Loans are a fundamental part of the market economy. Most businesses would not be able to get off the ground or achieve any of their goals without borrowing money from banks or other, more specialised lending institutions. One of the oldest and most enduring forms of lending is a loan secured by means of a collateral: That is to say, a pledge that if the borrower fails to meet his obligations, a certain specified asset will be handed over to the lender. Though basic, this type of loan is still central to the operations of many businesses and lending institutions alike.

With the proliferation of digital assets (particularly cryptocurrencies), there is an obvious appeal to the idea of using those as a collateral. It would both increase the value of such assets in the mainstream economy and help stimulate the cryptoindustry by creating new options for digital entrepreneurs. However, at the present stage, most institutions are not ready to embrace this possibility. This is not solely due to their conservatism. A whole infrastructure must be created before digital assets could reasonably be accepted as a collateral. Depository Network promises to assemble such an infrastructure with the help of smart contracts.

How will Depository Network enable digital asset lending?

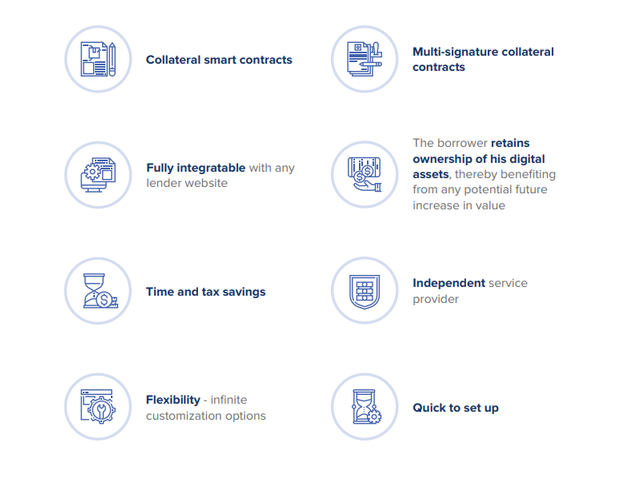

Depository Network will not create just one platform. Instead, it will develop a design that lenders could then use to set up their own white-label depository platforms, fully integrated with their own sites and operating on their own terms. In particular, the lenders will be able to decide for themselves what sort of cryptocurrencies they would accept as collateral. This will also determine which of the two contracts will be used: the self-executing DEPO Smart Contract or the manually-executed DEPO Escrow Contract, which will be used to handle currencies without smart contract support.

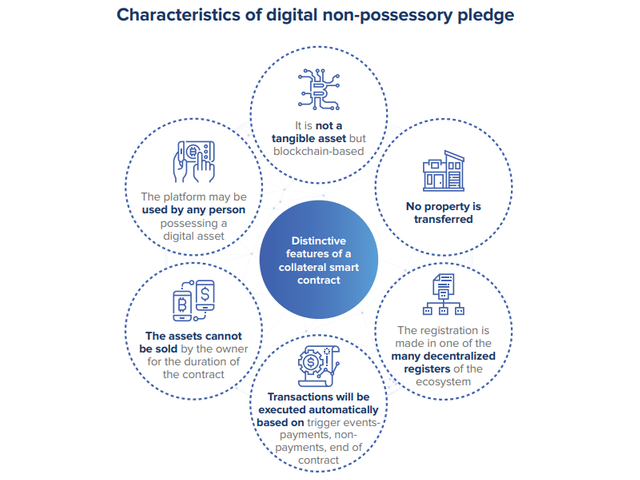

After signing a loan agreement (for any kind of currency) with the digital collateral option, a borrower will be able to create a special DEPO wallet used to store the asset. Those wallets will be multi-signature, with keys going to the borrower, the lender and the network, ensuring that the agreement of all interested parties will be necessary to carry out a transaction. DEPO Oracle will use smart contracts to respond to queries from authorised parties, giving them access to asset data. The DEPO Smart Contract will ensure that the lender will receive the collateral in the event of payment failure, or else will automatically give it back to the borrower once the contract is over. With DEPO Escrow Contract, either the lender or DEPO will be able to release the collateral instead. The system will accommodate changes such as further collaterals being added, provided that this is mutually agreed upon.

What are the advantages offered by the Depository Network?

The Depository Network team includes businessmen and professionals with experience in many different fields, including fintech and blockchain projects. Its project is designed with a focus on business-to-business use. At the same time, it caters to a wide assortment of lenders, from traditional banks to P2P lending platforms (whether fiat or cryptocurrency), and accommodates a similarly wide range of business models. The Depository Network design is simple and straightforward, allowing those lenders to easily create and integrate depositories into their existing services in order to expand their options. Its use of smart contracts should also be helpful for auditing purposes, ensuring maximum transparency with very little effort.

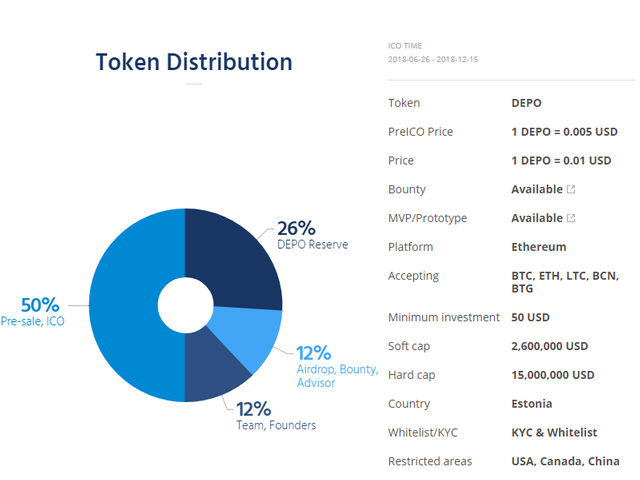

Token sale details

A small but essential utility for the future of cryptocurrency

Mainstream interest in cryptocurrencies is growing. Every week there are news of some established company or institution wanting to join in on the boom. But the actual usefulness of this class of digital assets in everyday business is still sharply limited due to its liquidity problem. Major steps need to be taken before cryptocurrencies can truly go beyond their current niche.

Establishing the infrastructure necessary for digital assets to be reliably used as a collateral in loans is one such step. The Depository Network's solution has the virtues of simplicity and adaptability on its side, and so it may very well succeed. It all depends on whether or not a sufficient number of established lenders will decide to adapt it. Given their current interest, and the chance to considerably expand their business in this sphere, that does not seem impossible. They would not be the only beneficiaries: many cryptocurrency owners will be better able to embark on new business ventures if they could use their tokens as a collateral. That, in turn, would help sustain the cryptocurrency boom into the near future.

Links:

Website: https://depository.network/

WhitePaper: https://depository.network/doc/whitepaper.pdf

Telegram: https://t.me/depositorynetwork

Facebook: https://www.facebook.com/depository.network/

Twitter: https://twitter.com/deponetwork

Medium: https://medium.com/@depo.network

ANN: https://bitcointalk.org/index.php?topic=4507954

Author: https://bitcointalk.org/index.php?action=profile;u=980049

Bountyhive Username: denvil

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

i noe you votes plz fullow me and votes my post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mainstream interest in cryptocurrencies is growing. Every week there are news of some established

i now you fwllo plz

nic e you advartice will done

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every day more interesting projects rolling out and this one goes to my portfolio! Thanks . Glad you guys do so many good reviews and very well writen ones!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit