Gann predicts the next economic crisis will take place in 2019. The real thing is to invite you to learn through the analysis of Alan Oliver - analyst of Gann theory.

How has the crisis been like?

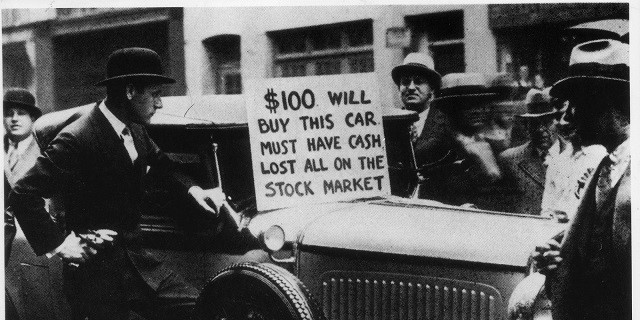

First of all, let's look back at the last major economic crisis that occurred in 1929, when, due to poor governance, the unemployment rate was up to 25% while those with jobs reduced salaries by 40%.

The Great Depression occurred not only because of the stock market; It is primarily due to the demand for gold from a number of countries that have adopted the currency valuation method since World War I, while others have kept the gold standard.

The US reserves about 40% of world gold reserves and when other countries "float" currency valuations, gold reserves begin to leave the United States (due to rising demand) that the Fed must raise interest rates on. high. High interest rates will stop the flow of gold from the US and reduce the momentum of the booming stock market. As a result, the United States began to receive more gold shipments.

In 1929, as countries lost gold to France and the United States, other governments began to implement deflationary policies to stop the flow of money and keep the gold standard. These deflationary policies are designed to limit the functioning of the economy. That is why the Great Depression around the world began.

What formula used to predict the time of the Great Depression?

Gann has developed a theory of market cycles and identifies key events in the financial markets. He used this theory to predict the times of strong market reversals before every month or every year.

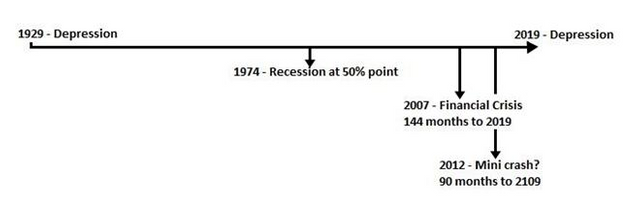

There is much evidence based on Gann's theory that 2019 will be a catastrophic year for financial markets. In the article, we will look at the two most important numbers: 144 and 90.

The 144 is a number in the fibonacci range. Gann see it as a "magic number". Take a look at the chart below:

In the top 200 Australian stocks, there is a company called Amcor, the world's leading packaging manufacturer. Here, we see the highest rate on March 21, 2006 was $ 7.74. Exactly 144 trading days later, the next peak was formed on October 16, 2006. Or perhaps the fact that since the market bottomed at $ 6.15 on Aug. 16, the market rallied properly. $ 1.44 or 144 cents to reach a peak at $ 7.59 on October 16, 2006?

What about 90? It is actually more reliable than the 144.

Let's look at an example of this on the FTSE 100 - UK stock.

The FTSE peaked at the beginning of June 2007 in the wake of the global financial crisis of the time, and was right 90 weeks later it reached its lowest level.

Number 90 in arithmetic means a change, a change or a hitch. Looking at the change in the AUDUSD, well 90 months since the price reached a low of 0.47 in April 2001 until October 2008, then AUDUSD reversed at 0.6.

What are the two numbers 144 and 90 predicting for us in 2019?

The last Great Depression occurred in 1929. If we add 90 more years it will be true for 2019. Interestingly, the Great Depression earlier occurred in 1840, nearly 90 years ago. 1929.

If you use the 144 to locate in 2019, we will have 2007, coinciding with the time of the start of the global financial crisis!

Finally, if we subtract 90 months from 2019, suppose we take October 2019 as landmark. 90 months ago will be the first quarter of 2012, the time of mini-crash in the market.

n fact, this is just a prediction and it may or may not happen. However, prevention is better than cure. Take a look at this as a factor to warn and find ways to diversify your portfolio in case of risk.

According to EducatedAnalyst

yes i agree that even this wouldn't come true or what its better that we are informed now right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit