INTRODUCTION

The context of financial services has been characterised by changes in the regulatory, technological and societal landscape. Consumers are increasingly interested in mobile payments, crowdfunding and microfinance services, either for themselves or because collaborative consumption is viewed as a more sustainable. Retail branches are re-organised to further meet the expectations of customers, start-ups focusing on technology for financial services (i.e. Fintech) are ever growing and financial services companies reinforce their own innovation practices (e.g. creation of innovation labs or venture capital investment funds).

The innovation ecosystem around financial services companies represents the many actors with whom they can co-create and co-produce innovative new services for their customers (or for themselves). The innovation process is no longer a closed internal effort but needs to include external actors from the innovation ecosystem. This topic is especially interesting in a small and open economy where the financial centre takes a prominent place in the economy. The research question is therefore “How does the innovation ecosystem influence the innovation process within financial services companies?

The influence of the innovation ecosystem on the innovation process within financial service companies mainly comes from its social capital and value creation efforts. However learning to work and exchange in an innovation ecosystem is also expected to influence the innovation process in place. Realizing the potential of the innovation ecosystem requires sufficient capabilities to manage new information coming from the innovation ecosystem. The professional associations provide the necessary coordination among actors in the innovation ecosystem to co-create and appropriate value, while fostering co-evolution within the innovation ecosystem

Today, I will be presenting you a particular undisputed project based on Decentralized Ecosystem For Financial Service called: DCC

WHAT IS DISTRIBUTED CREDIT CHAIN (DCC) PLATFORM?

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s missio is to transform different financial scenarios and realize true inclusive finance.

Conceptually, a Digital Bank, through fair financial service, will aim to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in such services so that each participant who has contributed the growth of the ecosystem may be incentivized.. Digital Banking will ultimately be a way to truly achieve an inclusive system of finance.

Through decentralized thinking, Digital Banking will be able to change the cooperation model in traditional financial services, building a new peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects and accounts. As it pertains to business, Digital Banking will completely transform traditional banking's debt, asset, and intermediary business structure. It will replace liability business with distributed wealth management, and substitute distributed credit and claims registration (for asset business) and distributed asset transaction (for intermediate business). The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for various businesses and improving overall business efficiency.

ABOUT DCC

USER ACCOUNT IDENTIFICATION SYSTEM

In DCC, each individual or institution has one DCCID generated through Public-Private Key Pair to form an address. This address acts just like a member ID in a traditional Internet system, identifying and associating various real-world attributes (such as real-name authentication, bank cards held, number of properties owned) and information on the credit chain—a loan request, loan, repayment, etc . DCCID is a decentralized account system, and its generation does not depend on any individual DCC node. Any person, organization, or company can generate this DCCID offline. Only when there is information needing to be associated to DCC can information be stored on the DCC ecosystem. DCC uses digital signature technology at every step of data exchange to fully guarantee the non-repudiation of individual-chain or institution-chain interaction of data.

DCC will provide an open source personal credit data management framework-DCDMF (Distributed Credit Data Management Framework) which is supported by a specific cloud storage provider, and developers, are able to quickly rebuild users’ personal credit reporting data using DCDMF based on their APP development needs. Users having a DCCID can exchange data in several APPs which use DCDMF by exporting their wallet addresses.

NON-COOPERATIVE GAME BETWEEN PARTICIPANTS

DCC uses the blockchain to expand the original interlinked credit ecosystem relationship consisting of many centralized systems into a flat credit ecosystem in which the blockchain smart contracts serve as the shared medium and all participants are be treated equitably. The openness of the DCC ecosystem enables each participant to cooperate on an independent and equal basis Further cooperation between previous lenders and borrowers will not depend on the original relationship, and decisions made by any participant within the ecosystem will be entirely independent of other ones, thus creating a truly non-cooperative gaming environment. Such independent bilateral cooperative model will greatly reduce the complexity of system interconnection. It is easier for credit system technology service providers to standardize the modules of credit services and provide the credit standard system that can be deployed rapidly.

DIGITAL ASSET LENDING

At present, in digital asset lending, the lack of effective personal credit information association between the world of data assets and the traditional world, results in no accumulation of historical credit. And there also lacks effective means to avoid risk before, during and after loan processing. DCC distributed credit reporting system can help the blockchain-based credit lending platform open up credit reporting links, conduct pre-credit risk control, manage performance during loan, and foster the expansion of the digital asset lending market. Imagine that people with different digital assets could pledge their digital assets through the loan chain and obtain mainstream digital assets (ETH, BTC, etc.) from different individuals for reinvestment through credit reporting data and credit records. Such loan market would create more liquidity for digital asset transaction markets and provide more financial derivatives.

DAPP

DCC is a decentralized open credit platform. Any platform with traffic and scenarios can submit its own Dapp applications to DCC, provided that these submissions are based on Distributed Credit Chain standards. In the early stages, to ensure the health and stability of the ecosystem, the Foundation would review Dapp release applications. The Cyber Sheng Foundation encourages different scenario platforms to enter the DCC ecosystem to provide consumption scenarios of Internet finance through Distributed Credit Chain ecoystem.

TOKEN

The Cyber Sheng Foundation plans to issue a total of 10,000,000,000 tokens of the encrypted digital currency DCC. 12 months after this issuance, the total circulation volume will be 3,700,000,000, accounting for 37% of the total. In the private round , famous qualified investors in the fields of credit and banking will be invited for the investment, with the fundraising percentage no more than 17%, and the investment amount of single investor no less than 100ETH. At this stage, DCCs will be locked, with 25% of the total to be unlocked before the opening of exchange, and another 25% to be unlocked every two months, with the full amount to be unlocked in 6 months. In ICO round, 500,000,000 DCCs will be issued to Non-Chinese and American investors. All these will be directly circulated. The ICO hardcap is 500,000,000 DCC tokens, DCC token will be exchanged by ETH. To know current trend of ICOs, you can check ICO stats.

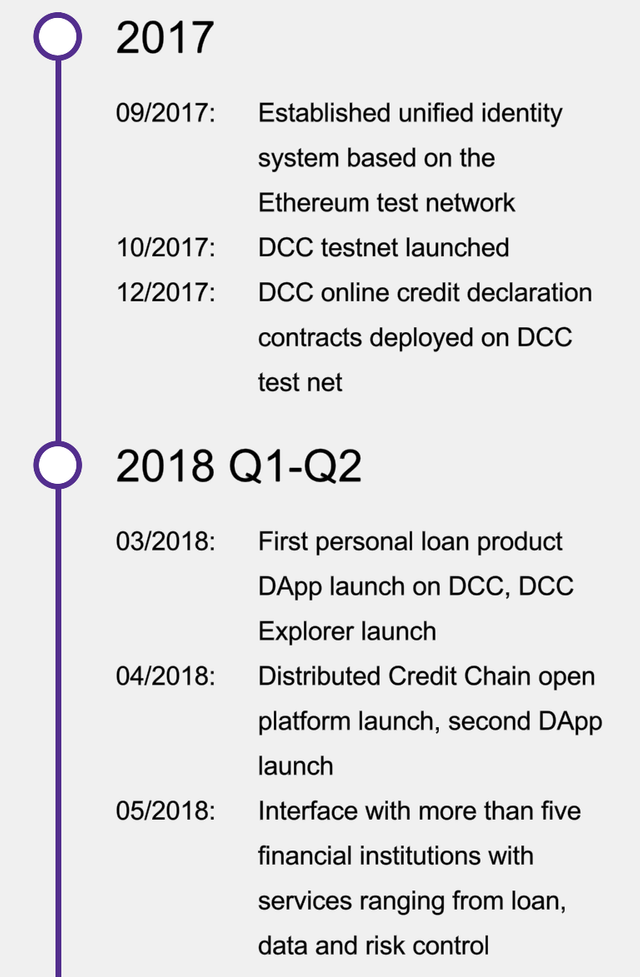

ROADMAP

For more information about this project, please! follow the links bellow » » »

★WEBSITE: http://dcc.finance

★TELEGRAM: https://t.me/DccOfficial

★FACEBOOK: https://www.facebook.com/DccOfficial2018

★TWITTER: https://twitter.com/DccOfficial2018

★WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://icoguide.com/en/ico/distributed-credit-chain

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit