yLEND protocol is built on Ethereum platform that will allow users to lend, borrow $eth or other tokens and earn algorithmically set interest rates, additionally double their earnings with farming functionality which is one of a few in DeFi.

You Deserve More Earnings

Our vision is that “You deserve more earnings”. There are many lending protocols available on the market, however their interest rates are only based on the ratio of lenders and borrowers. Usually, the interest rates are very low because of low number of borrowed amount. We aim to solve this issue and maximize your earnings by offering farming functionality.

- Lend your cryptoI and earn interest rates + yield earnings

- Borrow crypto earn daily yield earnings based on the collateralized amount.

- Stake your $yLEND holdings and earn profit by yield farming.

- Maximize your earnings by APY and yAPY.

APY + yAPY

- Lenders will earn two types of APY = APY and yAPY

Standard APY will be algorithmically calculated based on supply and demand. yAPY stands for the earnings from farming as yield earnings in yLEND tokens. This will allow lenders to earn high interest rates even if there is a low demand for borrowing which is missing in many lending protocols.

Borrowers will also earn yAPY on the amount they borrow. This sounds interesting, right? You earn money even when you borrow thanks to yLEND ecosystem.

yLEND Protocol Offers

Lending

yLEND protocol offers a new generation of crypto lending and borrowing protocol with farming opportunities. For provided liquidity users will earn standard interested rates and additionally yield earning from farming.Governance token

$yLEND is a governance token of yLEND protocol. One the core features of $yLEND is the ability to vote for the changes and development of the protocol. User will be able to decide distribution rate of $yLEND tokens, buy back and distribute or buy back and burn rates.Borrowing

Borrowing will be available on the collateralized amount from provided liquidity. Borrowers will also earn daily yield earnings based on the collateralized amount as yLEND tokens.Development Fund

yLEND development fund is one of the important part of the project. It is aimed to maintain the success of the project. Initially 500 eth (1/3) from pre-sale will be locked in the fund. Gradually, users will decide how to use these funds by voting. The main use case will be buying $yLEND tokens from the market and burning or distributing among the protocol users.Vault

$yLEND holders will be able to stake their $yLEND holdings and earn profit by locking their funds. The vault is designed to incentivize hodling the $yLEND tokens and maintain the sustainable price growth.yLUSD add on

Another exciting add on of yLEND protocol will be elastic supply token $yLUSD to maintain sustainable growth of the ecosystem. $yLUSD will follow the Ampleforth elastic supply models and it will expand and contract supply in response to market conditions, to target 1 USD per $yLUSD.

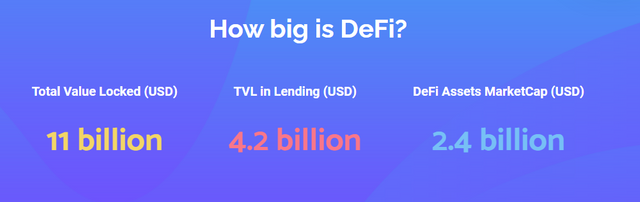

How big is DeFi?

Total Value Locked (USD)

11 billionTVL in Lending (USD)

4.2 billionDeFi Assets MarketCap (USD)

2.4 billion

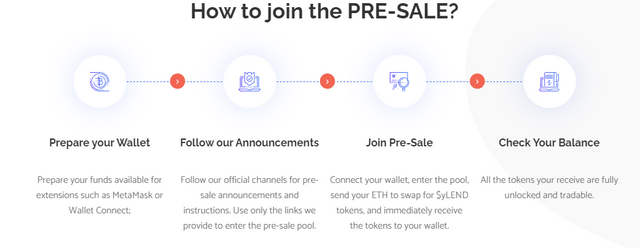

How to Join The PRE-SALE?

Prepare your Wallet

Prepare your funds available for extensions such as MetaMask or Wallet Connect;Follow our Announcements

Follow our official channels for pre-sale announcements and instructions. Use only the links we provide to enter the pre-sale pool.Join Pre-Sale

Connect your wallet, enter the pool, send your ETH to swap for $yLEND tokens, and immediately receive the tokens to your wallet.Check Your Balance

All the tokens your receive are fully unlocked and tradable.

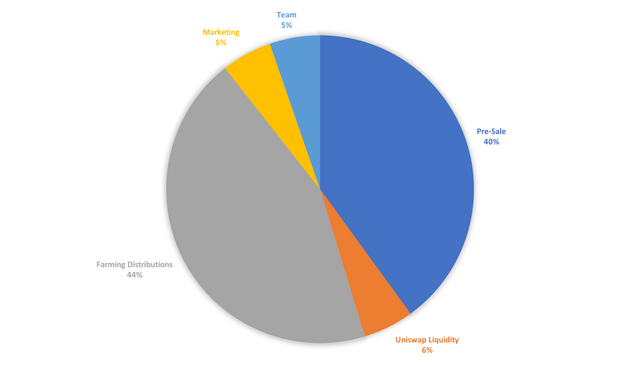

Token Distribution

- Name Token : yLEND

- Total Supply : 75,000

- Target Uniswap Listing Price: 1 ETH / 8 yLEND

- Pre-Sale Date: SOON

- KYC: NO

- Marketing: 5%

- Team: 5%

- Hard Cap : 1,500 ETH

- Soft cap : 900 ETH

- Pre-Sale Price : 1 ETH/ 20 YLEND

Roadmap

- Q3 2020 : yLEND protocol development.

- Q4 2020 : Public Pre-Sale.

- Q4 2020 : Uniswap Listing Immediately After the Pre-Sale.

- Q4 2020 : Preparing for Beta Launch.

- Q4 2020 : Completion of Audits.

- Q4 2020 : Beta Launch.

- Q1 2021 : Launching Full Community Governance.

- Q1 2021 : Vault Release.

- Q1 2021 : Preparing for yLUSD launch.

Maybe only this information that I can tell you all, if you are interested or want to join please you, can visit the link below, which can help you in the future and get more accurate information from their team or developer, and don't forget to follow me, so as not to miss the news about interesting projects and bigger projects .. Thank you

ACCURATE INFORMATION

- Website : https://www.ylend.io/

- Twitter : https://twitter.com/ylendprotocol

- Telegram channel : https://t.me/ylendio

- Telegram group : https://t.me/ylendgroup

- Medium : https://ylendprotocol.medium.com/

AUTHOR

- Bitcointalk Username : Ris88

- Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=742331

- ETH Wallet Address : 0x2CF4F93348116B2Ce67Ecb7A9eA57E10Bf0f81A2