Prosperous capital and credit Limited’s (PCCL) solution to the problematic situation of our target audience is provided through the PCCL digital credit bridge.

A digital credit bridge, as the name itself suggests, is a credit bridge available in digital form.

It is a bridge which connects our target audience - 1.3 billion poor people, 2.4 billion unbanked people, refuges & immigrants and young professionals – to the credit facilities that would solve their problems with the provisioned credit facilities.

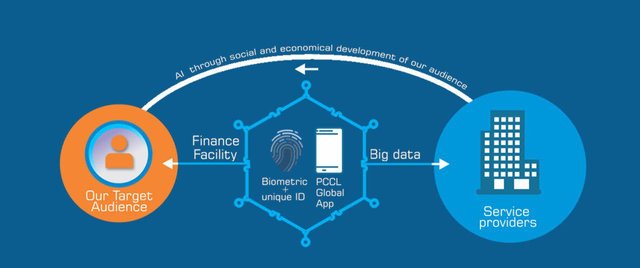

Included below is an illustrative representation of the PCCL digital credit bridge.

The digital credit bridge includes the PCCL global ecosystem which functions to make its ideals and aims a reality through its products and services.

First of all, the digital credit bridge is accessible through the i-lender global app which is powered by big data science based artificial intelligence.

To gain business access to the digital credit bridge, one must obtain the biometric plus unit ID provided to each member of the target audience by PCCL.

The biometric + plus unique ID is the solution we at PCCL came up with to tackle the problem of providing loans to the different sectors of our target audience who do not have a credit history or a proof of identity. As the single most access point for the target audience, this unique ID is created using the biometric (finger-print). The biometric plus unique ID literally dashes off all the fragments of today’s worn-out identity proof methods.

Through it, our target audience can gain access to the diverse services we offer such as education, health, food, industrial & financial services. The involvement of the biometric + unique ID enables us at PCCL to collect our target audience’s life data (Personal, social, physical & economic)

Our digital credit bridge is themed ‘target audience enhancement with big data science’ & ‘social and economic development of our audience through AI (artificial intelligence)’. Together, they reflect quite a deep illustration of our credit bridge.

It enhances the lives of our target audience, both socially and economically, through the facilitated services and products of the ecosystem with the use of artificial intelligence. These includes digital lending, peer to peer lending, green lending, remittance, insurance, the E-commerce trading platform, savings & bill payments.

The digital credit bridge is equipped by big data science and artificial intelligence. Broadly speaking, big data science is “the science that uses smart mathematical and statistical models to mine information from data. It is a multidisciplinary field that involves Statistics, Programming and Domain Knowledge. Data Science uses a host of smart Machine Learning algorithms to make smart and informed decisions about data”.

Through it we are able to socioeconomically develop our audience using the target audience life data we gathered.

Through it, we have facilitated a variety of services with the aid of service providers. We have a wide range of service providers such as educational service providers, heath service providers , sales service providers, electricity & water service providers, insurance service providers ,food & beverage service providers, infrastructure development, bank & financial service providers, non-profitable organizations, NGO’s and the government sector.

Another very special characteristic of our digital credit bridge is that , when we give out loans big data is used to select the suitable customers though KYC procedures. Through this, the repayment capacity can be properly found which is quite effective in the reduction of poverty as a well structure procedural approach since low repayments capacity means a compilation of debt.

Together, the digital credit bridge together with its other features enables the augmentation of the entire target population in a positive manner in a profit generation approach.

By Indrachapa Sandeepani Jayasundera