INTRODUCTION : The use and growth of blockchain technology is been so massive that it has almost reach out to every sector.The area of finance is not left out of this positive invasion.Infact it is a catalyst that accelerates the transferrance of crypto assets which are been applied in industry of banking and finance.

On a daily basis,the cryptocurrency market is increasing in volumes tremendously despite the fact that it has not been globally accepted.However,its acceptance on a glocal level is just a matter of when and not if,this is so because of way by which the crypto market is developing all around some certain nations everyday.

This is said with such assurance because it is assumed that products of cryptocurrency will function as a mean of securing cars,estate properties and also serve as a new type of collateral.

Meanwhile,there have been some challenges posed by internal and external forces which face this market on a day to day basis.For instance,digital money have not been known as an avenue of exchanging money in its universality,thereby not making it a means of guarantee by the private creditors and this proves to be an ache on the head for the market and investors likewise as it is not realistic to get original monetary value against a protection of crypto currency by the models of traditional financial system.Also,a threat thrown to the market is the time that is wasted just on obtaining a loan in cash.

However,a platform has been established in order to curb these problems in a unique way and bring whole lot of opportunities financially to the clients; this is noy other model but eCoinomic!

eCoinomic : Its identity and application

This financial model ensures access for FIAT loans and also injects various services that includes full scale banking.

eCOinomic helps to create an avenue where entities can lend money even with investors fro different countries It boosts ad enhances the liquidity of the crypt I currencies by making use of fiat money from diverse financial firms.

This model assists in minimizing the huge gap between crypto assets and traditional monetary assets

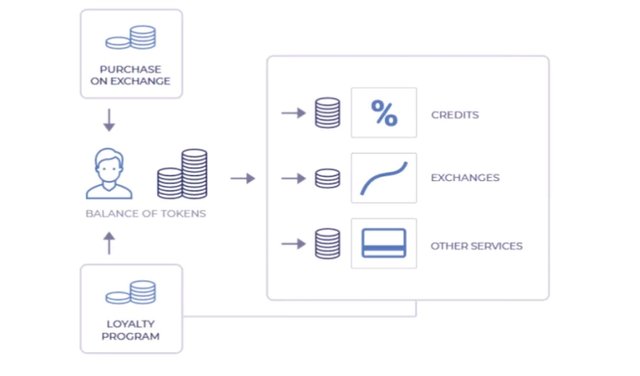

his image depicts how it aims to provide for its users with financial management services of digital currency.

It birth an answer to the high risk affecting the world of finances by giving to the investors:

Acceptance of different currencies like ADA,BTC,CNC

High security and clarity in business.

This network consists of two basic parts namely :

Lenders : Make provision for loans in Fiat currencies

Borrowers : are individuals or small corporations who are deliberate about collecting loans by employing crypto as a collateral.

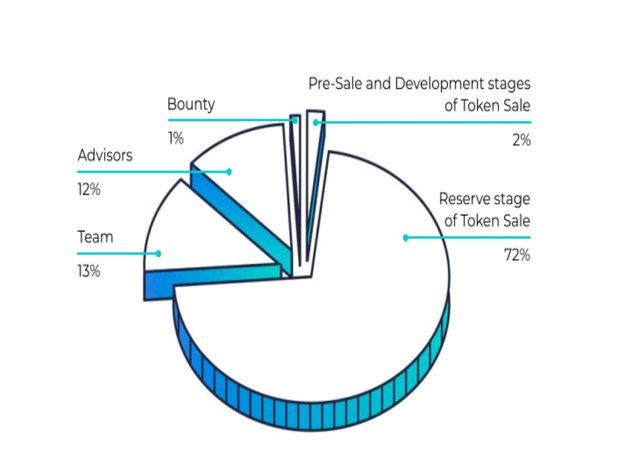

The distribution of tokens in economic

The funds derived from this network are not totally spent on the sales made.

The percentage of how funds are judiciously spent goes thus :

10% - The expenses spent on the operations before gain are achieved.

9%- Expenses used to market term promotion of services

81% - Allocated to the funds left and this won't be used for any transaction.

CONCLUSION: eCoinomic aims to bring about permanent solution to the issues facing the crypromarket.Therefore,if implemented in transactions,will make liquidity of the currencies in cryptomarket limited.

To learn more, visit the links below:

Website: https://www.ecoinomic.net

Whitepaper : https://ecoinomic.net/docs/whitepaper

Medium : https://medium.com/@ecoinomic

Social media

Facebook : www.facebook.com/ecoinomic/

Twitter : https://mobile.twitter.com/Ecoinomicnet

Telegram: https://telegram.me/eCoinomicchannel

Writer name : FunmilolaO

Writer Bitcointalk URL : https://bitcointalk.org/index.php?action=profile;u=2074860