In an era where markets move faster than a diabetic to the pisser, bubbles seem to blow and pop more frequently than ever. But what exactly is a bubble? What drives a bubble?

No, I'm not talking about gum bubbles you blow with your Big League Chew as you're waiting to catch a pop fly at your baseball game. I'm talking about a market bubble.

BusinessDictionary.com defines a bubble as speculation which results in an explosion of activity, causing vastly overinflated prices. The important part of this definition is the "speculation" and "explosion of activity" which touches on the herd mentality aspect of a bubble.

As humans, we think we're smarter than any other animal on the planet. We're not. Sure, we're more sophisticated and intellectual than animals as proven by our progress. However, emotionally we still have an extraordinary amount of carnal and animal tendencies which drive our decisions and behaviors. One excellent example of this is when we fall victim to groupthink and herd behavior.

Have you ever watched a group of horses in a field? Horses spook very easily. It's very common for one horse to spook, yet the whole herd of horses goes running. The horse the spooked ran because it saw something that personally scared it. However, the other horses ran because they saw the first horse running, and didn't want to get left behind. They get swept up in the euphoria, only to realize later that nothing was there.

But what were they other horses running from? If they could talk, they'd tell you they don't have a clue.

Humans still do this every day, and will continue to do this until the end of time. The only difference is we come up with more complex defense mechanisms to hide it than animals would.

So how the hell does all this apply to markets? In markets--whether that is a stock index, commodity, individual stock, currency, real estate, or literally any economic thing that is bought and sold--humans exhibit herd behavior. Even the smartest of us. PhD's, Billionaires, everyone.

When someone buys a security based on someone else's analysis, they're exhibiting elements of herd behavior. When someone buys something for "fear of missing out" or because it's “once in a lifetime”, they're being swept up in the euphoria. When someone buys knowing it's a bubble, but thinks they can still profit (Greatest Fool Theory), they're contributing to the euphoria.

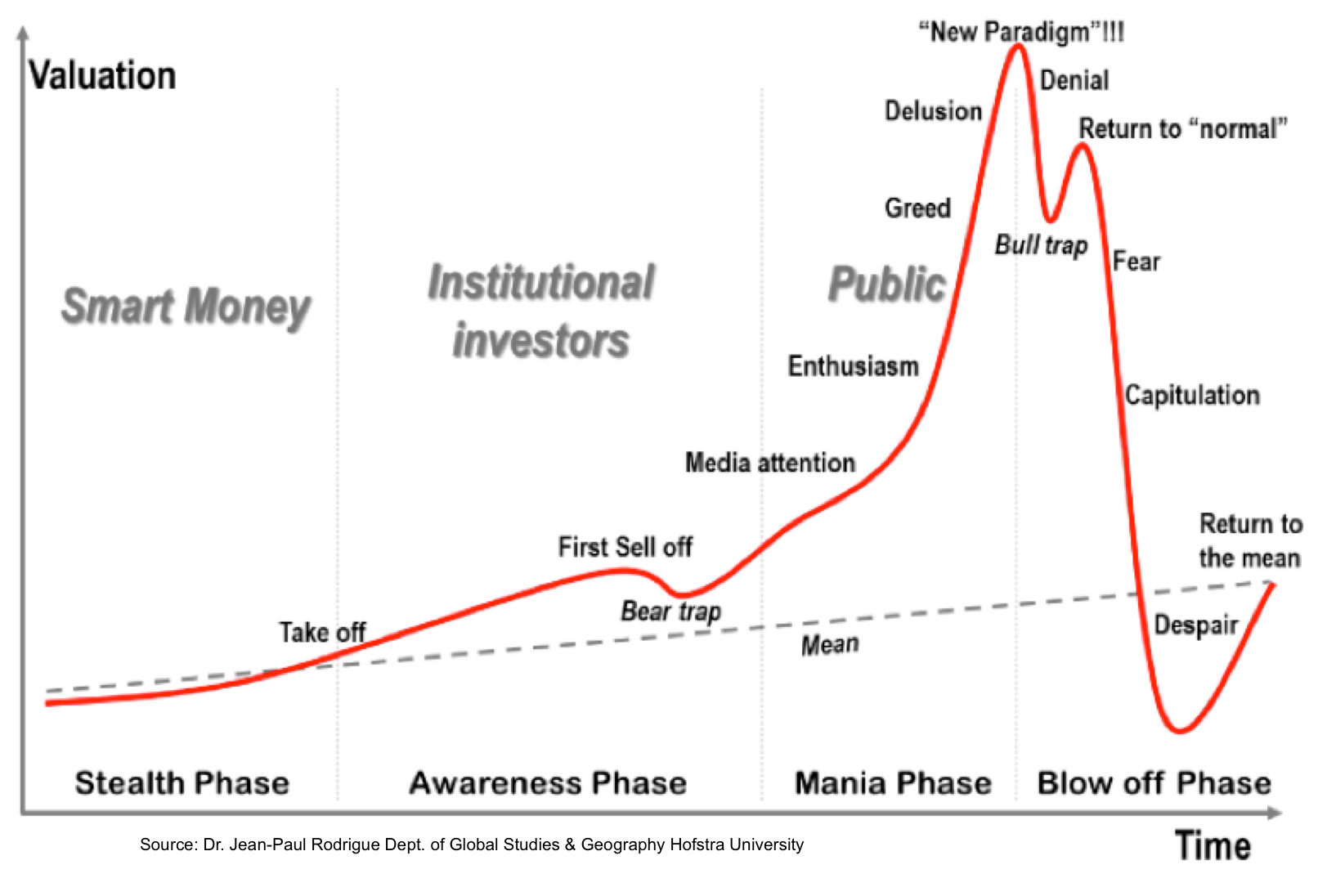

If you've been around markets, you've probably seen this chart:

It's the best pictorial view of the stages of a bubble that I've come across. Early entrants and fundamentals start the process. As momentum builds, more people pile on, and create a frenzy. At this point the herd begins buying because others are buying, and not because of underlying fundamentals. At this point all rationality is lost and prices are driven up as speculators eye more gains.

Until the breaking point occurs. Typically market participants act inversely irrational on the crash. This causes crashes from bubbles overcorrect to the downside a high majority of the time. Only after this does the market regain rationality and reflect upon what has happened.

Stay tuned for my next piece: How to spot a market bubble. How to avoid being swept up in euphoria. How to profit from a bubble. (It's a lot harder than you think).