Modern cryptocurrency trading platforms are designed based on two models which includes Decentralized Cryptocurrency Exchange (DEX) and Centralized Cryptocurrency Exchange. In Centralized exchanges, transactions can be conducted only through involvement of trusted third-parties while DEX cryptocurrency exchanges is built to enable traders perform peer to peer transactions without need for reliable intermediaries. Therefore, on DEXs users are entitled to advantages such as affordable or no transaction fees as well listing charges for companies looking to issue their trademark tokens.

Also, Decentralized Cryptocurrency Exchanges are very much protected against hackers than Centralized exchanges because there is no single point of failure. Decentralized Cryptocurrency Exchanges experiences freedom from regulations by government since there is no centralized authority as observed in Centralized Cryptocurrency Exchanges. With DEXs, there is no chance for price and trading volume manipulation coupled with improving capability of users to remain anonymous in any transaction or transfers.

ABOUT UNIDAPP :

UniDApp is developed by experts as a competent decentralized trading medium based on Uniswap protocol with merged fully advanced features and tools only available for centralized cryptocurrency exchanges within a single DeFi ecosystem to further improve users experience.

With UniDApp, users are given access to tools like Liquidity chart, planning of sales and purchases, analytics, scheduled automatic notifications. These impressive tools will address the shortcomings of Uniswap, effectively driving users to capitalize on any opportunity available in the crypto market as well exchange their assets powered by smart contract without relying on trusted intermediaries.

Uniswap is described as any other Decentralized Cryptocurrency Exchange, however it's very existence solves many problems facing modern Decentralized Exchanges such as bad interface, poor liquidity and many more.

All these advantages found in Uniswap is achieved through the platform's market making mechanism which is suitable for both small traders and professionals, while also providing good liquidity, prices and cheapest gas prices of all DEXs.

Nonetheless, many persons remain discouraged to move their trading activities from Centralized Exchanges to Uniswap because the platform design lacks the capability and features to enable traders build their strategy, monitor real time pool liquidity, prices and so on.

Thankfully, UniDapp based on Ethereum 's Uniswap protocol has been introduced to eliminate some of this issues.

Distinctive features of UniDApp :

Orders :

- The possibility of setting an unlimited number of pending orders for a decrease or increase in the price, which is an absolute necessity when a trader follows his strategy, be it using such instruments as Eliot waves or waiting for price fluctuations on the news. Orders will be triggered automatically regardless of whether you are sleeping, driving or just relaxing.

Notification :

- Notification of reaching the specified price of the given tokens, which will help an experienced trader quickly navigate the market and, if necessary, change the strategy.

Monitoring :

- The ability to monitor the required coin in real time, as well as, if necessary, view the price change graph since the coin listing on Uniswap.

Interface :

- Simplified and intuitively simple interface so that even an inexperienced person can figure out and study the functionality in a matter of minutes.

Perfomance :

- Performance due to the optimization of all processes.

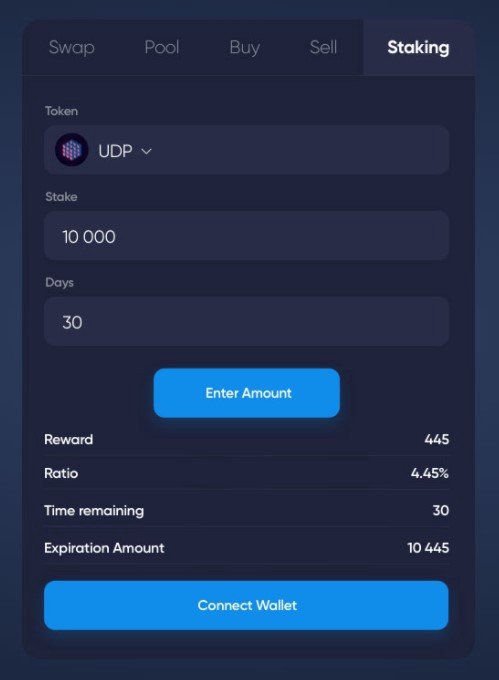

Staking:

The UDP token is a utility token. On the UniDApp platform, in order to make transactions, the user must own a UDP token, which can be purchased on Uniswap after the 3rd round of OTC or any other exchange a few days later.

For each transaction, the commission will be 0.25% of the transaction amount and will be charged automatically in UDP tokens. 90% of the amount charged will go as a reward to the UDP token holders, the remaining 10% will go to the UniDApp fund. The ability of token holders to receive passive income will stimulate the liquidity of the token and the growth of its price.

In conclusion, many individuals feel uncomfortable to trade on DEXs because of several issues like poor interface, low liquidity and so on, even Uniswap is not built with proper features to persuade many people to shift their trading activities towards their platform.

However, UniDapp based on Ethereum's Uniswap Protocol will serve as the solution to tackle the latter problem coupled with providing innovative methods for users to benefit from the booming DeFi industry by easily exploring the convenience and advantages of complete centralized cryptocurrency exchange merged in a decentralized framework without any flaws.

Token Details :

Ticker

UDP

Total supply

30000000

Accepted Currencies

ETH

Min Contribution

2

ETH

ROADMAP TIMELINE :

July :

Development of prototype, frontend, idea formation and market research.

August - September :

UDP private sale and token distribution.

September :

Technical and business documentation. Whitepaper presentation.

October :

Launching and testing the beta version.

November :

Launching the full version of the project and fully introducing the product to the market.

For more details, Kindly use the official links below :

Website: https://unidapp.app

Twitter: https://twitter.com/UniDApp

Telegram: https://t.me/unidapp

Medium: https://medium.com/@unidapp.project

Author

BTT Username : rahat369

BTT Profile Link : https://bitcointalk.org/index.php?action=profile;u=2810449

Telegram username : @shuvenkar55

Wallet Address : 0xf15aae8fe23dc766381ba1eb92df874fcef39ebb