On April 12th, Bitcoin hit the largest trading volume in history for an hour, when prices rose more than $ 1,000 over a 30-minute period. This price increase is not due to any news, it shows a "shark population" from a very low price and raised prices to sell high prices, or maybe a very large "shark" Market entry.

Another reason is that the selling pressure has been loosened, most waiting for the tax day 17/4.

The number of short-term orders fell from a high of 44,000 contracts on April 11 to 26,000 contracts on April 12. While some short orders are forced to cut due to price hikes, other orders may have to be cut because Bitcoin has kept a low on February 6.

Although it is difficult to accurately determine the reason for this increase, the move has boosted the prices of the big altcoins. As a result, the market capitalization of all crypto increased above $ 300 billion, after falling below $ 250 billion on April 1.

Let's see if we can find any trade orders based on the chart.

Bitcoin

In our previous analysis, we recommended Long Bitcoin when the closing price was above the 20 EMA. This situation met yesterday, as prices surpassed the upper resistance. Bitcoin is finally out of the bottom?

Previous attempts to exit the channel on March 3 failed within three days. This time, things became more active because the BTC / USD exchange rate was broken down from the declining channel. Now prices will quickly move to SMA 50, this may create new resistance.

Once the price is on the 50 SMA, the next move will be $ 10,000. The major resistance is at $ 12,172, where you should consider taking profit. We do not expect this level to pass quickly.

Investors who started buying yesterday were able to hug and set a stop loss of $ 6,700. They may set higher losses if Bitcoin breaks out of the SMA 50. It looks like the new bottom has already been established, but prices need to remain higher to confirm investor sentiment.

Ethereum

Our optimistic view on Etherum was confirmed yesterday as the price closed above the 20 EMA and the channel's resistance declined. This move will extend to SMA 50.

This is the first time the pair of ETH / USD has crossed its channel resistance, which is a positive growth. If the cattle were successful in breaking $ 600, the next step would be $ 725.

Any decline, mienx is above $ 420, may be the opportunity to buy.

Bitcoin Cash

Bitcoin Cash broke the resistance at $ 778 and the 20 EMA, establishing a short-term trading.

Traders could start trading at $ 779 and a stop loss near $ 610. The goal is to raise $ 974.

On the SMA 50, pair of BCH / USD may rise to $ 1115. Investors should increase higher stop loss rates as Bitcoin Cash is known to have made significant gains after moving into positive prices.

Ripple

The ripple has hit our first target of $ 0.7 mentioned in the previous analysis. The market has crossed the lows, which is a bullish sign.

Resistance from $ 0.70 to $ 0.73 could act as a key resistance and any decline to $ 0.56 is a buy opportunity. Cut loss at $ 0.45. We can confirm the bottom price if the next fall does not break the $ 0.56 level.

We expect the XRP / USD to trade in a wide range.

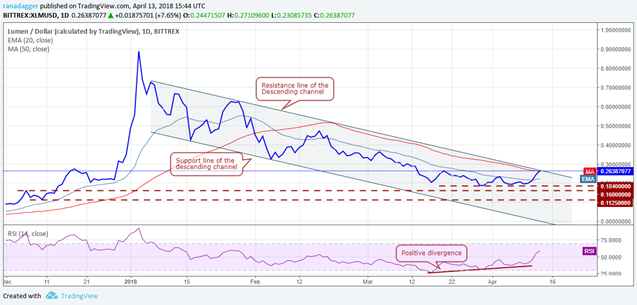

Stellar

We are optimistic about Stellar due to the positive divergence of the RSI. Yesterday, prices have confirmed our positive view as it escaped the 20 EMA.

The USD / XLM pair is currently trading at the descending channel resistance line. If it exits the channel, we expect the trend to change from bearish to bullish.

Traders can place several long trades on the channel's resistance line. Initial losses can be kept at $ 0.18 based on trading hours.

The goal of the uptrend is to move from $ 0.36 to $ 0.47. The risk-reward ratio should not be attractive, so traders should cut a portion of $ 0.36 to set higher losses to minimize risk.

If the whole market turns down, we will close the order before the bottom is confirmed. Our optimistic view will be disabled if prices remain in the channel.

Litecoin

Litecoin has crossed the first resistance line of the downtrend line 1 but is trying to surpass the 20 EMA.

Once it breaks out of the 20 EMA, it will have a resistance at $ 141. The LTC / USD exchange rate will go up after rising to $ 142.

On the uptrend line, it will face resistance at the downtrend line 2, at $ 165. At the moment, we do not have a good risk / reward ratio, so we do not recommend dealing with it.

Cardano

We suggest a long run with Cardano in the breakout and close above the 2460 level. Yesterday, the transaction took place when the currency closed at 2722 sts. The target of the pattern in an ascending triangle is 3230 sts, however, we expect a move to 3500 sts. Our optimistic view will be invalidated when price breaks below 2100 sts.

The 20 EMA and SMA 50 are on the verge of an uptrend, which is a positive sign. The ADA / BTC pair can retry the 2460 breakout.

Traders can continue to hold orders and buy more to test again the breakout level.

ANCHOR

We recommend long on the NEO as it crosses the $ 64 level. NEO / USD will find strong support in the area between EMA 20 and $ 63.62. The initial loss can be set at $ 44.

Although the SMA 50 was at $ 78, it did not act as a major resistance. Therefore, we believe that the currency will focus on the downward trend of the triangular downward trend for $ 88.

This is a dangerous position because prices are still falling, so traders should maintain current orders at 50% of normal value.

EOS

Our suggested buying price is $ 7.5 for EOS that was matched yesterday. Our goal is to increase to $ 11. The moving average is near the intersection of the uptrend, which is a sign of the beginning of a new trend.

Traders could take profit at $ 9.5 to reduce their risk and raise the stop loss for the remaining $ 5.5.

We expect a breakout of $ 7.28. However, if the EOS / USD broke through this support level, it would be a sideways move and we recommend closing all orders soon.

st

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!