Undoubtedly, DeFi is one of the major sectors that is fast growing in the crypto world in the last six months, with nearly $9 billion worth of funds locked in DeFi smart contracts. From Staking and investment platforms to decentralized exchanges and now liquidity providers, the DeFi industry is fast growing in the crypto world.

When talking about DeFi protocols, names like Uniswap, LEND, Curve, Yearn Finance, Compound to mention but few, will quickly comes to our mind. Be that as it may, Yearn Insurance vows to revolutionize the DeFi industry.

ABOUT DEFI

The reason for DeFi is to relegate CeFi to the history book. DeFi has being in the fore front of true decentralization of our financial system as it’s what blockchain stand for. Globally, developers, investors and traders are now heavily investing in this sector due to it potentials and profitability.

Yearn Insurance Farming is a protocol developed on Ethereum network that enable users from all tiers, be it institutional or individuals with small funds to invest in the same pools. Institutional investors with large funds will surely make more profits than individuals with few thousands of dollars in their portfolios. However, in YIF, profit ratio is strongly based on the amount of assets staked.

INTODUCTION TO YEARN INSURANCE FARMING (YIF)

Yearn Insurance Farming (YIF) is one of the latest DeFi protocol developed with the aim of revolutionizing the current DeFi platforms. Through the decentralized nature of the protocol, Yearn Insurance Farming (YIF) has domesticated investment opportunities for investors of all levels. The platform enable individuals to contribute to the platform liquidity pool by means of staking their liquidity tokens on the platform for high returns, and platform on their own aggregate all the liquidity tokens, offer it to crypto-exchanges as trading liquidity. The return on investment from liquidity pools is far better than that of the obtained from traditional financial system.

Any legitimate transactions on our platform are highly insured against any misfortunes. The security of our user’s assets is not negotiable. YIF offer equal playing ground for both institutional investors and individual’s investors.

YIF Vault

Our platform users will have the opportunities to locked their $YIF tokens in the vaults and earn passive income with respect to the amount of funds staked. The locked tokens will be utilized as liquidity tokens to farm other protocols for higher returns.

Insured Swap

Our users sleep and snore like a baby, believing their assets are 100% secured in our hands. While crypto-swapping is highly risk on few protocols, we at YIF offers our esteem users an insured swap via security and reliability of our platform.

$YIF Token

Yearn Insurance Farming has its own native token called $YIF. $YIF is the governance token will serve as the power house of our ecosystem. Holders of $YIF will earn passive income for holding our token, also they can express their view or exercise their right through voting, courtesy of their stake in the YIF ecosystem.

TOKEN DETAILS

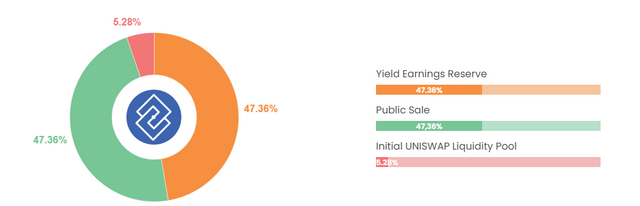

TOKEN DISTRIBUTION

ROADMAP

CONCLUSION

Yield farmers need high returns to cover all the risks involved in DeFi. However, with the emerging of some new DeFi protocols, such as Yearn Insurance Farming, yield farmers can now boost of better and higher income like never before.

For more Info:

Website: https://www.yif.finance/

Twitter: https://twitter.com/yiffinance

Medium: https://medium.com/@yif.finance

Telegram: https://t.me/yifofficial

AUTHOR

Bitcointalk Username: Alaho15

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2513944

Eth Address: 0xf8c20030A71708E73D58Ab3900629F17B8875da5