We were told the insanity of the housing boom and bust was over. We learned our lesson. Pay down debt. Try to put as much as possible on the down payment. Don’t take risk. That didn’t seem to last very long! The newest multi-billion dollar craze is the iBuyer. No, this has nothing to do with Apple and Steve Jobs. Let’s break it down right now.

Council Post: iBuyers: Is The Convenience Worth The Cost?

https://www.forbes.com/sites/forbesnycouncil/2018/06/05/ibuyers-is-the-convenience-worth-the-cost/#309b68a557dc

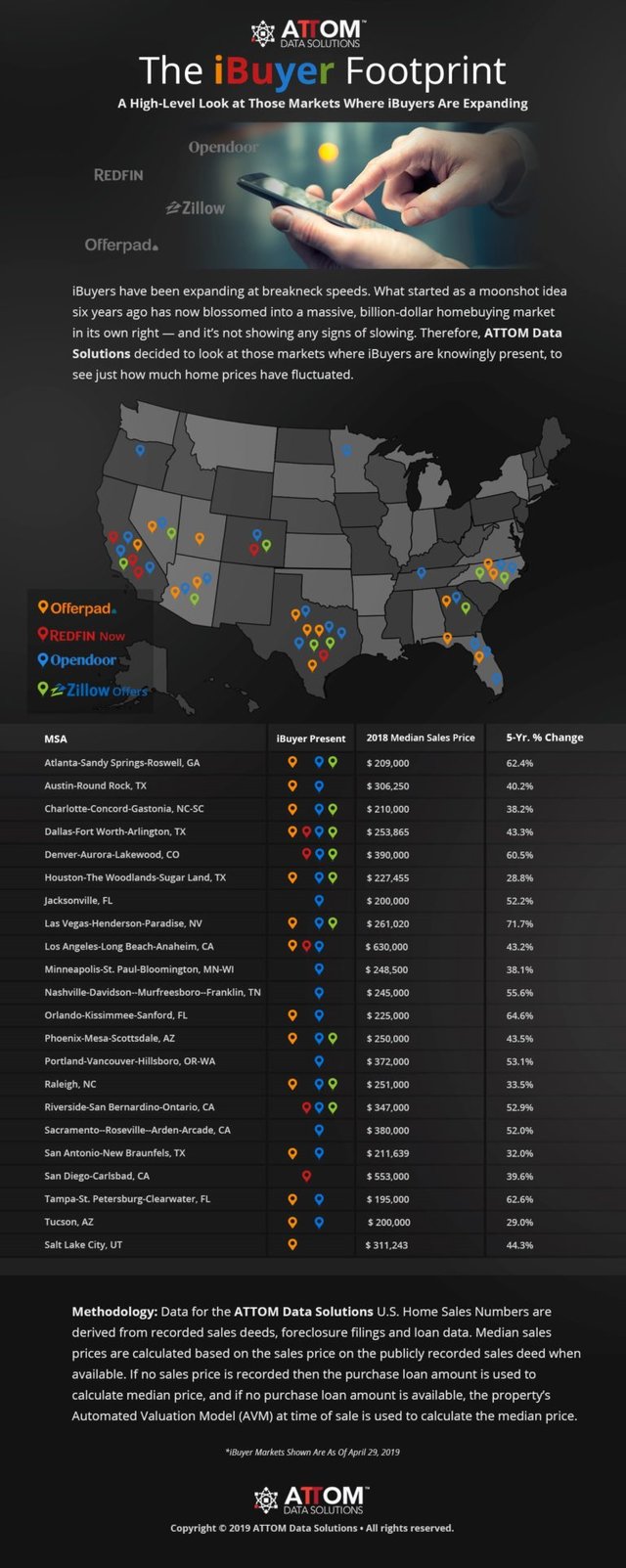

The Ever-expanding iBuyer Footprint | ATTOM Data Solutions

https://www.attomdata.com/news/market-trends/the-ever-expanding-ibuyer-footprint/

iBuyer-Infographic-768x1924.jpg (768×1924)

China trade war leads to lower mortgage rates for Americans

https://www.cnbc.com/2019/05/23/china-trade-war-leads-to-lower-mortgage-rates-for-americans.html

The Average Rent Reaches $1,436 in April, with Apartments in Two-Thirds of Cities Renting for Less than the National Average - RENTCafé rental blog

https://www.rentcafe.com/blog/rental-market/national-average-rent-reaches-1436-rental-season-starts/

America’s Largest Cities Are Shrinking

https://finance.yahoo.com/news/america-largest-cities-shrinking-040101410.html

Blackstone, Brookfield among bidders for Anbang's U.S. luxury hotels portfolio: Financial Times - Reuters

https://www.reuters.com/article/us-anbang-divestiture/blackstone-brookfield-among-bidders-for-anbangs-us-luxury-hotels-portfolio-financial-times-idUSKCN1SR1WM

▶️ DTube

▶️ IPFS

Well, what could possibly go wrong... :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Housing is getting more expensive. Local governments keep coming up with "affordable housing." In my mind, affordable housing is a brand name, not that the housing is actually affordable. As long as interest rates are low, the pricing in the short term will keep increasing. The big short for the 2020s will be much larger than the 2008-09 housing meltdown.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit