Today's price discovery destroyers market action:

https://www.zerohedge.com/news/2019-08-07/bonds-gold-surge-stocks-purge-fear-reaches-2019-extremes

In the US, markets were mixed with Nasdaq best as desperate panic bids appeared to lift stocks back to unch (and to top the farce off a super-spike at the close)...

Farce is a very good way to put it.

that's always fun to watch, everyone fleeing to bonds, gold, and crypto while ppt tries over and over again to keep equities at unchanged

Gold surged to new six-year highs...

(ppt has to print money to manipulate those markets)

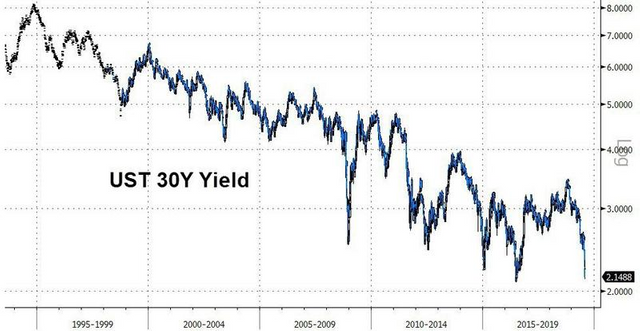

30Y Yield plunged to near record lows...

and people are so desperate to park their cash somewhere, they're even willing to lend to the US for 30 years - and everyone knows theyll be insolvent with unprintable dedollarization by then

Finally, with $15 trillion (and rising tonight) in negative-vielding debt, bullion and bitcoin appear the preferred safe haven against policy-maker panic...

because no-yield is better than negative-yield in todays central bank shenanigans

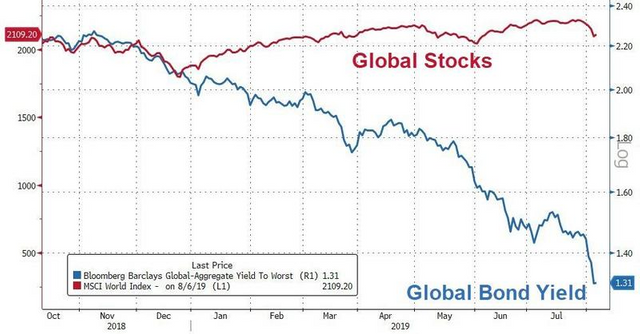

Still, global bonds and stocks remain massively decoupled...

With plenty of room to run in the equities sell-off!

And for those market-leading research analysts at the Federal Reserve:

https://en.wikipedia.org/wiki/Minsky_moment

here is a nice powerpoint to accompany that:

http://www.quantlab.it/IFM/5-Grasselli_IFM-19Oct2012.pdf

pay special attention to the "Ponzi financing" slides - it pertains specifically to the QE question you emailed zerohedge about

https://www.bloomberg.com/professional/request-demo/

Quick set-up guide:

What solution do you want to learn more about?

(hold down Shift and the Down Arrow to highlight all)

Please explain the business situation or problem you are trying to manage.

Type in: "Not fucking up the entire US financial system. And according to Minsky, the rest of the world's financial systems, as well".

Have you ever used the Bloomberg Terminal?

click "No"

And then fill in your personal details.