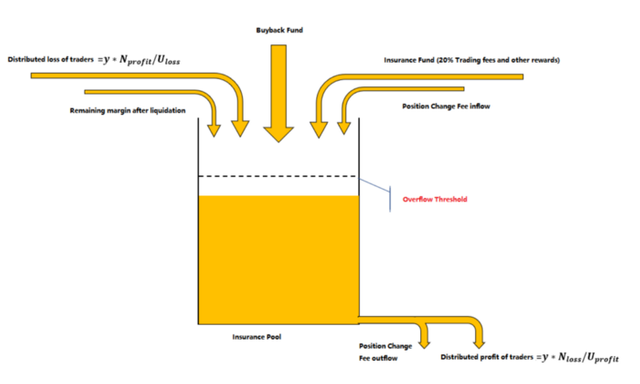

In the previous article “How does the insurance pool in Derify works”, we elaborated the mechanism of the insurance pool and mentioned that the insurance pool may also face the risk of a deficit in extreme market conditions. Traditional exchanges usually deal with the situation by a “loss distribution” mechanism, essentially distributed loss among users, typically, by reducing profitable positions in a certain order, leads to a poor user experience. Differently, Derify improves the user experience by issuing redeemable bonds.

Bond Token bDRF and Issuance Conditions

As shown in the chart of the insurance article, bond tokens are automatically issued when there are no funds left in the insurance pool. bDRF, Derify’s bond token, is a stable coin with a 1:1 peg to USDT and automatically issued by the system. All outstanding payments of USDT that Derify’s insurance pool can’t pay off are paid with an equal amount of bDRF tokens, ensuring that no system loss is shared by users, and users always gets paid. bDRF is a type of token with unlimited issuance, unlimited redemption and unlimited burning.

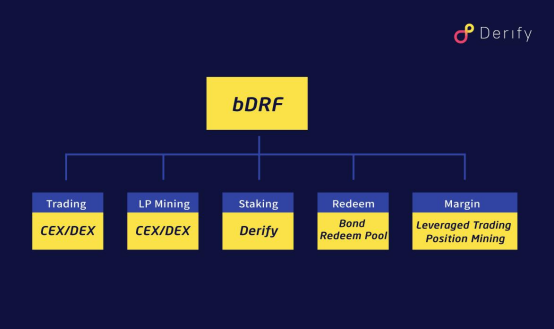

Utilities of bDRF

After receiving bDRF tokens, users can use these bDRF tokens according to their own needs:

- Staking to get rewards

Just like all bonds, holding bDRF will give you interest.

The Derify system provides a bDRF staking function, and users can stake bDRF tokens to in the interest pool to can receive interest.

- Trading in Secondary Market

bDRF can be traded directly through uniswap or other DEXs/CEXs for circulation, and users can sell the obtained bDRF tokens through trading platforms to get USDTs and other stable coins.

Liquidity in the secondary market help to discount the bonds.

- Providing liquidity for bDRF transactions

bDRF can also be used for providing liquidity and liquidity mining on other DEXs.

- Redeem for USDTs

When there is an overflow in the insurance pool, the overflowed funds can be used to redeem the bond token bDRF, and then the bDRF will be burned by the system. When the redemption fund is available, users can always exchange bDRF tokens for USDTs at a ratio of 1:1.

- Margin participation in trading/mining (not available right now)

After mixed margin function will be online, and users can directly use the obtained bDRF tokens as USDTs at a ratio of 1:1. These bDRF tokens can be used as margin for perpetual trading or position mining.

With the system’s unique risk control mechanism, bonds will only be issued when extreme market conditions appear and the insurance pool is short of funds. When the market stabilizes again, the insurance pool will start to receive funds again and the bond issuance will not continue. Therefore, the bDRF issuance will be a rare event.

Derify’s incentive mechanism (staking and LP mining) and redemption mechanism can bring good trading liquidity and price stability to bDRFs (arbitrage opportunities will appear when the bDRF price is below 1 USDT). Thus, the bond mechanism can still be stable under extreme market conditions, which is vital as it will be Derify’s last risk control layer.

Please spread the words, for the future of DeFi community.

Follow/Subscribe us for more updates!