.

About The Applications

Applications based on PRIVI Protocol will incorporate data control highlights into their Privacy Settings; this will educate users regarding the full rundown of suppliers, sponsors and organizations that are partaking in the PRIVI ecosystem and it will be accessible for users to empower or lock data sharing. In the event that a client wishes not to share private data to any organization or industry, it will be so as no organization gain access to users own data without assents.

In such manner, users can choose the organizations they wish to share individual data to. For example, client can choose not to impart data to any organization as it very well may be utilized to impact market conduct. In any case, for the situation a user chooses to share data to organization or industry, it gives the possibility to acquire from the offer of the data.

Preferences - Liquidity Providers

PRIVI Liquidity Pools solve existing challenges cryptocurrency ecosystem.

By far most of the game plans of liquidity in crypto go with the limit of having liquidity in liquidity pools made out of sets of tokens. By then, an AMMis used to choose the expense of progress by looking at the arrangements of the two tokens in the pool. This philosophy goes with a couple of significant issues:

Impermanent Loss

High slippage on Trading

Low significance in liquidity

Low utility of liquidity

Trading costs confined to one liquidity pool

In any case, why have the liquidity in pools of sets? For example, ETH disengaged into pools: ETH-BTC, ETH-UNI, ETH-USDT, and so forth .It is better to have a more broad pool of ETH which is split between all the exchanges that happen with some other token? Does it not give more prominent utility to the liquidity of a token, increase total trading costs, and give better expenses to crypto traders because of significantly further liquidity and less slippage?

With PRIVIs liquidity pool game plan, financial backers are not, now limited to:

Having simply to store sets in a liquidity pool, with same degrees, having peril introduced to both being influenced by Impermanent Loss

Confined to swap costs from just one pool

The PRIVI liquidity solution is made out of a lot of users and boundless pools. Each Liquidity Provider (LP) can pick which token they need to get prologue to. Likewise, benefits by the trading charges of any trade of the saved token with some other external or native token (such as Social tokens, FT Pod tokens, NFT Pod tokens)

This is the beginning of new shift in defi ecosystem and you are welcome to privy protocol .You can access more inform information from official website below and other social platform operate by the privi protocol below.

Website: https://priviprotocol.io/

Twitter: https://twitter.com/account/access

Instagram: https://www.instagram.com/priviprotocol/

LinkedIn: https://www.linkedin.com/company/privi-protocol

Medium: https://priviprotocol.medium.com/

bounty0x username : cryptosignal

Disclaimer: This article was published for information purpose only. Kindly make sure to conduct require due diligence on privi protocol.