DESICO is the world’s first platform to issue, buy, and sell security tokens in full compliance with the law. Its ecosystem will disrupt the global $155 billion venture capital market by introducing security tokens through blockchain.

The goal of DESICO is to create a gateway for retail and institutional investors to step into VC Dominated startup funding space. At the same time, DESICO seeks to contribute to creating fully global, fair and less costly access to capital for promising businesses from anywhere in the world.

DESICO will build on the advantages of an ICO (Initial Coin Offerings) to create an ecosystem bringing the next big change in the global capital markets. DESICO will enable decentralization of pre-seed investments by adopting unique capabilities of blockchain technology and providing a legal way to purchase security tokens. Tokenization of existing assets with revenue streams, or other hybrid security tokens ICOs are an emerging asset class that has huge potential to grow with the right capital markets infrastructure. Currently, most are hybrid (partly securities, partly utility tokens), some are utility tokens, and few are clearly securities.

Background

The company, who will actually be operating from within Lithuania, established their core team way back in the third quarter of 2015 when they created a P2P lending platform. After a crowdfunding platform launch in early 2017, they went on to successfully receive an E-money license at the end of that same year. At the start of 2018, they became a member of the ICO regulatory development team, set up by the Ministry of Finance of the Republic of Lithuania. After their own ICO has completed, they will launch their beta security ICO platform, followed by the launch of their payment system for Crypto/fiat.

Full decentralization of the DESICO platform and its services are made possible by the use of smart-contracts on the Ethereum blockchain. So, on the face of it, it’s already sounding pretty impressive, especially as what we have here is an already established company with working systems and a very experienced solid team behind.

Introduction of Business Plan and Token Model

Business-related subtle elements of the platform are to some degree unclear. For instance, instead of providing specific points of interest with respect to the fees to list an ICO on the platform, it is simply expressed that “”the cost of listing an ICO on the DESICO platform will be approximately 33% of the present aggregate cost for launching and listing an ICO through different service suppliers””. Competing service suppliers and the corresponding listing costs are not talked about. The projected number of ICOs on the DESICO platform, but without discourse regarding suspicions or how the projection is justified. Moreover, “”DESICO plans to service 50 ICOs and draw in up to 50,000 investors to the DESICO platform during the first year of its tasks””, but assist exchange with respect to how the platform will have the capacity to achieve this (or why this is a sensible supposition) isn’t included.

Introduction of Platform Technology and Use of Blockchain

The specialized talk is minimal. It is only expressed that “”transaction-level”” data will be put away on the Ethereum blockchain and an ambiguous discourse of using side-chains to “”allow DESlCO to scale its activities and keep away from conceivable network clogs””. Specific subtle elements are not outlined.

Lawful Review and Risk Assessment

When considering the accentuation on the platform’s administrative consistency, there is by all accounts an absence of authoritative archives gave by the association. The lawful substance is principally restricted to a concise two-page disclaimer towards the beginning of the whitepaper. It is expressed that “”tokens to be issued by the Company are not intended to constitute securities or potentially aggregate investment units in any ward””. DESI tokens are intended to be utility tokens.

Infrastructure for launching an ICO

DESICO will provide the necessary infrastructure for a startup to successfully launch its ICO. The key services provided by DESICO will include support in setting up a company, the preparation of all necessary ICO documentation, an ICO marketing package, plus technical support. By joining DESICO, business founders will receive full support throughout their fundraising process and an immediate listing of their tokens. We estimate that the cost of listing an ICO on the DESICO platform will be approximately one-third of the current total cost for launching and listing an ICO through various service providers. The utility tokens issued by DESICO – called DESI tokens will be used by ICO issuers to pay for all services provided on the platform. Investors will use the DESI tokens to invest. They will also have certain privileges.

European e-money license

DESICO will either receive a European e-money license or have direct access to the services of an institution in possession of one. This allows DESICO to execute payment transactions and manage payment accounts. Therefore, ICO-funded businesses using DESICO will overcome the frictions they are faced with in their business banking dealings. Through the European e-money license DESICO will be able to manage both crypto and fiat holdings for businesses, as well as exchange cryptos to fiat, as operational costs are still fiat-based.

Built-in exchange

DESICO will operate an exchange, which will provide immediate listing and liquidity for the ICO’s security tokens after completion of an ICO on the DESICO platform. The exchange will be subject to the regulatory supervision of the Bank of Lithuania, which will provide additional financial security and trust for participants of DESICO network. The DESI tokens will be used to list and trade on the exchange.

DESICO community

DESICO will only be filtering projects for illegal practices, before listing on the platform, but will not be vetting projects. Instead, DESICO seeks to foster an actively engaged community of crypto investors who will not only invest in ICOs but will participate by sharing their own due diligence and highlight their rankings and ratings of projects on the platform. The DESI tokens will be used as incentives in the DESICO community.

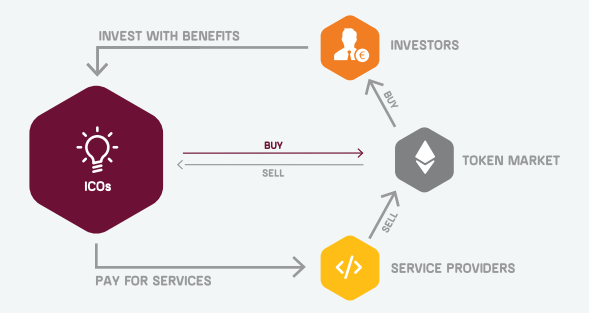

Token Flow

The nature of the DESICO ecosystem will ensure a continuous token flow. Investors will spend their DESI tokens to participate in an ICO. ICOs will pay for services to various providers within the DESICO ecosystem. While startups have the right to decide what to do with the DESI tokens they receive from investors, they expect them to put their DESI tokens immediately back onto the token market after they complete their ICO and no longer need the platform services. Similarly, the service providers are also expected to sell their tokens back to the token market.

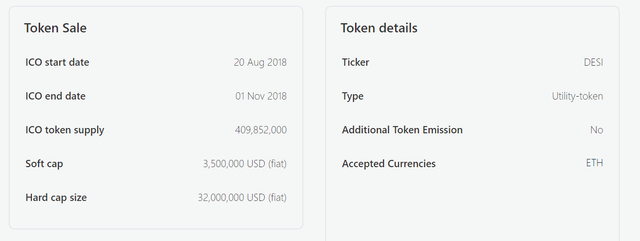

Token Info

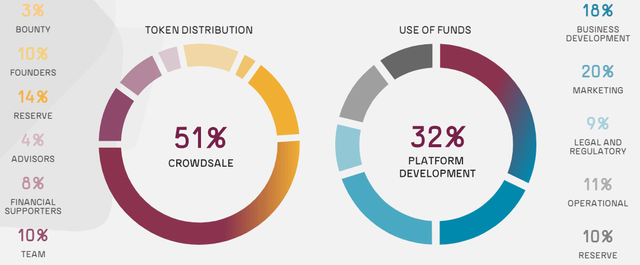

Token Distribution

Roadmap

Team

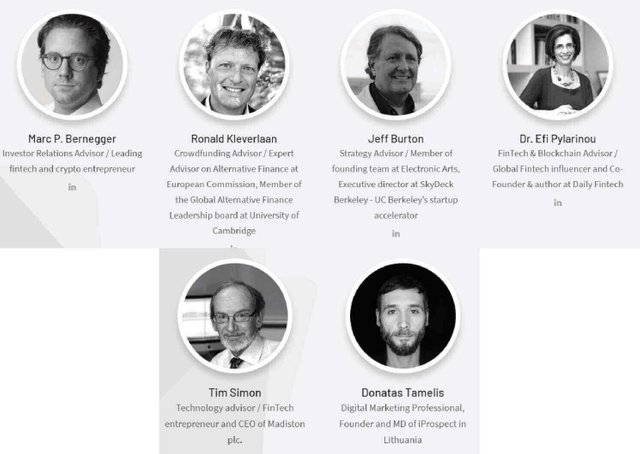

Advisors

Useful Links:

WEBSITE: https://www.desico.io/

WHITEPAPER: https://www.desico.io/whitepaper

ANN THREAD: https://bitcointalk.org/index.php?topic=4398505.0

BOUNTY THREAD: https://bitcointalk.org/index.php?topic=4948249

TWITTER: https://twitter.com/desico_io

TELEGRAM: https://t.me/desicochat

FACEBOOK: https://www.facebook.com/desico.io/

My Profile: https://bitcointalk.org/index.php?action=profile;u=826971