Derify removes the traditional Funding Fees mechanism in perpetual trading.

The need to eliminate Funding Fees

In CEX or traditional DEX, Funding Fees are always a painful experience for all traders.

Generally, Funding Fees mechanism serves two main purpose: 1) Minimize risk exposure to the imbalance of long and short positions of the exchange; 2) potential Funding Fee cost will force the traders to close their position or migrate their positions between different epochs, to avoid Funding Fees, thus bring more trading fees to the exchange, at the cost of user experience.

Funding Fees is a good design for perpetuals, however, it is not a perfect solution to minimize the risk when it comes to a DEX: just like Funding Fees mechanism in CEX, the risk exposure of the system remains completely un-hedged during the different epochs, but unlike CEX who has a centralized money pool to cover the payment happening during this period, a DEX is not in a position to maintain a centralized wallet to cover the payments, so there is no backup option.

On the other hand, Derify is using HAMM to provide infinite liquidity, so unlike typical perpetual trading, there’s no need to pay risk premium at the end of different epochs, since there’s no “epoch” in a bet to the asset price.

Thus, for the purpose of better user experience and better risk control, we use new mechanism of Position Change Fees (PCF), which is a one-off payment between traders when they are opening or closing positions.

Function and Calculation

Let’s jump back to our last article:

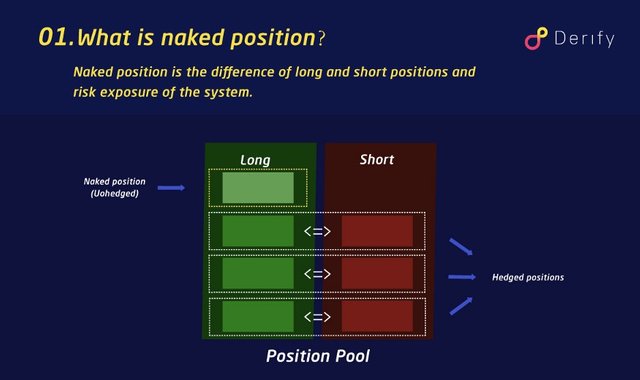

In Derify, all traders hold their positions, all remaining positions will be calculated together by the system. When long positions are larger than short positions, the winnings of long positions is larger than the loss of short positions (do you remember that profit of one position is provided by opposite positions?), it is possible that system need to pay off profits of long positions with its own money, and vice versa. The position difference is also known as “naked position”, such imbalance of positions will poses a risk to the system and should be controlled.

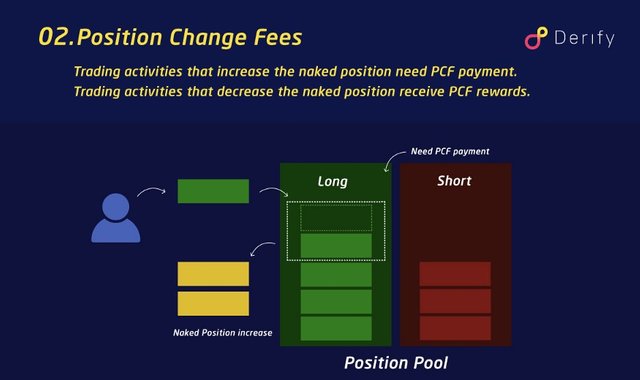

Because any change of one position will change the balance of the opposite positions, an ideal risk control system should factor in any change of positions. The PCF mechanism apply to all activities that changes the position — open or close positions, long or short positions.

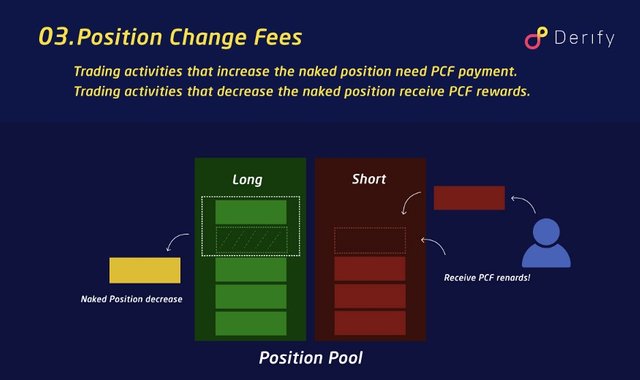

The PCF is only charged once — when a position is opened or closed. Any position changes that increase the naked positions will have to pay the PCF to other traders as rewards, any position changes that decrease the total risk exposure of the system (i.e. reduce naked positions) will receive the abovementioned PCF rewards.

PCF rates are determined by the state of balance between positions, risk sensitivity coefficient and external liquidity depth simulator, the formula can be found in our white paper, but generally you only need to know the following:

When total long position is larger than total short position,

naked position is long

PCF rate is positive

opening long position/closing short position increase naked position, shall pay PCF payment

opening short position/closing long position decrease naked position, shall receive PCF rewards

When total short position is larger than total long position,

naked position is short

PCF rate is negative

opening short position/closing long position increase naked position, shall pay PCF payment

opening long position/closing short position decrease naked position, shall receive PCF rewards

Synergy and Adjustment

With PCF, traders are encouraged to make trades that reduce naked positions and discouraged to do the opposite.

Besides, just like Funding Fees, the existence of PCF will also encourage arbitrageurs to do PCF arbitrage and earn risk-free profit, meanwhile reduce naked positions and the risk exposure of the system.

When PCF rate is positive and naked position is long, arbitrageurs will open a short position under Derify protocol that is opposite to the naked position, then open a hedged position in an external market. They will receive PCF rewards in Derify and hedge their risk in Derify in external market, and vice versa.

The PCF rewards are risk-free profit for arbitrageurs. The arbitrage cost will be priced into the PCF through coefficient of external arbitrage cost and is fully covered by PCF, in order to incentivize all arbitrageurs.

Such arbitrage activities will decrease the risk of the market, and decreases the risk exposure of the system.

As we already mentioned in previous articles, Dynamic Mining Reward (DMR) is a complement of PCF mechanism. When there is an imbalance of positions, rewards of our Position Mining will also be adjusted accordingly. Just like in PCF, Derify encourages any position mining activities that reduce naked positions (by holding positions opposite to the naked position) and discourages position mining activities that increase naked positions.

When PCF rate is positive and naked position is long, position miners who hold long positions will receive slightly lower yield than miners who hold short positions, and vice versa.

DMR is influenced by the state of balance between positions and mining rewards coefficient.

With the help of PCF as an one-off reward for all position changes that reduced naked position, and DMR as a constant influence (through its changes and adjustments) for all position held against the naked position, Derify’s innovative risk control mechanism has better risk control performance than Funding Fees mechanism, while significantly improve the user experience of all traders.

Derify will always try to provide best trading experience to all traders, miners and position holders.

Please spread the words, for the future of DeFi community.

Follow/Subscribe us for more updates!