Something a little different for you today.

Usually, I make it my job to discuss what I see as the best trades and investments going at any given moment. Today I’m going to do the opposite.

I present to you the five worst investments to make now.Why? Well, I’ll explain at the end…

Dumb trade No.1: Buy Deutsche Bank

It is one of the biggest banks in the world. Well, it used to be. It is the world’s largest foreign exchange dealer.It’s German – so it’s really well run, right? It has a tradition that goes all the way back to 1870. It has assets worth close to $2trn – more than half Germany’s GDP.

And, according to the not-so-dark corners of the internet, it’s as good as bankrupt.

Deutsche Bank’s share price has been falling even more inexorably than the Labour party’s chances of winning the next general election. It’s lost more than 90% since its 2007 high of near €118, hitting new lows on Tuesday of €10.20. On top of derivatives liabilities the value of which not even Carl Gauss could have calculated, costs that are too high, profits that have been annihilated by new regulation, and a £1.7bn fine for rigging Libor, it now finds itself faced with $14bn fine for allegedly mis-selling bonds. That fine is not far off the company’s current market cap of about $18bn.

The yields on its Coco bonds have now spiked, meaning the market is sceptical about its ability to pay the coupons. (Coco bonds were introduced after the financial crisis – they are part of the padding around a bank that’s supposed to take the hit instead of taxpayers next time there’s a crisis.)

Deutsche Bank has told the German government that it doesn’t need bailing out. But that’s like a football manager being given a vote of confidence by the chairman. Meanwhile, the German government has reportedly said that it doesn’t have any plans to bail out Deutsche Bank. And why should it? The Germans took a hard line with Italy over bailing out its troubled banks, not to mention Greece and Cyprus.

But Deutsche Bank is too big to fail. If it goes under, it would be Lehman Brothers 2008 all over again, only worse. So politicians won’t let it go bust.

But can they bail out another bank and stay in power? Good luck with that one, Angela.

Dumb trade No.2: Buy government bonds

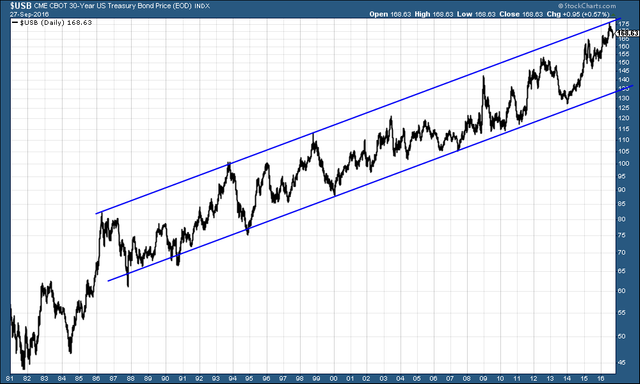

The US long-bond (the 30-year US Treasury) has been in a bull market that has been going on for 35 years (a chart of the price is below). Interest rates are the lowest they’ve ever been.

This mania extends everywhere in the government bond market.

In some cases, bond yields are negative, meaning that you lend a government money, and you are guaranteed to get back less than what you lend to them (assuming you hold to maturity). And that’s before you consider the loss to inflation.

In August, according to the Financial Times, the value of negative-yielding bonds hit $13.4trn. That’s over four times UK GDP.

It is a market that makes no sense. And it’s a market that is also rigged. Central banks suppress rates. They print money via quantitative easing, and buy their own debt with it (the Bank of England, for example, now owns 25% of UK national debt).

Regulation means that large institutions have to buy bonds. Career risk means that fund managers don’t dare avoid government bonds, not when prices are going up and everyone else is making money off them.

But rigged markets have a habit of unwinding.

What can possibly go right?

Dumb trade No.3: Buy an overpriced London luxury flat

When it comes to real estate bubbles, Vancouver is the biggest, according to the latest UBS Global Real Estate Bubble Index, which came out this week. London is in second place. Sydney is third.

According to the reliable source that is my mate who lives there, Sydney’s bubble is worse than ours. But I’m going to go with the devil I know, because he (or is it she?) is just up the road.

The most overvalued property I can find is a new-build flat on London’s south bank – and Dumb Trade Number Three is to recommend you buy one of those.

To make the trade as dumb as possible, we recommend you do so with as much leverage as you can muster (ie as big a mortgage as possible). With a hat tip to our old chum Henry Pryor, we recommend that you pay the full list price.

And we recommend you buy an apartment that won’t be complete for a couple of years, in order to bring some individual company risk (the danger that the flat won’t ever get built – the company goes bust first) into the frame as well.

Bottom line: there are too many of these flats coming to market. They are not very nice. They are horrendously overpriced. There are not the buyers for them. So if you follow the advice above, you will surely lose a lot of money.

Dumb trade No.4: Bet on Hillary Clinton to win

According to my spread-betting company, Donald Trump has just a 26% of winning the US election.

In other words, if you bet on Hillary Clinton, then for every pound you place, you can make 26, but lose 74. Those are terrible odds. And the odds on Britain staying in the EU were similar in the three months before Brexit.

Which of the two sociopaths is going to win? Dunno. But I do know that a tide of anti-political sentiment is sweeping the world and the power of that tide is still not fully appreciated.

The world is sick of the establishment and Clinton represents the old establishment. Forget New York and LA, this election gets decided by the voting folk in between – and them thar folk are mighty hacked off.

People say that bookies get it right; no, they don’t.The odds are determined by dumb folk like you and me placing bets. The bookies got Brexit wrong and I suspect they’re going to get this wrong too.

If nothing else, Trump’s chances of winning are much better than the odds suggest.

Dumb trade No.5: Buy three randomly chosen Aim-listed resource stocks

Thanks must go to private investor, Stefano Paolini, who outlined this particular money-losing scheme to me in the pub last week.

Step one is to print out a list of Aim-listed (or TSX Venture or OTC - the strategy is equally effective there) companies with a market capitalisation of below £10m, which are exploring for some kind of natural resource – ie cash-burning not cash-generating. Ideally, you want ones with little or no cash, and a management with expensive habits and a proven track record of failure. There’s no shortage on Aim, the OTC or the TSX-V.

Step two is to pin said list to the wall.

Step three: take three darts and a blindfold (a monkey mask will serve). Put the blindfold on. Throw the darts at the list of companies. Wherever the dart hits, buy that company.

The lesson

The irony is that I’ve labelled all of the above “dumb trades”. In each of these cases, the odds of success look poor to me.

Yet Deutsche Bank could get bailed out. The government bond market can carry on rising. Hillary Clinton may well win by a landslide. Heck, even that flat in Vauxhall may actually retain its value, and that randomly-chosen Aimco might strike gold.

In fact, I’d almost bet you that at least some of these so-called dumb investments end up doing well, despite my scrying.

And that’s sort of the point of this article. It’s a test of your (or my) contrarian prejudice. You never quite know what’s going to happen, and things always look obvious in retrospect.

As if to prove it, having finished this article, I now read that Apple may be taking up residence in Battersea Power Station from 2021. Maybe a Vauxhall apartment isn’t such a bad idea after all.

Maybe it will be your author, not the dumb investor, who ends up with egg on his face.

We’ll come back to the topic before the end of the year and find out.

@frizzers aka Dominic Frisby is a financial writer from London. This article first appeared at Moneyweek.

Good post. I think staying away from all real-estate at the moment would be wise. All of it going to correct quickly, obviously the higher end stuff more so. The U.S. is full of pockets with overpriced luxury real estate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice!

I think you might eat your hat on number 4. Votes only matter as long as they fit the plan, otherwise they're bought. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit