Blockchain and cryptocurrency developers are constantly on a research for developing a more suitable and decentralized systems for utilization by the global community. When DeFi was earlier introduced, there was issues surrounding the initial injection of liquidity offering which makes it difficult in determining assets market price of the token been provided liquidity.

Considering that the space is saturated with a lot of competitions which has caused a great deal of dissatisfaction among investors. Poolz is a decentralized exchange protocol technology that is designed to maintain pools of liquidity for investors and liquidity miners. Poolz is designed to help investors secure their liquidity Mining.

Introducing Poolz's & Its Liquidity Solution

Poolz is a Decentralized ecosystem that is built to facilitate the connection between blockchain start-ups and prospective investors. Poolz ecosystem empowers developers to operate their liquidity pools in order for their project’s proper identification in the ecosyetem by investors. The team behind this project is on the process of building a project that will enhance the sustainability of liquidity pools and improve the value of DeFi market.

The Opportunity Poolz's Saw in the Market

Decentralized Finance (DeFi) has gradually become popular due to the fact that the technology has been consistent for the past couple of years, DeFi market has being in progression since from 2019 with a current market capitalization of more than $16Billion. With all this growth and popularity, Poolz group of minds recognized that there is a challenge that is faced in the DeFi ecosystem, particularly the challenges of an improved liquidity that will guarantee profitable price for investors. The team has taken upon this challenge and is building a solution to it.

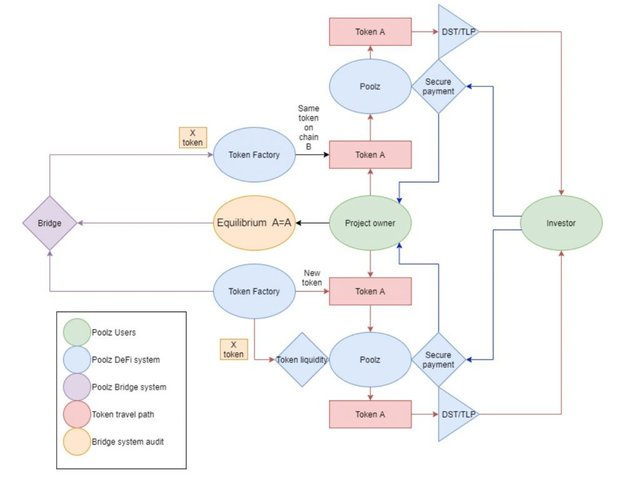

The poolz Ecosystem

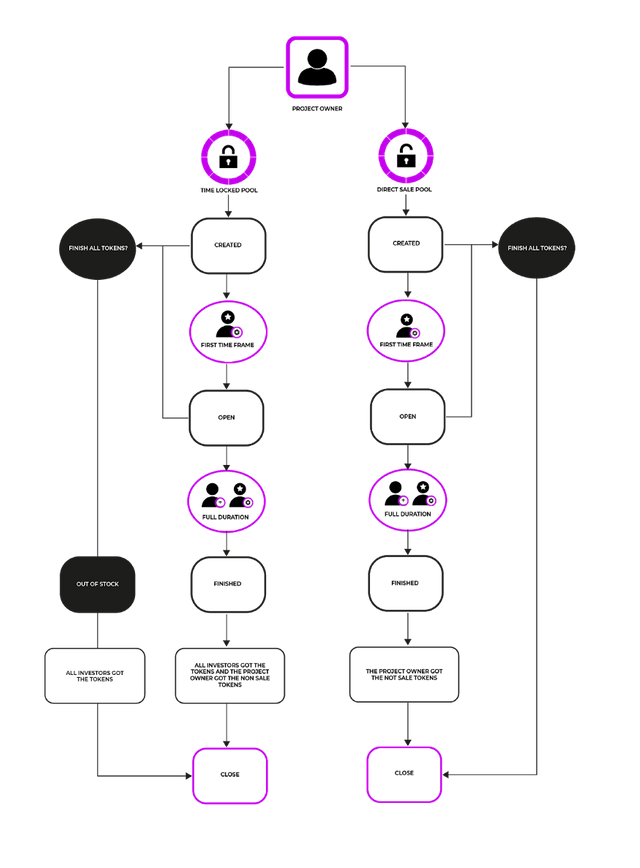

The ecosystem is designed and equipped with two kinds of liquidity pools which includes;

Direct Scale Pools: In this pool, the system allows investors to receive back their tokens after swapping for liquidity.

Time locked Pools: in the case of the timed locked pools, the system allows investors to receive back the tokens they swapped for liquidity only after an initial agreed completion of locked duration.

Poolz ecosystem has interface for two categories of clients, with the first interface being for developers and project owners while the second interface is for investors.

Developers & Project Owner's Interface

The developers and project owners interface of Poolz ecosystem is designed with a number of features which includes;

- Supporting blockchain & wallet: Before becoming a project owner, a client will need to select the type of blockchain protocol the project is being built on, this will also determine the wallet to be used. For now only Ethereum blockchain is supported but Poolz will introduce other blockchain ecosystems in the future.

- Liquidity Pool Creation: creating a liquidity pool as a project owner or a developer requires clients to take note of address of the token, total supply of token, total ratio and duration of the pool.

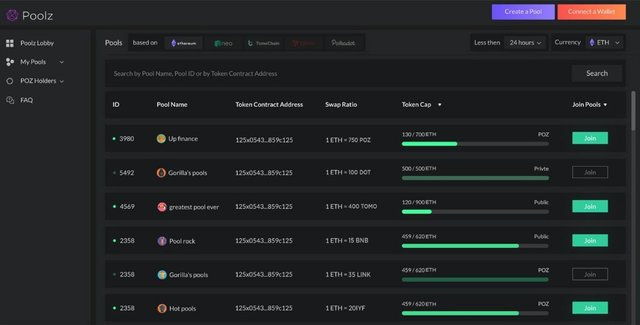

Investors Interface

The investors interface is designed with features which includes;

- Pool Selection: This feature has a list of all the pools that are created by developers and project owners. Investors have the liberty of running their research on all available pools listed before deciding to join any. Every particular pool will have information which includes;

i. An available time for the pool

ii. The duration of the pool

iii. The remaining time available for the pool

iv. Methods of payment (ETH or DAI)

v. The swapping rate of the pool and

vi. Status of the pool.

- Fees: Poolz ecosystem has a provision for two different kinds of fees to be paid by a investors for the development and maintenance of the system. 0.15% of liquidity generated while 0.2% of total liquidity raised. The amount of fees can be changed by the governance if voted for.

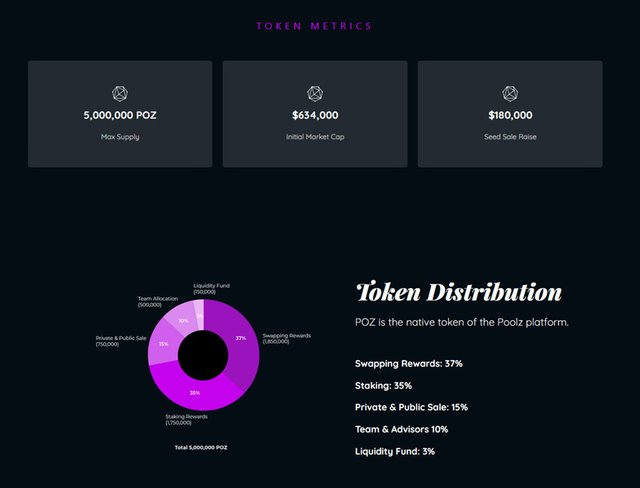

The Poolz Utility Token (POZ)

Poolz ecosystem’s token (POZ), primarily serves as a utility token for a number of features in the ecosystem, features that range from governance and project development. Now aside these, the token have a number of other use cases which includes;

- Additional benefits: POZ token investors stand to benefit from additional profits and a better swap ratio.

- Staking: investors that choose to stake POZ tokens stands to gain annual income as staking rewards.

- Token burn: 16.667% from the POZ token’s daily earnings from the market is burned. This is a very fascinating feature that will do well in impacting the steady growth in demand and value of the token.

37% of total POZ token supply will be dedicated as swapping rewards for users within the Poolz ecosystem, the reward percentage is liable to changes in the future by the governance team. This reward will by design be available for only 10years. In essence, users gain percentage of the total liquidity being deposited every week, the swapping rewards is calculated and distributed in every 4hours.

Meet the Project Partners

Project Roadmap

Conclusion

The current DeFi ecosystem is plaque with an issue that is inherent with liquidity pool injection, this has scared a lot of liquidity providers away after hitting on a serious lost. Poolz has implemented a sustainable solution to this liquidity issue and is also bringing a great deal of sustainable benefits into the DeFi space. I implore my readers to consider looking more closely on Poolz technology by following the official links i provided below, thanks.

interesting read buddy, i love your content!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit