What is the Foolish Four?

The Foolish Four is a stock dividend strategy based on the Dogs of the Dow. This strategy and the unique twist from the regular Dogs of the Dow strategy was created by two legendary investors, Tom and David Gardner. These two brothers are the Founders of the company called, “The Motley Fool”, where they cater to individual investors to navigate through the stock market with Buy and Hold recommendations. Before we talk about the Foolish Four, we first must discuss the Dogs of the Dow where it is derived from.

The Stock Buying and Dividend Return Strategy - The Dogs of the Dow, and Puppies Too

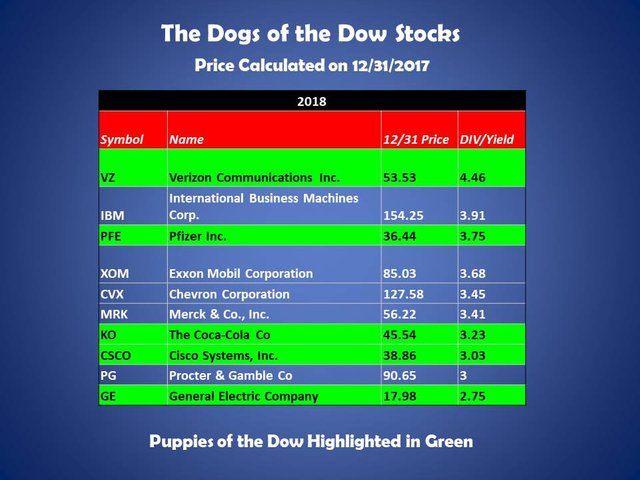

The Dogs of the Dow is a systematic stock buying system, where an investor will take the ten of the thirty worst Dow Stocks, and invest an equal amount into each of the 10 stocks. The average returns of the Dogs of the Dow are 8.6% calculated all the way back from 2000(Source: DogsoftheDow.com). The investor updates the portfolio only once a year, replacing the new Dogs to the list and replacing them with the Dogs that do not qualify in the recalculation. Most investors will create and update their Dogs of the Dow portfolio on January 1st of every year.

Michael Higgins created the Dogs of the Dow system. He had a derivative of the system, which uses only five of the stocks, called the “Small Dogs” or “Puppies” of the Dow. This derivation takes the five cheapest Dog stocks in terms of stock price, and the investor allocates in equal amounts into each stock. For example, if General Electric, Merck, Pzifer, Caterpillar, and Coca-Cola were this year’s puppies, you could allocate $1,000 to each of those stocks in a $5,000 stock portfolio. Mr. Higgins theorized that there is more volatility in smaller priced stocks, which could lead to more gains over the regular Dogs of the Dow.

The Classic Foolish Four

The Foolish Four uses the five Puppies for this strategy but with a slight twist. In theory, the puppy that is the cheapest, is usually the laggard of the group for good reasons, because they are struggling or underperforming. The Foolish Four ignores the worst Puppy and only uses the next four puppies. However, the Foolish Four will “double down” on Puppy #2, meaning that they money that was supposed to be allocated to the worst puppy, will go to Puppy #2. In the example below, Verizon(VZ) from the previous table, was removed and replaced by another investment into Pfizer(PFE).

The Foolish Four is a great system to put some money to work, taking advantage of Dividend returns. This system is easy and mechanical, meaning you only have to maintain it only once a year. In the next installment of the Classic Foolish Four we will look at 2017’s Foolish Four, and Dogs of the Dow.

This post can also be found at http://foolishfour.wordpress.com