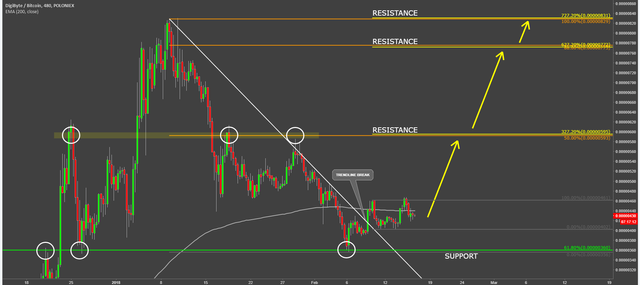

DidiByte found the resistance at 830 satoshi and corrective wave down started, resulting in a 56% loss to the Bitcoin. The decline of the DGB/BTC price was stopped by the 61.8% Fibonacci retracement level applied to the 07.12.17-10.01.2018 wave up.

After the clean rejection of the Fibonacci support, the price went up and broke the 200 Moving Average and the downtrend trendline, suggesting the potential change in the medium term trend. Although range trading could be extended a little longer the growth potential remains. DigiByte is expected to rise towards one of the 3 resistance levels confirmed by two Fibs.

First resistance: 600 Satoshi

Second resistance: 770 Satoshi

Third resistance: 830 Satoshi.

If the price will break above first resistance is will become very likely that DigiByte will produce a double top, hitting the area between 770 and 830 sats. Daily break and close above the 830 sats resistance should confirm a long-term uptrend. On a downside. Daily break and close 360 could invalidate bullish outlook.

Source: http://cryptopost.com/digibyte-vs-bitcoin-signs-of-reversal/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://cryptopost.com/digibyte-vs-bitcoin-signs-of-reversal/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit