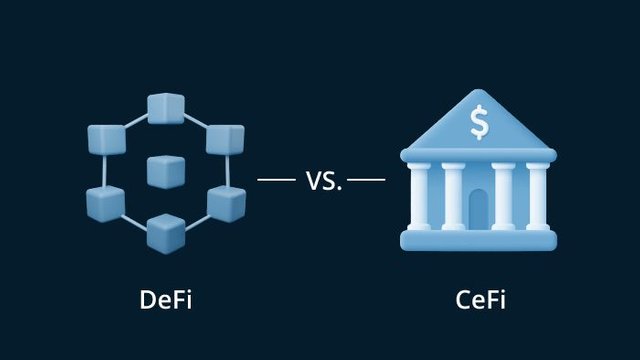

Decentralized Finance, or DeFi, is an ecosystem of financial applications built on blockchain that is transforming the way we manage money, offering financial services without intermediaries.

Main Content:

What is DeFi? DeFi refers to a set of applications that enable the creation of financial services like lending, saving, trading, and more, without the need for banks or financial institutions.

Advantages of DeFi:

Global Accessibility: Anyone with internet access can use DeFi services, regardless of their location or financial history.

Transparency: Transactions and operations in DeFi are completely transparent, as they are recorded on the blockchain.

Elimination of Intermediaries: By removing financial intermediaries, users can save on fees and obtain better interest rates.

Popular DeFi Platforms:

Uniswap: A decentralized exchange that allows tokens to be traded without intermediaries.

Compound: A platform that allows users to lend and borrow cryptocurrencies at automatically adjusted rates.

Aave: Another lending protocol that offers a variety of options for borrowers and lenders.

Risks Associated with DeFi: Despite its benefits, DeFi also presents risks, such as potential errors in smart contracts or vulnerabilities in platform security.