eCoinomic.net (CNC) A New Way to Make a Loan Revolution

thsaudtl1July 29, 2018

Rating: ★★★★★ Comprehensive 4.8 / 5

eCoinomic Grade Status # eCoinomic

(ICO Bench 4.7 / 5) (ICO marks 9.0 / 10) (The Tokener 5.0 / 5)

eCoinomic (CNC) is a coin in the form of a loan platform with collateral assets as collateral. eCoinomic is different from other lending platforms and attracts investors attention. The current market for encryption is not seen as a means of payment and service, but because there are many things to look at as investment and speculation, demand for loans is also high. In this current situation, eCoinomic's loan platform is required for:

People who need money but do not want to lose their investment

Those who want to buy half of the coin in a credit coin after they have secured the beat coin

Those who want to prevent the risk of falling cipher money prices

Below is a YouTube video with a detailed description of eCoinomic.net. Note please.

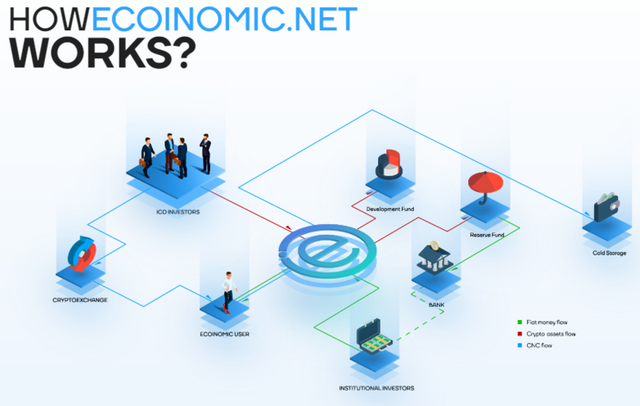

Workflow chart of eCoinomic.net

< eCoinomic.net mean>

eCoinomic.net is part of Sauber Gruop, a consortium of companies engaged in the services, finance and fin tech industries.

Business development of eCoinomic.net was started in 2001 as a service, finance, and pin-tec project.

The core team of the project consists of experts with more than 10 years experience in the PinTech industry and software development.

The important Sabuer Bank JSC was established in 1992 as the oldest USSR bank reorganized. In addition to offering financial services such as loans, deposits and currency exchanges to individual customers, Sauber Bank also provides rental, payment and cash services for corporate clients.

eCoinomic.net provides a scalable general call lending solution for cryptographic investors.

The first step is to create a platform that connects individuals, institutional investors, and family offices who want to receive a loan so that they can receive the loan. The next step is to add a variety of financial services, including overall banking services.

Reviews on eCoinomic.net

< in the Current Cryptographic Market>

In most countries, cryptography is not a financial asset and can not act as collateral. If you sell your cryptography after you need it in the short term, and you buy it again, the high volatility and commission on the exchange will be risky and you will not earn any profit.

Because the value of cryptography is growing rapidly, cryptographic investors fall into a dilemma: on the one hand, money is needed for reasons such as business development / updating of mining hardware / improving their quality of life. On the other hand, however, they hope that the value of their currency will rise tremendously in the near future. In order to receive a cash loan, it takes a lot of time because you have to go through the process of applying, making the required documents, evaluating the security and providing the guarantee. So much preparation and insufficient or

Bank loans may be refused due to credit history that can not be loaned. Since digital assets are not recognized as collateral at present, it is impossible for existing financial institutions to borrow real cash from collateralized money. In addition, some private lenders do not guarantee the safety or transparency of transactions.

< Solution>

eCoinomic.net will create a global network for individuals or small businesses to lend out ordinary currencies as collateral. Then you do not have to sell the password you had to borrow.

The eCoinomic.net platform will serve as a bridge between financial institutions that provide loans and individuals who want to receive loans. eCoinomic.net provides all coverage of the loan and acts as a guarantor, eliminating all risks that may arise during the loan process. Financial institutions such as investment banks and family offices provide loan services on the platform of eCoinomic.net. Our business model provides solutions for financial institutions that want low-risk, profitable investments. It can also increase the liquidity of the cryptographic market by attracting investments from financial institutions.

General currency loan secured by password currency

Investment and Asset Management

exchange

Remittance and mutual payment between users and partner companies

All platform users can use the following optimization services when the value of the cryptographic currency rises in the future.

mortgage or credit of general currency and password currency

Long-term or short-term investment of general currency and password currency

Exchange risk hedge against password currency

Financial transactions, money exchange, collateral management

Payment of goods and services in an online trading platform with a password

Transactions with general toilets, issuing credit cards with password money security

This service will be available as the first complete version of the platform, at least within the fourth quarter of 2018.

In addition, eCoinomi.net will continue to provide services by creating loyalty programs for customer retention.

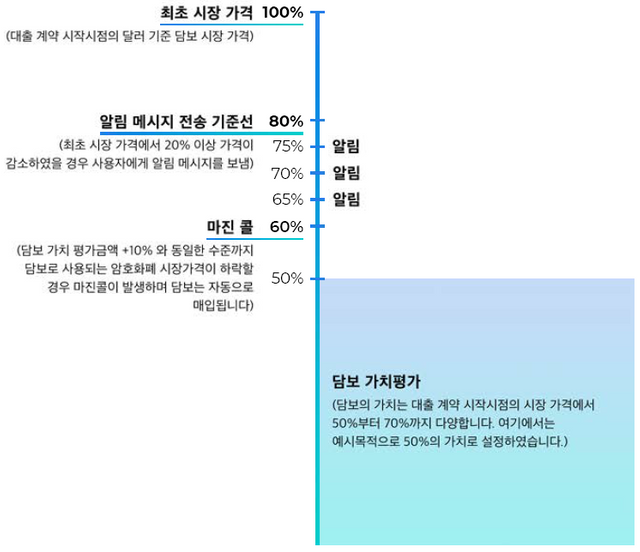

The valuation of the collateral can vary from 50% to 70% depending on the type of password, the user class, and the amount of CNC tokens you have during a particular period.

The loan limit is at least $ 200, up to $ 10,000, and the loan period is 30 days.

The service fee per loan is set as follows until the platform opens in the fourth quarter of 2018.

The CNC token issued by eCoinomic.net is a token used to pay the loan agreement fee.

All tokens not sold during ICO will be incinerated.

All platform fees are shown in dollars but accepted only in the form of tokens.

The platform has the right to sell each token according to the FIFO principle only after the blocking period has expired.

The token lifecycle model quickly reduces the amount of tokens in the market while the decrease in the token amount does not go down to zero because it leads to an increase in the token . On the other hand, the token split can be paid in 100 parts.

< proposition of eCoinomic.net>

eCoinomic.net creates new value the cryptographic industry by creating a stable and reliable platform that can easily and quickly get a standard currency loan.

First, we provide users with various passwords as collateral.

CNC, BTC, ETH, XRP, LTC, BCH, EOS, NEO, ETC, ADA, TRX, DASH

Available in general currency: USD, EUR

GBP, JPY, CHF, CNY will be added in the future.

And the eCoinomic.net will work with leading billing service providers to provide high-speed, normal-rate, general currency trading services that will last no more than four or five minutes.

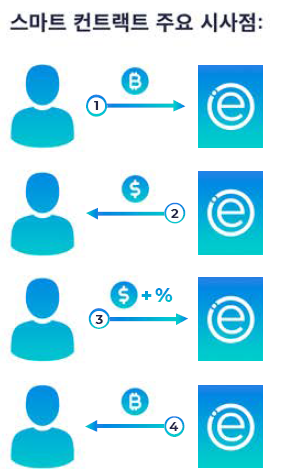

eCoinomic.net's smart contract protects the assets of cryptographic and currency investors by enabling them to fully fulfill their obligations.

In addition, real-time price monitoring is used to select the value of collateral from the top-ranked cryptographic exchange.

< Features of eCoinomic.net>

The of eCoinomic.net is based on etherium, and the smart controller is built as Solidity.

All users registered on the can set their own credit conditions.

-> Loan amount and interest rate

The deposit will be sent to the platform user's personal account the guarantee of the cryptography used as security. Unless the cipher currency is held as collateral the loan, the cipher investor can withdraw his password cipher from the platform at any time.

The highest possible amount per loan is set at $ 10,000. All users can receive up to 30 days of loan multiple times. The loan period can be increased if you have paid interest and service fees the previous loan.

1 To receive a loan, a user must provide a certain amount of

You need to send money in a secure currency.

2 Once the security has been transferred, the smart

You will be able to send money to your users. The loan amount is automatically

Will be sent.

3 To terminate the loan agreement, the user must pay the loan principal and /

You have to repay interest. All of this is done in the Smart Contract

It will be controlled.

4 Once the redemption of the loan in the public currency is confirmed,

Automatically sends the security and the user gets the password back.

It's possible.

Debts on loan contracts are implemented through Smart Contracts. If the user fails to repay the loan, Smart Contract will liquidate the mortgage to repay the loan principal. After the liquidation, the remaining security is returned to the lender.

Smart contracts allow you to view the current quotes of multiple cryptographic exchanges, so you can set a cryptographic price in a transparent way.

If the current price of the cryptographic collateral has fallen by more than 20% from the market price at the time of the loan offer, the system will notify the user. This message will be sent each time the current cipher money price is further reduced by 5% from the cipher price at the time of the loan offer.

In this case, the user can take the following actions:

• The additional amount that can cover the difference between the principal amount of the loan arising from the declining price of the cryptographic currency

Deposit the password.

• Allow partial liquidation of the collateral to repay the loan.

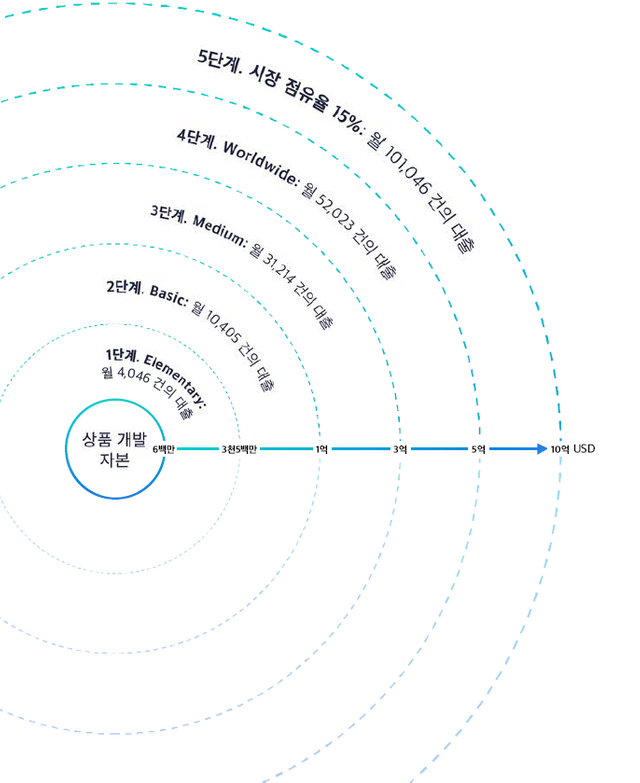

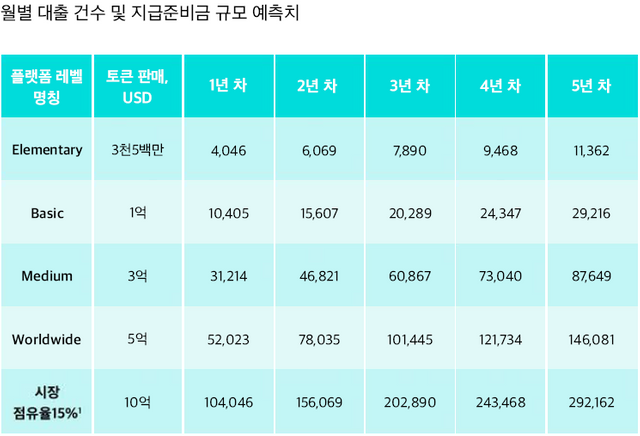

(Platform scale)

Estimated Monthly Loans and Prepared Levels

roadmap summary>

2017 - Platform idea birth, password currency market research, technical solution evaluation, team recruitment and concept development

Q1 2018 - Initial release of project information, early stages of platform development

Q2 2018 - launch of pilot projects in Russia, sales of tokens (pre-sale phase)

Launched global platform alpha version, started selling tokens

Q3 2018 - Licensing, developing solutions different jurisdictions

End of token sales, partnership with major global payment agents

Signing a Memorandum of Understanding with Financial Institutions and Family Offices

Q4 2018 - Virtual cards issued

Released eCoinomics.net payment agent with public API

Platform launch - November - Early release early adopters, December - all customers

Platform release

1-2 quarter of 2019 - attracting general monetary investment from financial institutions and family offices

Expansion through global partnership with local microfinance institutions

Legal process issue of bonds

Q3 2019 - Cooperation and technical exchange with trading platforms

Bond issuance

Begin the password money bank registration process

1-2 quarter of 2020 - start IPO process

The first step in the launch of a cryptographic bank (licensed in the UK and EU)

3-4 quarter 2020 - IPO implementation

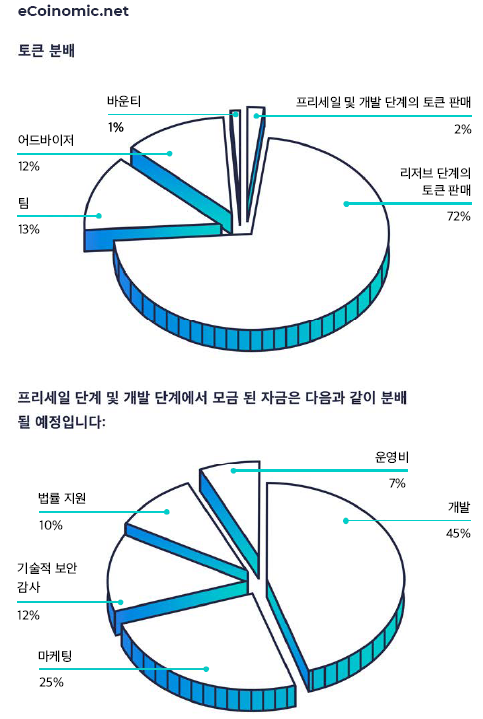

Total 2.100.000.000 CNC (ERC20) tokens issued (2.1 billion)

Pre-sale phase: April 3, 2018 - April 21, 2018 (ended)

$ 600 million sales (hard cap reaching) 1CNC = $ 0.05

Crowd phase: May 1, 2018 - May 31, 2018

1CNC = $ 0.05

Reserve step (change schedule): June 1, 2018 - November 1, 2018

- Current $ 47 million sales final price 1CNC = $ 0.12

Official sales soft cap: $ 6 million, hard cap: $ 106 million

Token not sold Country: USA, China, Singapore

All tokens that have not been sold since the sale of the token will be canceled.

81% of the funds raised at the reserve stage will not be used as deposits.

This amount is needed to allow institutional investors and family offices to participate as lenders.

The reserve will be deposited with Escrow Bank.

10% of the funds will be used the necessary operating costs until the platform makes a profit.

The remaining 9% will be used platform marketing and promotion.

eCoinomics.net will provide reports and related documents on the use of funds,

You will receive an annual audit from one of your accounting firms.

Token not sold Country: USA, China, Singapore

Talk about eCoinomic.net Token Sale and CNC Token

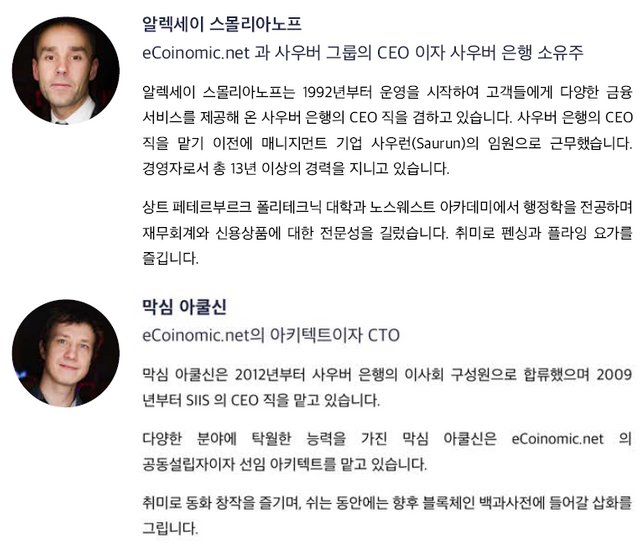

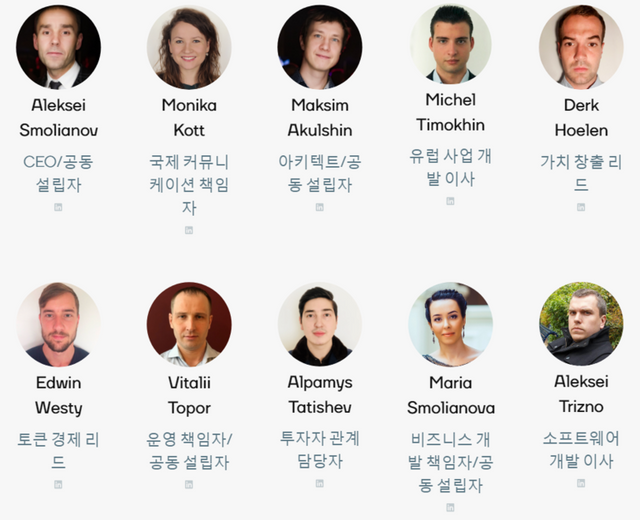

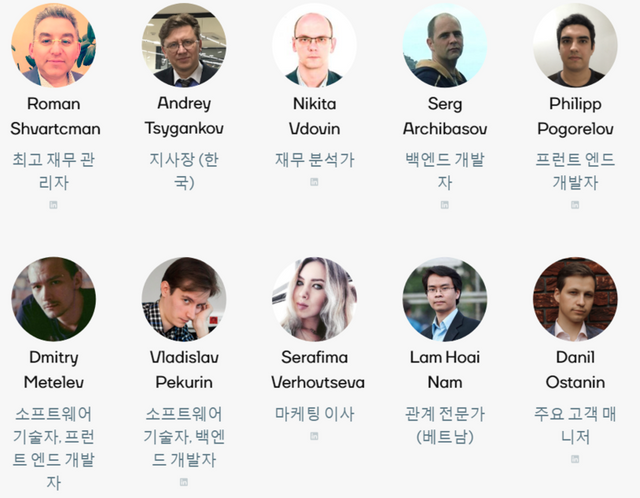

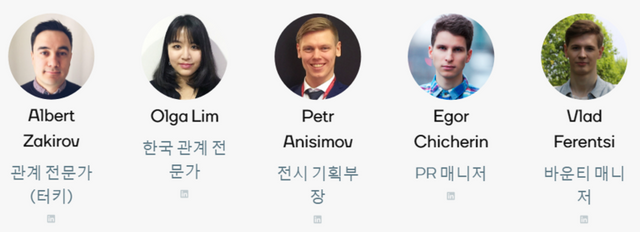

<Founder and Team Composition, Advisor, Partner>

four founders of eCoinomic.net

Teaming up at eCoinomic.net

(Advisor)

(partner)

Official site - https://www.ecoinomic.net/

Official Telegram - https://t.me/ecoinomicchannel

Official Twitter - https://twitter.com/Ecoinomicnet

Official Facebook - https://www.facebook.com/ecoinomic/

Official Medium - https://medium.com/ecoinomic

Official Reddit - https://www.reddit.com/r/eCoinomic/

Official Bit Coin Talk ANN - https://bitcointalk.org/index.php?topic=2878954

Official LinkedIn - https://www.linkedin.com/company/ecoinomic/

Official YouTube channel - https://www.youtube.com/c/eCoinomic

Official White Paper: https://ecoinomic.net/docs/korea_whitepaper

Bitcointalk Username: thsaudtl1

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2171409

ETH Address: 0xa1968D44405Ed17fee3CD0B4944f7D34f8B19c54

This post has been upvoted for free by @nanobot with 5%!

Get better upvotes by bidding on me.

More profits? 100% Payout! Delegate some SteemPower to @nanobot: 1 SP, 5 SP, 10 SP, custom amount

You like to bet and win 20x your bid? Have a look at @gtw and this description!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit