Content

To promote the bull market, DEX will play an increasingly important role.

DEX will push the future bull market more than borrowing and derivatives

Although Compound, Maker, and Synthetix currently rank among the top in the market value of DeFi, DEX is hopeful that it will come from behind. If Uniswap and Curve can measure the market value through tokens, they will not be lower than the former, and Balancer may catch up later.

Compared with borrowing, liquidity mining is more suitable for DEX scenarios. Providing liquidity on DEX can bring lower slippage and better user experience for traders. In the lending scenario, using liquidity mining can easily conceal the user's real borrowing needs. When the tide recedes, the liquidity mining incentives recede, and the real borrowing needs will be revealed.

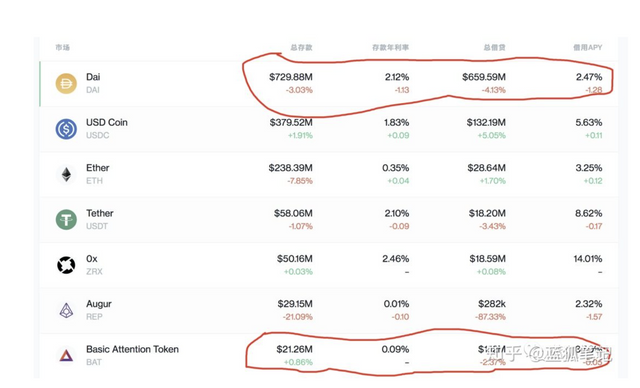

A very realistic example is BAT. Its total borrowing volume (total deposits + total borrowings) once exceeded $600 million, ranking first in all currency markets. However, after Compound adjusted its mining rules, its total borrowing volume plummeted within a few days. To only more than 21 million U.S. dollars, a drop of more than 28 times; while the previous total borrowing of DAI was less than 100 million U.S. dollars, soaring to more than 1.3 billion U.S. dollars in just a few days.

(Source: Compound)

Imagine that if the token incentive of COMP is lost, how much real borrowing will be left? Funds are like grazing and living by water and grass, wherever the profit is high, it will flow wherever it is. This is understandable in itself, but it conceals the real demand of the market. Because the reward time of COMP is very long, it still has enough time to cultivate market demand, which has gained time for Compound.

In addition, in the crypto ecosystem, it is transactions that drive the development of lending, not lending to drive transactions, especially leveraged transactions that drive lending demand. Borrowing is a strong demand, but transactions are stronger and more frequent than borrowing demand. From a holistic perspective, the value capture of borrowing is lower than that of exchanges. Derivatives are also very important, but more important is the trading of derivatives, which is where DEX can give full play to its advantages.

Finally, from the perspective of the business of centralized crypto exchanges, crypto exchanges are currently absolute giants and super value capturers. There is a large gap between borrowing and transaction demand, and crypto exchanges are critical to market changes. DEX will play an increasingly important role.

DEX is gradually growing into a substantial opponent of CEX

Liquidity mining is a key step for DEX to have a chance to seize the share of CEX

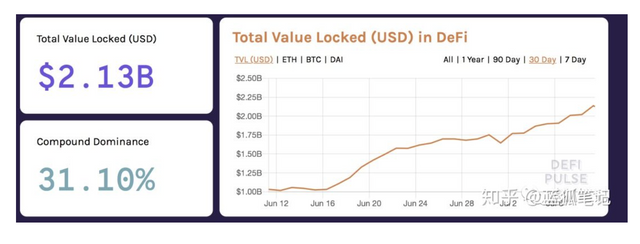

Since Compound and Balancer started liquid mining, the assets locked on DeFi have risen from US$1 billion to more than US$2 billion in less than a month. Most of them are contributed by liquidity mining. During this period, the price of ETH did not rise slightly.

(DeFi locked assets increased from US$10 to more than US$2 billion in one month, Source: DEFIPULSE)

Liquid mining has laid the most important foundation for DEX to take off. The real development of DEX comes from the practice of Uniswap, but in terms of liquidity and depth, it is far from CEX. In the absence of liquidity and depth, DEX cannot be the choice of ordinary users, nor can it fundamentally challenge CEX. .

But now, why is there a chance to challenge? Although DEX is far less than CEX in terms of transaction volume and number of users, DEX is shaking the foundation of CEX. One of the most important reasons is that DEX's liquidity and depth are increasing.

What promotes DEX liquidity and in-depth enhancement is liquidity mining. Liquidity mining allows anyone to participate in market making through token incentives. Even if there is the possibility of "impermanence loss", it will be compensated through token rewards. Even "Impermanent Loss", solutions similar to Bancor V2 are being explored and resolved. For details, please refer to the previous article of Blue Fox Notes "Can Bancor have a chance to surpass Uniswap?" ".

Due to the increase in exchange pool funds, some tokens have lower slippage and better liquidity in DEX exchanges than CEX exchanges. Compared with the CEX order book model, the exchange pool model has its experience advantages.

For example, for the exchange of hundreds of thousands of dollars in stable currency on Curve, the slippage may be lower than that of some CEX. As the liquidity of DEX increases, as more users realize the benefits of exchange on DEX. There will be more and more cases where DEX slippage is lower than CEX. In this way, DEX will erode CEX's share little by little.

Of course, it is impossible for DEX to truly beat CEX for a long time. The trading token pair on CEX is very rich, and it can also be used as a centralized wallet. It has a good depth and is more suitable for the current ordinary user experience. It will be the main place for encrypted transactions for a long time. But things are changing. Before DEX wanted to challenge CEX, this was unthinkable, but now it is becoming a reality.

Comparing liquid mining to a black hole, it is more of a MEME meme. In fact, it is not a black hole. It cannot siphon everything because it mainly attracts funds from large investors, whales and institutions, including funds from CEX. User funds, but most ordinary investors cannot access it. Although it does not require permission, for small funds, considering the gas cost and the potential high risk, the benefits of locked funds are not too much. high.