Hello Everyone

This is @max-pro from, #Bangladesh

thumbnail image

thumbnail image

Greetings to all. Hope all steemian friends are doing well and enjoying this year's engagement contests. See the thumbnail above to understand that I am here to participate in this engagement contest. Here I will answer some questions and discuss in detail.

| We are interested to know about the registration procedure of your business in your country and how you manage it. |

|---|

Unfortunately no one in our family is involved in business. But my uncle is involved in business and some of my neighbors do business. So I have some ideas about business. Business registration in Bangladesh requires certain procedures and processes to be followed which are regulated by various agencies of the Government of Bangladesh. Generally following steps are to be followed for business registration.

| Select the type of business | Sole Proprietorship, Partnership, Private Limited Company, Public Limited Company. |

|---|---|

| Name Registration | Choose a unique name for the business. The name must be registered with the Registrar of Joint Stock Companies and Firms. |

| Trade License | A trade license must be obtained from the local city corporation or municipality to operate the business. It is valid for one year and has to be renewed. |

| Bank Account Opening | A bank account is required to be opened in the name of the business. This bank account is usually required for company registration. |

How people manage it : We generally consider below few things while conducting business in Bangladesh.

Choosing a suitable location.

Forming an efficient management team to manage the business activities.

Establishing relationships with local markets, suppliers, and customers.

Emphasis on promotion and marketing activities.

Conducting regular financial and tax reporting.

| Tell us all about the procedure to obtain any licence/permit etc. to run your business. |

|---|

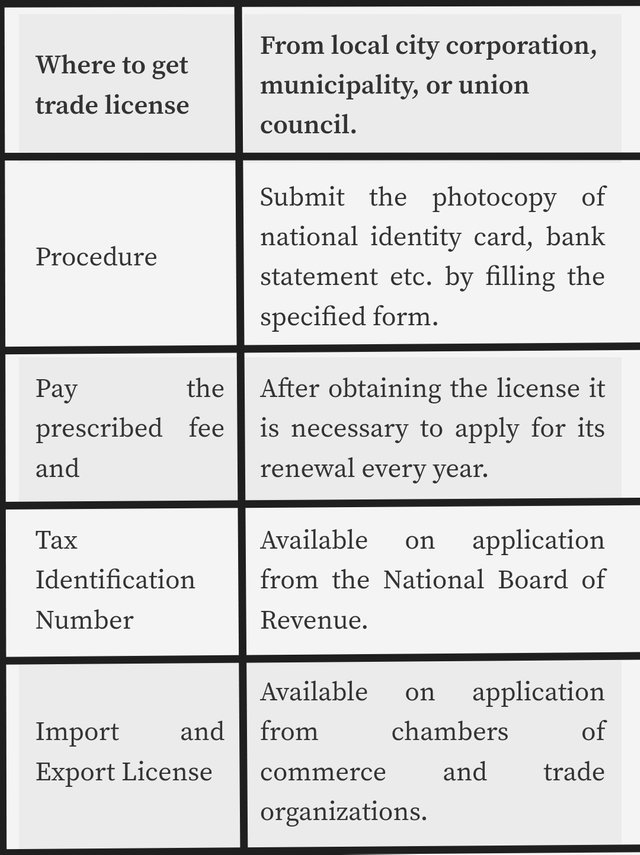

Operating a business in Bangladesh requires different types of licenses and permits depending on the type of business and activities. The process of obtaining license and permit has to be completed in several steps. Below are the steps to obtain the required license/permit to operate a business in Bangladesh.

design with polish

design with polish

As a general process, the application form has to be filled in the concerned institution. Then the necessary documents and fees have to be paid. Then the license/permit is issued after audit and verification from the institution. Besides, if license renewal is required, it must be renewed on time. These processes are essential to the proper running of the business and ensure that the business is being conducted legally.

| What is the tax structure for traders/manufacturers |

|---|

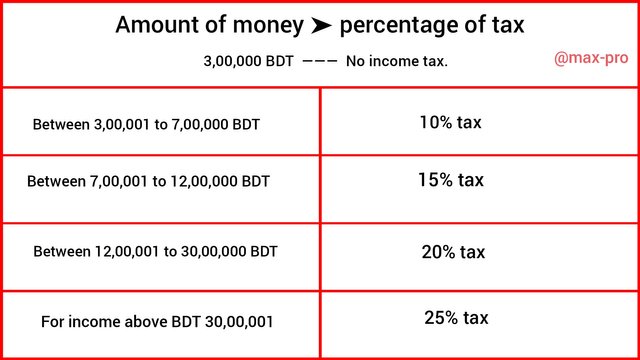

Our tax structure for traders and manufacturers in Bangladesh is divided into several tiers. Basically it depends on the size, type and activities of the business. The tax structure includes income tax, value added tax and other taxes including customs duties. So I have given a detailed chart about the tax structure for traders and manufacturers in Bangladesh below.

- Income Tax :-

Income tax is imposed on the income of the business owner, partner or company as per the income tax law in Bangladesh. Income tax is basically levied on business profits at fixed rates. Income from a sole proprietorship business is considered personal income of the taxpayer. Taxes are to be paid step by step according to the income. For example, the income tax rate for a sole proprietorship business is:

design by polish

design by polish

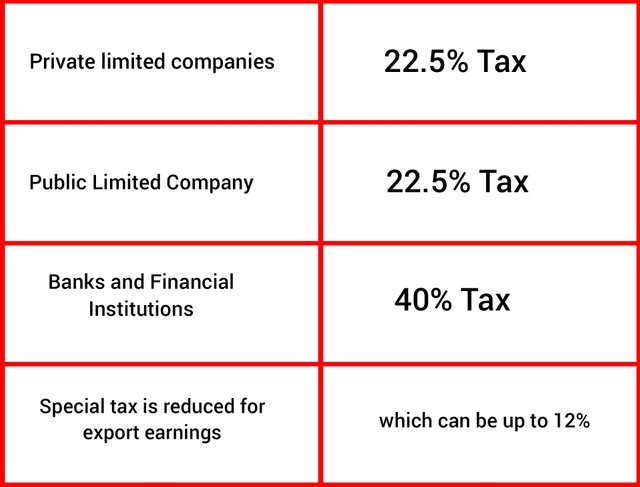

| Company Income Tax Rate :- |

|---|

design by polish

design by polish

Most IT and software companies will get tax-free benefits till 2024. The tax structure for traders and manufacturers in Bangladesh is well structured. Compliance with Income Tax, VAT, Customs and Tax at source rules is mandatory. However, there are tax exemptions and incentives in various sectors which can be helpful in business development.

| What are the options in case you face any tax-related problems? |

|---|

If any of us are facing tax-related problems, there are several options that can help us solve our problems. The tax system in Bangladesh and the government provides certain procedures and assistance to taxpayers.

Taking help of tax consultant and National Board of Revenue.

Seek help from a professional tax consultant or the National Board of Revenue. Because they provide assistance to taxpayers in solving various problems.

Tax consultants can help in filing income tax returns, intricacies related to VAT and understanding various sections of the tax law. One can also apply directly to the office of NBR for solving any tax related queries or problems.

Legal Action in Court.

- If the problem is serious, if the decision of the Tax Appellate Tribunal is also not satisfactory, then a case can be filed in the High Court. A writ petition has to be filed in the High Court Division of Bangladesh Supreme Court.

Tax Relief and Penalty Waiver.

- In certain circumstances, if the taxpayer is unable to pay the tax on time due to natural calamity or illness, they should make a written application to the Income Tax Office under NBR for waiver of penalty. Where the reason for waiver of penalty shall be explained.

Therefore if an individual or businessman faces a tax-related problem, he can resolve the problem through various auxiliary mechanisms like Tax Consultants, NBR, Appeals, Courts and ADR. So from my point of view the discussion on this topic ends here. Hope you all understand.

So I am Inviting my lovely Steemian friends @shohana1, @kouba01, @wilmer1988, to Participate in this Competition.

Twitter share link : https://x.com/Maxpro51412/status/1842090315299090618?t=083UB1nO5_0QtYahBB5ahA&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much @fantvwiki for your kind support. It means a lot for me. I am grateful to you. Good luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit