About DeHedge

DeHedge platform – perspective investment in ICO with investment protectionThe DeHedge platform is a fundamentally new format with a developed infrastructure and a complex of powerful tools for the protection of crypto-investments.The main task is to prepare a stable and convenient decentralized platform for hedging investors’ risks in crypto-currencies. The goal of the developers is to carefully consider the reliable protection of investments in the ICO and the security of crypto currency against the risk of fraud, failure of selected projects or serious fluctuations in rates.

How Does DeHedge Work?

DeHedge is a decentralized insurance market. You enter into a smart contract with DeHedge. Each smart contract is programmed to automatically pay out in full if an insured event takes place. The entire platform is built on the Ethereum blockchain.

Investors can also waive an automatic payout and choose not to make an insurance claim. If the exchange rate drops below a certain amount, then the smart contract can pay you ETH or BTC in exchange for your tokens. Or, if you’re confident the price will come back up, then you can waive your claim and hold onto your tokens.

Another key feature of DeHedge is that its smart contracts use a binary relation algorithm based on insurance, reserves, and liabilities. This makes it impossible for insurance cover to exceed insurance reserves. In other words, DeHedge isn’t going to promise huge protection to insurers, then fail to pay out when an event takes place. This isn’t possible due to the logic of the smart contract. It’s impossible for liabilities to exceed the coverage.

The entire system revolves around DeHedge’s unique scoring model. That scoring model was developed “in collaboration with a world class consulting firm,” explains the official website.

Full details about the scoring model can be viewed in the DeHedge whitepaper. The system involves using proprietary software to process two types of information, including automatic collection and analysis of publicly-available data as well as manual data adjustments when necessary.

Some of the data analyzed by the DeHedge engine includes the project whitepaper, project web page, team information, social activity, Github and repository activity, blog articles, news and posts in popular online forums, token emission volume, token price during ICO, post-ICO token quotes, the number of investors, the amount of money being raised, the trading volume, and the number of bidders. DeHedge takes all of this information into consideration, then uses machine learning algorithms to assign projects to certain categories and domains.

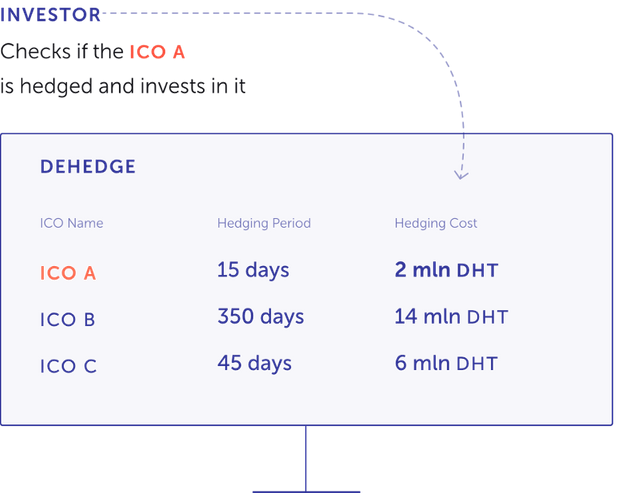

The end result is that you can browse the DeHedge platform to view insurance prices for various ICOs. You might see one ICO listed on the platform with a 350 day insurance coverage package available. That package is priced at 14 DHT. Meanwhile, a shorter-term, 15 day insurance package for another ICO is priced at 2 DHT.

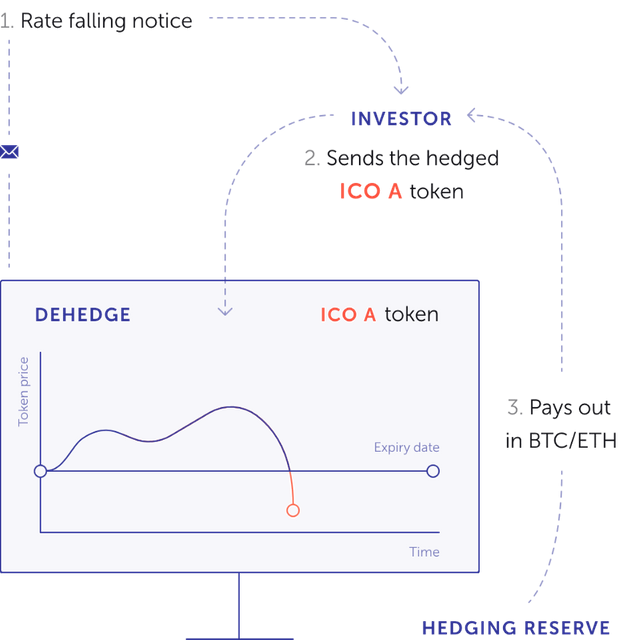

You buy one of these insurance packages, then receive protection in the event of a price drop. If the price of the token drops, then DeHedge will send a rate falling notice to your address. If the price drops below a certain point, then you can claim your insurance, in which case you send your tokens to DeHedge and they’ll pay BTC/ETH from their insurance reserve. If you’re confident the price will come back up, then you can also waive your insurance claim.

DeHedge Benefits

Overall, DeHedge aims to deliver benefits to ICO investors, cryptocurrency traders, institutional investors, and blockchain startups.

- ICO investors are guaranteed the safety of their investments

- Cryptocurrency traders can access protection against exchange rate volatility

- Institutional investors can retain profitability and attract new investors by guaranteeing greater levels of protection than other funds

- ICO projects can attract investors and protect against post-listing pump and dump schemes (investors will be more attracted to a project if it’s insured against a scheme like this)

- ICO trading venues help to attract large investments in a project

- Crypto exchanges insure transactions between clients

- Crypto wallets can insure customer funds against hacks and protect their customers

- Mining farm vendors can access protection against exchange rate volatility

As you can see, DeHedge aims to deliver major benefits to all members of the cryptocurrency community, from individual investors to the supply side. Companies can provide additional protection to their customers, while individual investors can purchase protection for themselves.

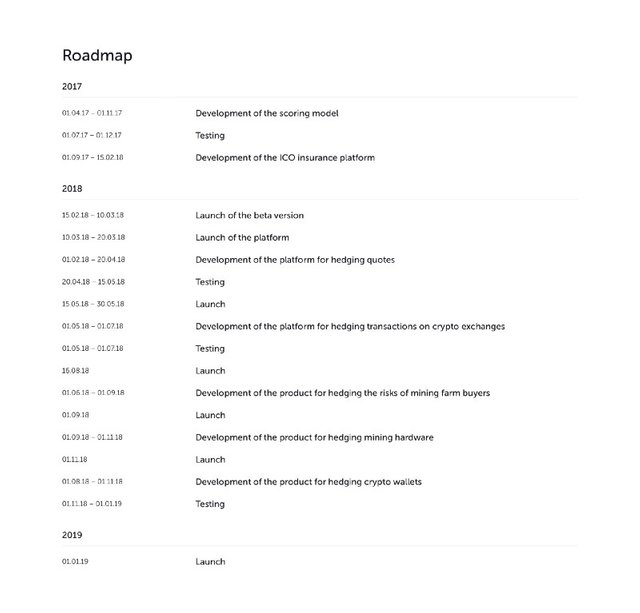

ROADMAP

The DeHedge Token Sale

DeHedge is issuing a total of 10,000,000,000 (10 billion) DHT tokens. 80% of the total supply will be sold during the pre-sale/crowdsale. 15% is going to the project team and co-founders, 2% is going to the bounty program, and 1% is going to marketing.

The ICO begins with a pre-sale from December 4 to December 17, 2017. DeHedge is seeking to raise $3 million during the pre-sale. Investors get a 25% bonus, with a base rate of 1 DHT = $0.0165 USD (or the equivalent in BTC / ETH.

The general ICO, meanwhile, is scheduled for March 2018, closer to the release of the beta. More information about the general ICO will be released in January 2018.

Planned DeHedge products

- Hedging transactions on exchanges.

- Hedging of wallets.

- Hedging the risks of currency fluctuations for buyers of mining farms.

- Hedging of lost profit for miners.

- Hedging of mining equipment. Entering new products on the DeHedge platform will increase the demand for DHT tokens, which in turn will increase the cost of the token

Ecosystem:

The DeHedge project will be implemented on the public blockbuster Ethereum. The Ethereum blockbuster is the industry standard for issuing digital assets and smart contracts. The ERC20 token interface allows you to deploy a standard token that is compatible with the existing infrastructure of the Ethereum ecosystem, including development tools, wallets and exchangers. The Ethereum block is excellent for the needs of the DeHedge project: release of tokens, decentralized fixation of hedging obligations, payment and payment methods. DHT follows the ERC20 standard. Smart contracts will be implemented in the Solidity programming language.

For more information visit:

Website: https://dehedge.com

WhitePaper: https://dehedge.com/documents/dehedge-whitepaper-en.pdf

Twitter: https://twitter.com/De_Hedge

Facebook: https://www.facebook.com/dehedgeofficial/

Telegram: https://t.me/Dehedge

ANN Thread: https://bitcointalk.org/index.php?topic=2412456.0

Bounty Thread: https://bitcointalk.org/index.php?topic=3008651.0

Posted By: https://bitcointalk.org/index.php?action=profile;u=1638981

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcoinexchangeguide.com/dehedge/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit