British Steel’s potential collapse has become a national event in which people see their political prophecies affirmed.

When British Steel announced on May 22 that it was entering insolvency, steelworkers felt a sad sense of deja vu.

For at least the past 40 years, the industry's future has seemed uncertain. British Steel alone has changed hands and names three times in that period, and was on the brink of closure as recently as 2016.

Back then, when the London private-equity firm Greybull Capital stepped in, there were early signs of promise. The new owners restored the steel company's original name, and turned a profit in their first year.

Few imagined that the "Save Our Steel" banners would need to be unfurled again so soon.

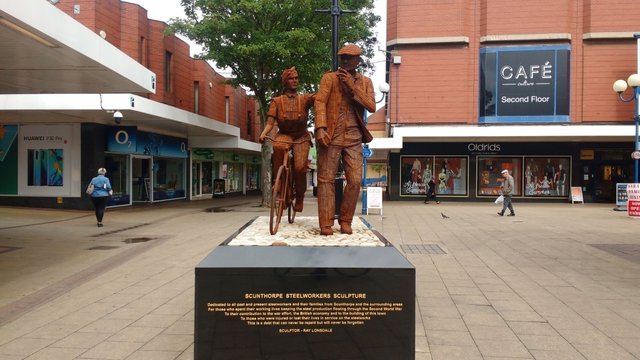

The unfolding saga of the steel industry in Britain is a significant economic story in itself. Once at the heart of world trade, still central to national identity, the 150-year-old steelworks in Scunthorpe in northern England were sold to Greybull Capital for only one British pound ($1.27) in 2016.

The company's potential closure puts more than 30,000 jobs at risk - including jobs that come through its supply chains - and could cost the national economy as much as 2.8 billion pounds ($3.6bn) in lost wages.

But in the fraught political landscape that is Brexit Britain, the fate of British Steel is about much more than jobs and money. Its trials and tribulations are charged with symbolic significance, fitting into national narratives around the European Union, the economy and the future of Britain's identity.

When British Steel announced on May 22 that it was entering insolvency, steelworkers felt a sad sense of deja vu.

For at least the past 40 years, the industry's future has seemed uncertain. British Steel alone has changed hands and names three times in that period, and was on the brink of closure as recently as 2016.

Back then, when the London private-equity firm Greybull Capital stepped in, there were early signs of promise. The new owners restored the steel company's original name, and turned a profit in their first year.

Few imagined that the "Save Our Steel" banners would need to be unfurled again so soon.

The unfolding saga of the steel industry in Britain is a significant economic story in itself. Once at the heart of world trade, still central to national identity, the 150-year-old steelworks in Scunthorpe in northern England were sold to Greybull Capital for only one British pound ($1.27) in 2016.

The company's potential closure puts more than 30,000 jobs at risk - including jobs that come through its supply chains - and could cost the national economy as much as 2.8 billion pounds ($3.6bn) in lost wages.

But in the fraught political landscape that is Brexit Britain, the fate of British Steel is about much more than jobs and money. Its trials and tribulations are charged with symbolic significance, fitting into national narratives around the European Union, the economy and the future of Britain's identity.

When British Steel announced on May 22 that it was entering insolvency, steelworkers felt a sad sense of deja vu.

For at least the past 40 years, the industry's future has seemed uncertain. British Steel alone has changed hands and names three times in that period, and was on the brink of closure as recently as 2016.

Back then, when the London private-equity firm Greybull Capital stepped in, there were early signs of promise. The new owners restored the steel company's original name, and turned a profit in their first year.

Few imagined that the "Save Our Steel" banners would need to be unfurled again so soon.

The unfolding saga of the steel industry in Britain is a significant economic story in itself. Once at the heart of world trade, still central to national identity, the 150-year-old steelworks in Scunthorpe in northern England were sold to Greybull Capital for only one British pound ($1.27) in 2016.

The company's potential closure puts more than 30,000 jobs at risk - including jobs that come through its supply chains - and could cost the national economy as much as 2.8 billion pounds ($3.6bn) in lost wages.

But in the fraught political landscape that is Brexit Britain, the fate of British Steel is about much more than jobs and money. Its trials and tribulations are charged with symbolic significance, fitting into national narratives around the European Union, the economy and the future of Britain's identity.

When British Steel announced on May 22 that it was entering insolvency, steelworkers felt a sad sense of deja vu.

For at least the past 40 years, the industry's future has seemed uncertain. British Steel alone has changed hands and names three times in that period, and was on the brink of closure as recently as 2016.

Back then, when the London private-equity firm Greybull Capital stepped in, there were early signs of promise. The new owners restored the steel company's original name, and turned a profit in their first year.

Few imagined that the "Save Our Steel" banners would need to be unfurled again so soon.

The unfolding saga of the steel industry in Britain is a significant economic story in itself. Once at the heart of world trade, still central to national identity, the 150-year-old steelworks in Scunthorpe in northern England were sold to Greybull Capital for only one British pound ($1.27) in 2016.

The company's potential closure puts more than 30,000 jobs at risk - including jobs that come through its supply chains - and could cost the national economy as much as 2.8 billion pounds ($3.6bn) in lost wages.

But in the fraught political landscape that is Brexit Britain, the fate of British Steel is about much more than jobs and money. Its trials and tribulations are charged with symbolic significance, fitting into national narratives around the European Union, the economy and the future of Britain's identity.

Source of shared Link

Source

Copying/Pasting full or partial texts without adding anything original is frowned upon by the community. Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.aljazeera.com/ajimpact/190625204621816.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit