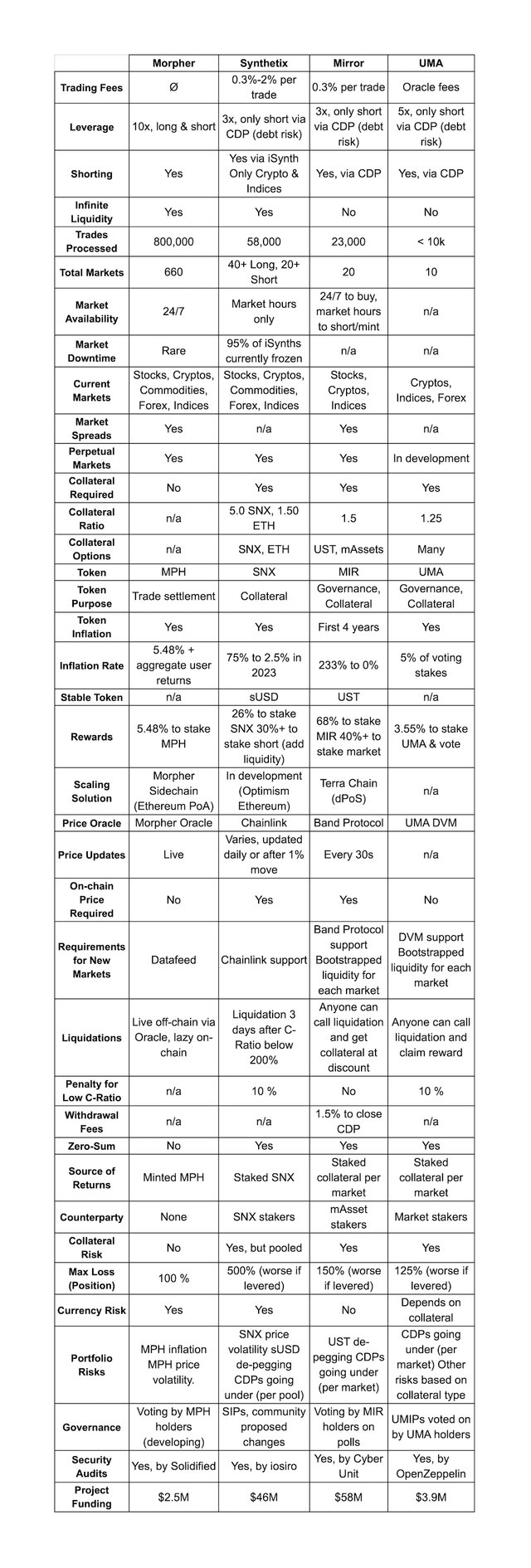

Morpher vs Synthetix vs Mirror vs UMA

Which synthetic asset protocol is best? That’s for you to decide. But we think you will appreciate this breakdown of how Morpher compares to other DeFi derivatives platforms.

What is DeFi?

DeFi is a term that refers to financial products and services that are available to anyone who has access to the internet and therefore can use Ethereum. The goal of DeFi is to give anyone access to markets at any time, and to use code to make services that are usually slow and flawed, automated and safe since anyone can inspect and scrutinize their code.

What are synthetic assets?

Synthetic assets give users exposure to different assets without the need to hold or own the underlying asset. For example, someone that has synthetic gold stock can profit from a change in the price of gold without having to actually own gold. This is true for other assets, from fiat currencies like the US dollar or Japanese yen, to other commodities like silver, and even index funds or other digital assets. With synthetic assets, investors can own tokens that track the value of more traditional assets without having to leave the cryptocurrency ecosystem.

An overview of synthetic asset protocols

Morpher

Morpher is powered by a set of smart contracts built on Ethereum. These smart contracts act as the counterparty to all trades, while the MPH token acts as the settlement currency. Users select a market they wish to stake their tokens to, and the resulting price-action difference is materialized in the minting and burning of staked tokens. Should the user’s position earn a profit, an amount of tokens proportional to the return are minted, and, if the user realizes a loss, a proportional amount of the staked tokens is destroyed. Morpher is available as a trading app and as a decentralized exchange.

Synthetix

## Synthetix is based on Ethereum and synthetic assets on the protocol are known as “Synths.” Like other synthetic assets, Synths track and provide the returns of another asset without requiring you to hold that asset. Users can trade Synths — which range from cryptocurrencies, indexes, inverses, and real-world assets like gold — on Kwenta, Synthetix’s decentralized exchange. Synthetix’s native token, the Synthetix Network Token (SNX), is used to provide collateral against Synths that are issued.

Mirror

Mirror Protocol is a separate blockchain protocol operating on top of the Terra blockchain network. It enables the creation of fungible synthetic assets called mirror assets, or mAssets. mAssets "mirror" the ongoing real-time value of share prices from leading enterprises around the world such as Tesla (mTSLA), Apple (mAAPL), Microsoft (mMSFT) and a host of others. Mirror Protocol uses its utility token MIR and can be used to create mirror assets and for numerous other decentralized finance (DeFi) uses within the Terra ecosystem.

UMA

UMA stands for Universal Market Access. The Ethereum-based protocol allows anyone in the world to access and create tokenized financial derivatives with self-executing agreements. Through UMA, two counterparties come together to create a financial contract that is secured through economic incentives (collateral), and enforced through smart contracts on Ethereum

Compare Synthetic Asset Protocols What Makes Morpher Unique?

What Makes Morpher Unique?

Morpher does not require any collateral to create synthetic markets. All users have to do is connect their wallets and start trading. But other than being a convenience, this also allows the platform to offer more than 700 markets and to keep adding more. There is also a huge variety of markets Morpher would be technically able to support: from weed spot price to NYC real estate or even corporate fundamentals. The ability to support markets that cannot exist in traditional finance is something the platform hasn’t started to explore yet, but will in the future.

There is no counterparty in the Morpher Protocol. In contrast, SNX stakers are counterparties for Synthetix and each market on Mirror and UMA has direct counterparties. The financial crisis showed counterparties can and will default. Morpher is the only protocol that is completely solvent by design.

Morpher makes using leverage and shorting extremely easy. These critical trading features are just parameters in the Morpher smart contracts. That’s really important because complicated financial instruments are hard to use and obscure the real risks. To democratize investing we believe shorting has to be as simple as buying a stock. As for professional traders, they can enjoy a maximum leverage of 100x or more in the future.

Morpher has perfect liquidity. Liquidity is the lifeblood of markets, so having to build up liquidity through staking is a significant hurdle. On Morpher, all markets are available to trade with one currency: MPH. That means there are no debt positions for users to repay, they can just swap MPH for ETH/USDC/DAI to exit the Morpher ecosystem.

Morpher can support significantly more trading volume than any other protocol. In traditional finance, the trading volume of derivatives dwarfs the underlying asset markets. The same is true for the Morpher Protocol and our virtual markets, which have few limitations on scale.

Here are the key features of Morpher DEX:

- Long & short exposure to every market

- 24/7 trading

- Stocks, commodities, forex, and cryptos

- No overcollateralization

- Infinite liquidity

- Zero slippage on any order size

- 10x leverage

- Global permissionless access (no signup)

- No counterparty

- Swap any ERC20 token directly into a market position

- Morph ETH into Tesla / Amazon Virtual Futures

- Morph DAI into Polkadot / Cardano / Tron Virtual Futures

- Earn over 5% a year by staking

The Morpher team has been developing its protocol since 2018 and launched a sidechain trading app in August 2020. Since then, Morpher has gained a following of 40,000 active traders and settles thousands of trades every day.