Foreword:

At present, the overall number of DeFi users is about 100,000. Compared with mainstream web2 applications, this magnitude is almost negligible. However, for the encryption field, this is a precious kind of fire. So, why do these seed users use DeFi? What kind of people are they and what are their needs? What hinders the current development of DeFi? Answering these questions is essential to promote the development of DeFi. The author of this article, Dex.blue, was translated by "Joe" from the "Blue Fox Notes" community.

What hinders the development of DeFi?

What drives the adoption of DeFi users? What are the needs of DeFi users today? The purpose of conducting extensive surveys on the DeFi community is to find answers to these questions. In the Ethereum ecosystem, DeFi is still very new, but it is also a complex and diverse field. Our goal is to enhance our common understanding of user needs and goals. This is why we are investigating with other DeFi teams such as Argent, Kleros, Kyber, Maker, RenSynthetix and Uniswap. Since we are all committed to the growth of DeFi and believe in its strong community, the data in the survey is open source, and everyone can dig deeper and generate deeper insights from real DeFi users. Looking at the survey results, we are very satisfied with the number of results given the time and scope of the survey. In terms of quantity, the survey included 26 questions, the average completion time was 11:04 minutes, and a total of 467 responses were received. The result and opinion survey consists of two parts. The first part explores the general characteristics of DeFi users, including demographics, occupations, etc. The second part is an in-depth study of the most commonly used DeFi application categories, usage patterns, trust and frustration.

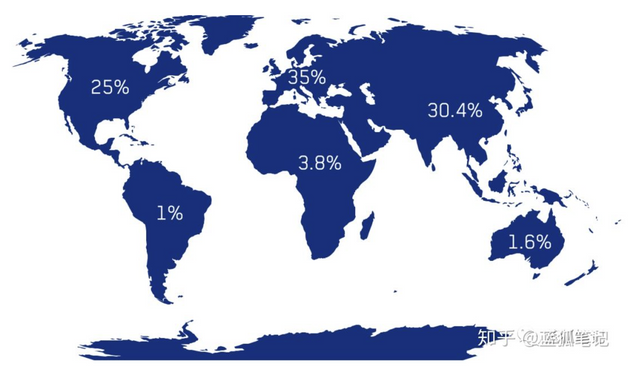

The DeFi application categories include: decentralized exchanges, derivatives platforms, lending agreements, games & NFTs, and wallets. The conclusions of the first part are directly given by the dex.blue team, while the insights of the second part come from the comments and feedback of Argent, Kyber, dex.blue and Maker. Part 1: Demographics and overall user information*Age The average age of all survey participants is 31 years old, and the age range is from 16 to 66 years old. *Geographical distribution As you can see from the figure, the main geographical sources of survey participants are Europe, Asia and North America, which are roughly evenly distributed (2.8% of the respondents did not disclose their geographic location)

Geographical distribution of DeFi users (based on DeFi user survey)

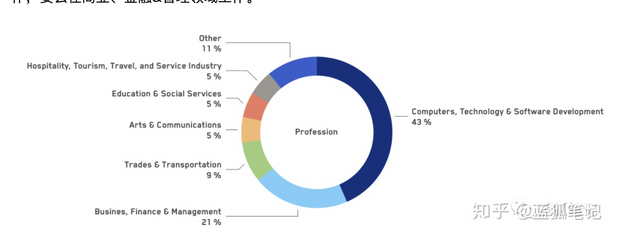

The occupational distribution of professional participants is in line with everyone's expectations. Most people work either in the fields of computer, technology & software development, or in the fields of business, finance & management.

Occupation of DeFi user (based on DeFi user survey)

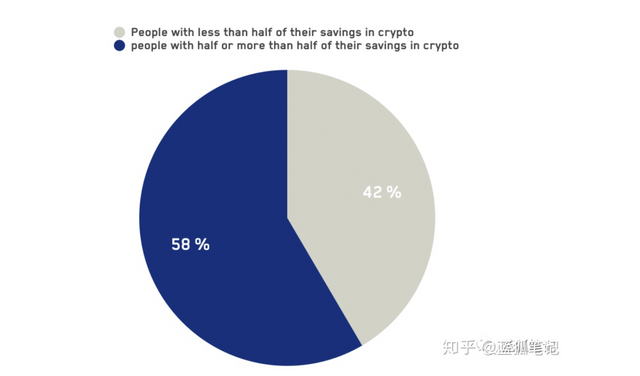

Considering the volatility of digital assets and the immaturity of asset classes, DeFi users hold 54% of their total savings in encrypted assets on average.

Deposit distribution of crypto assets (according to DeFi user survey)

Activity Check the bar graph below, you can see that the average activity of DeFi users is very high. About 75% of users interact with their DeFi applications at least twice a week. In 75% of users, almost half of them interact with their dApps every day. (Blue Fox Note: Look at this problem from two perspectives. One is that the core users of DeFi are very sticky. The other is that most of the users who are willing to spend more than ten minutes answering the questionnaire are heavy users of DeFi, so this conclusion Not surprising.)

(Adoption/category of DeFi applications)

Part 2: Insights into specific categories of DeFi applications. Although there are more categories in the survey than those analyzed below, this article only selects and reviews a representative sample size (>50) category: Decentralized exchangesLending platforms *Number of replies per category of wallet: Decentralized exchange: 211; Derivatives platform: 22; Game/NFT: 18; Lending platform: 95; Lotto: 0; Wallet: 113. (Blue Fox notes: It can be seen that transactions and wallets are the biggest demand, and the user experience is relatively simple; while for ordinary users, derivatives, NFT, and lottery are relatively complex or insufficient in demand. DeFi has to go mainstream. It's a long distance, but it also shows that there is a lot of space) 1. Decentralized Exchange * Trust When asked about DEX (decentralized exchange) related questions, security and trust are the key. This is what we found: 1) The average trust score of decentralized exchanges is about 8.5 points (10 points total). The main reason for not giving full marks is the new field and general suspicion: "I only trust my mother 100%."

However, some respondents gave a score below 6 points, the main reason is, either because of recent Historical attacks have caused them to distrust exchanges in general, either because they are not developers themselves and cannot verify smart contracts.

Transaction motives So, what are the respondents’ motivations for trading on decentralized exchanges (as opposed to centralized exchanges): 60% of decentralized exchange users tell us that the main goal is to achieve financial independence. The other answer is "understand the underlying technology" and "promote the progress of decentralization," each accounting for about 20%. It is also clear that users who use advanced order book-based DEXs have higher financial motivations than users who use only AMM-type decentralized exchanges. One of the purposes of this survey is to find out when and why people started trading in the first place. When asked about this, the majority of traders (58%) told us that they trade when they are impulsive (news, etc.), and about one-third (31%) of users said they would schedule time or have time Make a transaction while doing a transaction. The remaining 11% gave other reasons, such as specific needs or portfolio adjustments.

However, what triggers most decentralized exchange users to have the impulse to trade? Many of the initial triggers for users to trade impulse are information from Twitter or other social media channels (41%); among the survey participants, research-based methods are also very popular, such as TA (technical analysis) and market sentiment analysis ( 32%) etc. 2. 56% of the respondents of the lending platform said that their goal of using DeFi is to achieve "financial independence." Loan agreements play an important role in helping users achieve this goal. Especially considering that the respondents in this survey own 54% of the assets in DeFi, the loan agreement provides an infrastructure that can grow and utilize these wealth over time. In the DeFi field, the most popular lending platform to date is Compound, which has a market share of 44% and is in the leading position.

The rest is more decentralized than other DeFi categories, followed by Aave (22%) and MakerDAO (20%). Among the survey participants, the distribution is more dispersed, Curve/iEarn (7%), Nuo (5%), Uniswap (5%), Synthetix (4%). What makes some platforms more popular than others?

You might think that interest rate/APY is the most critical criterion for choosing a platform. However, the ease of use of the lending platform's UI/UX (user interface/user experience) seems to be the most critical factor, with 36% of respondents taking this as the most important function of the basic platform. Interest rate/APY (22%) ranked second, while safety and reliability (14%) ranked third. Obviously, loan agreements have an opportunity to improve their adoption and ease of use. Only 19% of the respondents said that their most frequently used DeFi is the "lending agreement", while 46% of the respondents said that they most commonly use decentralized exchanges, and 24% of the respondents said that their The most commonly used is the wallet. Of course, many of these agreements, such as Maker, dYdX, and Compound, can better educate the wider DeFi ecosystem on how to use “borrowing” carefully to help them achieve the goal of “financial independence”.

Wallet Unsurprisingly, MetaMask is to some extent the most popular wallet for accessing DeFi. 71% of people chose it, while Ledger was 32%, and the third was Trust Wallet, which was 27%. (Blue Fox notes: Most DeFi users have used Metamask, which is related to their user experience and earlier entry) After them, the mobile wallets Coinbase, Argent, and imToken are basically around 12%.

Although Argent is the most popular smart contract wallet, it is clear that new players need to do a lot of work to make it look different from other wallets. In the hardware wallet market, this difference has already occurred as Ledger is increasingly ahead of Trezor (32% vs 9%). Who can catch up with MetaMask and Ledger? Perhaps the better question is, which mobile wallet best complements its functions? Among the interviewees, very few people use only one type of wallet, so no one type of wallet takes everything. You may see fragmented markets in the future. Although encryption is global by default, the popularity of wallets is largely affected by regional factors. According to the survey, imToken is mainly used in Asia. Trust Wallet is the closest wallet to MetaMask's popularity in Asia. What hinders the development of DeFi? The last question in the survey is perhaps the most interesting question, "What is hindering the development of DeFi"?

The most common answer is education/marketing (45%). For most of us, this is not surprising. However, it emphasizes the need for more accessible and beginner-friendly learning resources.

One interviewee mentioned “lack of explanations for beginners, too many high-level encryption explanations.” Following education and the market, there are security considerations (40%), UI/UX (39%), and liquidity. (36%). Considering the latest development of DeFi applications, Web2 applications are easier to use than Web3, and the liquidity of decentralized exchanges is growing but small compared with centralized platforms. These friction points seem reasonable, but they can be resolved in the medium term.

In the next step, finally, this survey helped answer some questions (such as who are DeFi users today, do they believe in DeFi, the proportion of their assets in encryption, what hinders the development of DeFi, etc.), but these answers It also sparked the following discussion: *What kind of basic education is still lacking in attracting more users to use DeFi? *If most DeFi users are motivated to make money using DeFi, what can we do to support this? *What do users really care about in the "De" part of DeFi? The community can also obtain survey data and seek more clues and insights, hoping that these data will be helpful to the community.