dVest Labs is a decentralized autonomous organization (DAO) operated by its community and developers.

#dVest #dDEXX #CPI and #CPIndex

What is the dVest Labs DAO?

dVest Labs is a decentralized autonomous organization (DAO) operated by its community and developers. All decisions are handled by public vote, and all operations, finances, investments, holdings, and decision making are 100% transparent, blockchain verifiable, and fully decentralized.

The dVest Labs DAO holds positions (up to 49%) in the DAOs of it’s creations, joint ventures, and offshoot projects in the dVest Ecosystem

What is a DAO?

A decentralized autonomous organization (DAO) is an entity with no central leadership. Decisions get made from the bottom-up, governed by a community organized around a specific set of rules enforced on a blockchain. DAOs are internet-native organizations collectively owned and managed by their members. They have built-in treasuries that are only accessible with the approval of their members.

Introducing dVest Labs, the dVest DAO, and more!

What is dVest Labs and Where Did the dVest Concept Come From?

dVest (short for Decentralized Investing, duh!) was initially started as an idea between some of the people working on the marketing and development teams behind the Crypto Price Index project. It began as a side project, developing a protocol called DeFiVest for DeFi borrowing and lending that is chain-agnostic and can handle ERC20 assets, BEP20 assets, and any other compatible asset. Eventually this exploded in to multiple development projects, across multiple teams, at which point the team behind CPI decided to “acquire” the project, adopt the branding and development teams, and spin everything into fully democratized decentralized autonomous organizations (DAO).

Our Projects & Ventures

This organizational restructuring results in the following projects within the ‘dVest Ecosystem’…

dVest Labs — The central DAO that handles development, marketing, and management of all the dVest and related projects, partnerships, and products. The dVest LAbs DAO is a decentralized autonomous organization (DAO), operated by its community and developers. All decisions are handled by public vote, and all operations, finances, investments, holdings, and decision making are 100% transparent, blockchain verifiable, and fully decentralized. For ancillary projects that have their own DAOs, dVest Labs holds up to 49% of those dDAO tokens and voting rights. Anyone can join dVest Labs and purchase dDAO tokens to become a member, having voting rights, and have a say in the direction of the organization.

dDEXX.io — The dVest Labs automated market maker (AMM) based decentralized exchange (DEX) on both Ethereum and Binance Smart Chain networks, with Polygon support coming soon as well. dDEXX features easy and fast exchange functionality, profitable liquidity pools, and high APR yield farms, where users can earn dDEXX tokens, fees from exchange transactions, and much more.

dVest.io — The dVest centralized cryptocurrency exchange (CEX). dVest CEX users can trade all popular cryptocurrencies include BTC, ETH, DVEST, CPI, LTC, UNI, DOGE, ADA, XRP, DOT, BCH, LINK, XLM, TRX, XMR, XTZ, and many more.

Crypto Price Index — the very first token ecosystem of its kind, which provides options for users to gain broad exposure to the cryptocurrency market through our ‘CPIx’ tokens. Unlike other indices of its kind, CPIx tokens are novel in their approach of showing token holders a diversified range of assets across a cross-section of the cryptocurrency markets. The CPI (CPI) flagship tokens are a governance token, used to represent an interest in the health of the CPIx token ecosystem. CPIx tokens are backed by component assets, held via an escrow smart contract, and each CPIx token holds the underlying assets which can be redeemed at anytime without third party involvement.

DeFiVest [COMING SOON]— a non-custodial decentralized finance liquidity protocol for borrowing and lending of tokenized assets and earning interest on deposits.

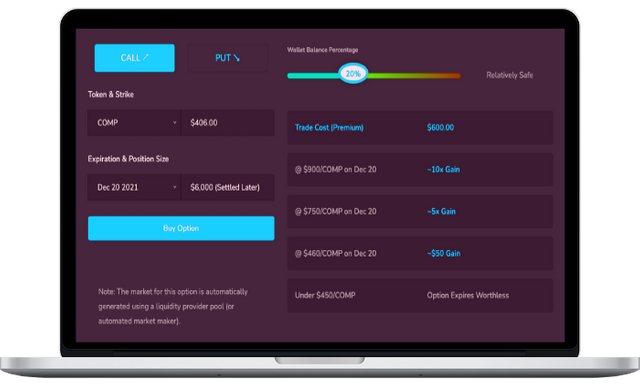

OPTIONZ [COMING SOON]— a DeFi options platform allowing anyone to buy or sell options for any token, provide liquidity to any options market, and track/withdraw yield at any time.

dSurance [COMING SOON] — a decentralized insurance protocol covering common risks for crypto asset management, treasuries, and other use cases. dSurance enables nearly instant liquidity to insurance buyers and risk underwriters, ensures constant collateralization, and guarantees transparency through an unbiased claims process.

Tokens

Additionally, the following tokens play important roles within the ‘dVest Ecosystem’:

dVestDAO (dDAO) tokens are the governance tokens for dVest Labs and its holdings. dDAO holders vote on the direction of the organization and how funds are to be spent, and funds can only be spent with a majority vote. dDAO holders share in the profits generated by dDAO holdings and investments.

dVest Labs (dLABS) tokens are the governance tokens for the dVest Labs Venture Fund. All proceeds from purchases of dLABS tokens go directly into the dVest Labs venture fund, where dLABS holders vote on which ventures should be approved, and funds can only be spent with a majority vote. All funds, distributions, investments, assets, holdings, and decision making are 100% decentralized, public, and blockchain verifiable. dLABS holders share in the profits generated by dLABS investments.

dDEXX (DDEXX) tokens are the reward token paid to users who provide liquidity and use the farms/pools on dDEXX, the dVest decentralized exchange (DEX).

CPI (CPI) tokens are a governance token, used to represent an interest in the health of the CPIX token ecosystem.

CPIx (CPIx) tokens are backed by component assets, held via an escrow smart contract. In order to mint CPIx tokens, componement assets must be deposited to the balancer pool. Users can mint CPIx Tokens by depositing token assets, such as ETH or wrapped BTC. In order to redeem tokens, users can redeposit their CPIx back to the smart contract, simultaneously receiving their underlying assets and burning the CPIx specific to that contract, e.g. CPI5. The token will then self balance.

dVest (DVEST) tokens are the governance token for the dVest CEX and related projects.

DeFi Options & Yield Farming

Buy or sell options for any token, provide liquidity to any options market, and track/withdraw yield at any time.

Until now, true liquid DeFi options contracts were a thing of theory, something people discussed and had great ideas for, but couldn’t properly execute. Not anymore, though.

How Does it Work?

Create Options Markets

Add any compatible token to the options market and set the first price. Earn rewards for every trade of that token for one year.

Buy & Sell Options

Set your own fees and sell options by providing the underlying token to the options market contract.

Earn Tokens

Earn tokens for buying, selling or providing liquidity in options markets. Claim, HODL or compound.

Conclusion

dVest Labs is making likely the most creative exercises in the DeFi space. As this space creates and ends up being more norm, dVest and it’s connected undertakings will be especially arranged to enhance their idle limit.

Website : https://dvest.org/

Twitter : https://twitter.com/dvestproject

Medium : https://medium.com/@dvestlabs

YouTube : https://www.youtube.com/channel/UCLnrGT2xZCwpoCzMfon_mAQ

Discord : https://discord.gg/56ESaPCdpx

Telegram : https://t.me/defivest

Author

Bitcointalk Unsername: KenzoKen

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2961513;sa=summary

Telegram Unsername: @Kenzokenzooo

BEP-20 Address: 0x42bf3b13486f392c24ce814c5B5b131d7247a6ec