No doubt, blockchain is presently trending in the global financial market. However, a lot of new interesting things haven't ceased to spring out of the industry, which one of them is DeFi. DeFi has taken over the industry with full force, in recent times. Hold on! Did DeFi get you confused? It simply means Decentralized Finance.

DeFi is a new Financial system that uses Decentralized Apps to power its operation. The DeFi system is autonomous and secure as it does not operate with human resources unlike traditional Financial setup like banks but rather implements a powerful Decentralized App to manage its system. The good news is DeFi also offers services available in the Centralized Financial set-up like loans, savings, lending, trading, and more.

Moreover, there is a DeFi platform that has been launched to make the industry sustainable and also make available, sustainable solutions to existing challenges in the DeFi space. This platform is named poolz. Now, let's talk about poolz.

POOLZ

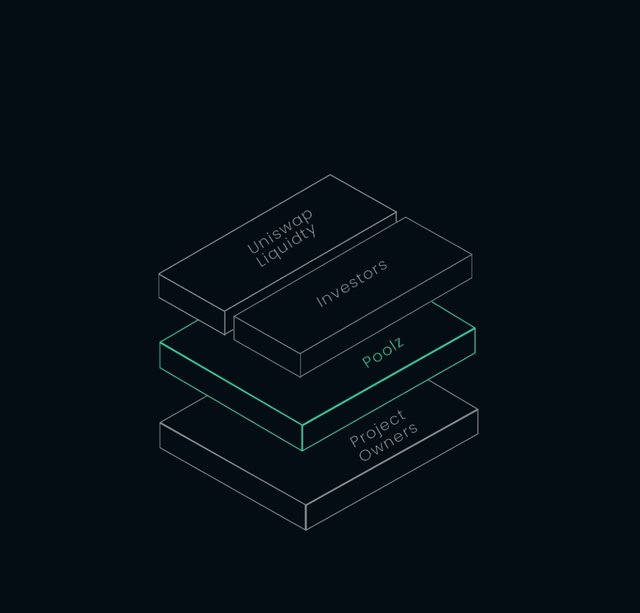

Poolz is a layer-3 swapping protocol (layer-3 here refers to the fact that it operates above Ethereum base and application layers) that connects innovators and investors of early-stage crypto projects to a decentralized system. Before now, innovators find it difficult to attract investors. Now, the problem is solved, as poolz enables project developers to launch and manage liquidity auctions that can be easily found and accessed on the platform by investors.

Poolz has interesting features you need to look into; firstly, let's talk about pools of Poolz.

To trade your DeFi assets on Poolz DeFi, you need to understand what pools are and how they work.

POOLS

Pool in this context is not a body of stagnant water, but a medium for early-stage crypto project investors to access the risks and gains of the projects. Poolz lets users make created pools- which are only accessible to POZ holders, the native token of poolz. Also, there are pools called open pools that are accessible to any poolz user.

Moreover, DeFi projects that want their tokens auctioned via poolz can leverage on any of the two specific pool formats: DSP and TLP.

Direct Sale Pools(DSP)- These are pools that do not have a lockdown period, where after a swap, investors can get tokens.

Time-Locked Pools(TLP)- as the name implies, they are pools with a lockdown period, where investors get tokens after the lock period.

Cross-Chain Infrastructure

Another interesting aspect of Poolz is it is going to have Cross-chain or what you would call a multi-chain future, the project's builders are planning to integrate with other top blockchains to spread out and make it interoperable across the world of cryptocurrency.

POZ token

The POZ token can be used by its holders to govern in a decentralized manner. Also, you get to earn POZ rewards by staking Poolz LP tokens via a different staking system that will be employed by Poolz.

NFT

Another fascinating element of Pools is how it is embracing NFTs, through the ERC-721 standard, which opens up different opportunities for NFT users like dynamic ratio auctions and more.

Website: https://poolzdefi.com/

Twitter: https://twitter.com/Poolz__

Telegram: https://t.me/PoolzOfficialCommunity

Written by cryptboss255

https://bitcointalk.org/index.php?topic=5280470.msg55607034#msg55607034