Since 2017, more than 100 different stablecoin projects have been announced, but only 30% of them are live. The rest are either still in development or they stopped their operations for various reasons.

USD-backed stablecoins are the most popular type of stablecoins but the majority of failed stablecoin projects were backed by gold.

Digital Gold (https://gold.storage/en/home), a digital currency backed by real physical gold stored in company vaults, is one of the few projects that prevail in the competitive stablecoin market. More about this project later on.

Let us first take a look at how many different types of stablecoins there are, and what makes them so useful.

Types of Stablecoins

Researchers of BLOCKDATA have classified stablecoins in three major categories:

- Asset-backed off-chain stablecoins

- Asset-backed on-chain stablecoins

- Algorithmic stablecoins

Asset-backed off-chain stablecoins

These can further be divided into Fiat-Backed and Commodity-Backed stablecoins. It is important to mention that 95% of all existing stablecoins are Asset-Backed, both off-chain and on-chain.

Fiat-Backed stablecoins are backed by fiat currencies such as the USD. The most popular examples of these are Tether or USD Coin.

Commodity-Backed stablecoins are backed by real assets, like gold. The most popular examples of these are Digix and Digital Gold.

Asset-backed on-chain stablecoins

The second type of stablecoins are the so-called asset-backed currencies. These are stablecoins that are not backed in fiat or real assets, but other cryptocurrencies. Multi-collateral DAI is probably the most used type of asset-backed on-chain stablecoin. DAI is backed by Ether.

More than 50% of all active stablecoins today are built on the Ethereum blockchain. Ethereum provides the most popular Dapps platform where it is easy to integrate new projects, confirmation times are fast, and transaction fees are low.

Algorithmic stablecoins

Algorithmic stablecoins use a combination of algorithms and smart contracts to maintain a stable price. Ampleforth is probably the most popular member of this category.

Issues With Cryptocurrencies

To understand what stablecoins are good for, we must first realize what the biggest issue of cryptocurrencies is.

Volatility! Cryptocurrencies are highly volatile and stablecoins were created to solve the volatility problem. Bitcoin is not a widely accepted and gladly seen payment method by merchants because of its volatility.

The price can drop at any time and you suddenly discover that the value you received for a sold item has now dropped by 10% in just a day. To avoid all this, merchants can request payment to be sent in a popular stablecoin, and be confident that their received asset is worth $100 today, but will also be worth $100 tomorrow.

Besides volatility, here are some other common issues with cryptocurrencies:

- Value is based on speculation

- Merchant risk

- Network fees

Value is based on speculation

Many cryptocurrencies are purely based on speculation. They have no working product and their use case and effectiveness is yet to be proven. Chances are that in a year or two many coins will completely die out once the users realize that there is no reason for them to be around, and there is no benefit in using their native token compared to other available coins in the industry. https://deadcoins.com/ is a graveyard of crypto projects that are no longer active. Its database shows almost 2,000 dead projects.

Merchant risk

The biggest risk is, as stated before, the volatility factor. Other risks are associated with proper storing and safekeeping of cryptocurrencies and the reliance on third party wallets and exchanges to provide the service they said they would.

Network fees

In case of sudden price spikes transaction fees will also go up. This happens because miners are motivated by the rewards they receive. More transactions equal bigger rewards, but this also results in slower processing times and longer periods of waiting for transaction confirmations.

Use Cases of Stablecoins

Stablecoins offer solutions to all of the above-mentioned problems and more.

- No volatility

- Asset pegged

- A secure entry point to the crypto market

- Liquidity

No volatility

Stablecoins are not as volatile as other digital currencies because they are mostly pegged to real fiat currencies, like the USD, or valuable assets, like gold. Therefore, the upward and downward movements of these assets are not as extreme as with standard cryptocurrencies.

Asset pegged

Stablecoins pegged to well-known currencies give investors and users a sense of confidence and sustainability. Being tied to traditional money like USD or EUR provides the needed security for institutional investments.

A secure entry point to the crypto market

Stablecoins connect the traditional financial world with that of the crypto industry. Many cryptocurrency exchanges use stablecoins as trading pairs. When you deposit money from your bank or credit card you receive the equivalent of your deposit in stablecoins which are then used for trading purposes.

Liquidity

Stablecoins provide exchanges with the needed liquidity for their every-day operations. Bitfinex uses Tether, Coinbase uses its USD Coin, Gemini has the GUSD (Gemini Dollar), etc.

The Birth Of Digital Gold

Digital Gold (https://gold.storage/en/home) is a stablecoin pegged to the spot price of gold. This means that the GOLD token is a commodity-backed off-chain stablecoin. Each GOLD token is equal to one gram of 99.99% fine gold.

Gold has always been a profitable investment and is considered to be both a payment method and a store of value. To learn about the benefits of investing in Digital Gold make sure you read the article: Digital Gold Investment — How To Invest In Digital Gold Token During Covid?

The Digital Gold platform makes it possible for everyone to become an anonymous owner of blockchain-based gold bullion. For a step-by-step guide on how to buy and sell gold on the Digital Gold marketplace, please take a look at HOW TO SEAMLESSLY PURCHASE GOLD.

The Digital Gold project started its operations in May 2019. A few weeks later the Digital Gold Marketplace was launched that allows instant trading of Bitcoin and Ethereum for GOLD tokens and vice-versa. Trading on the official marketplace bears no additional transaction fees, unlike with traditional cryptocurrency exchanges.

Over $300,000 worth of gold bullion was purchased and stored at BullionStar's official vaults soon after. The matching GOLD tokens provide needed liquidity for the Digital Gold Marketplace.

In November 2019, Digital Gold issued a statement confirming that additional 2,000 Grams of GOLD tokens were added to the overall supply. In contrast to many other startups and ICOs, Digital Gold never had a fundraising campaign. The platform operations, exchange listings, and marketing was fully financed by project developers and owners.

The Live Audit Report shows that Digital Gold currently owns 9,197 grams of gold and 9,200 GOLD tokens, worth approximately $470,000. Live audits are publicly available information and the data can be accessed here: https://www.bullionstar.com/myaccount/audit.

The Digital Gold project has an-ongoing bounty campaign worth $200,000 with various interesting campaigns that users can participate in. More information about the campaign is available here: https://bitcointalk.org/index.php?topic=5164058

The Differences Between Tether (USDT) and Digital Gold (GOLD)

Tether is without a doubt the most well-known stablecoin there is. Its current market cap, according to live data provided by CoinMarketCap is $4,644,481,421. In spite of that, Tether suffers from transparency and regulation issues.

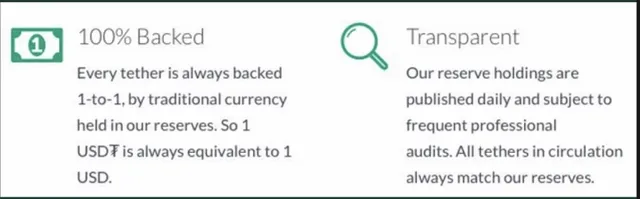

Tether claims that their USDT stablecoin is 100% backed by a USD collateral but all attempts to inspect their reserves and verify their claims have failed.

Forbes magazine has released an interesting article showing how Tether's claims of 100% USD backing have changed during the years.

This is what the original website said:

After Tether turned down attempts of a professional audit and after it was impossible to verify the assets in their reserves, they changed the description on their website a few times.

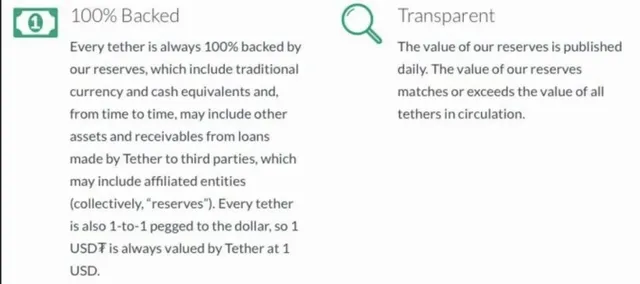

This is what the website said after the Forbes article was published:

All of a sudden, Tether no longer claims that they are 100% backed by USD. The site now says that they are backed by cash equivalents (whatever that means).

Tether has been using US-based financial services. However, banking laws in the USA are very strict and since Tether does not adhere to them, US government agencies are trying to shut them down.

Two individuals connected to Global Trading Solutions LLC have been indicted for bank fraud and for doing illegal bank transactions for Tether.

This new revelation is bad news for the crypto industry because we believed we could rely on stablecoins like Tether to reduce our fears of volatility. Turns out that is not the case because there is no way to verify any of Tether's claims. Because of their lack of transparency, their USD and cash equivalent backing can be seized by governments for lack of cooperation.

Disadvantages of using Tether (USDT):

- Lack of transparency

- Regulatory issues

- No proof of collateral or asset backing

- Risk of seizure of assets and loss of value

Advantages of using Digital Gold (GOLD):

- Transparent and verifiable claims

- No regulatory issues

- Live audits of gold backing are publicly available

- Security

- Liquidity

- Privacy

Transparent and verifiable claims

Gold Tokens are issued using Ethereum-based smart contracts. The amount of GOLD tokens in circulation is always equal to the amount of gold that Digital Gold holds in Bullionstar vault.

No regulatory issues

Digital Gold is a decentralized system. It is not regulated by any government or agency. Tokens cannot be seized or transferred without users' consent.

Live audits of gold backing are publicly available

The number of tokens in circulation and gold reserves can be verified at any time. Live audit reports and the Vault Certificate are available at https://gold.storage/en/audits. The gold bullions are stored in Bullionstar's vaults. The quantity of stored gold can be verified by entering Digital Gold's account number in the search field on https://www.bullionstar.com/myaccount/audit.

Security

Compared to private physical storage of gold in your home, which is not insured, all gold stored in Bullionstar vaults is 100% insured at all times. The insurance company provides replacement guarantees at full value.

Liquidity

Digital Gold guarantees liquidity of GOLD tokens. Agreements are in place with digital currency exchanges where the tokens are listed on and the company purchases these tokens off of exchanges and the company marketplace.

Privacy

Physical purchases of gold require extensive verification procedures and identity verification. Not to mention the issues associated with storing the gold in its physical form. The purchase and sale of gold via the official marketplace are 100% anonymous. After a few clicks of a button, your new GOLD tokens are deposited to an address of your choice. No regulatory requirements, no identity verification.

Conclusion

The time has come to move away from questionable stablecoins who have proven to be unreliable and lack the transparency we as a community require. Digital Gold is an entry point to a thousand years old investment empire. We finally have an opportunity to own gold without any of the hassles that accompanies the physical state of gold. In the last 20 years alone, the value of gold has increased by nearly 400% compared to the USD.

To find out the development of https://gold.storage/ you can continue to follow the ANN bitcointalk thread because it will continue to be updated there.

You can also read a white paper to see in detail.

This article published by fauzan123

Ethereum Address : 0xcAD9187D8fB2528e2e464d49d3e11c4848821741

#digitalgold #stablecoin #goldstorage #blockchain #gold #erc20

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit