There’s one incredible feature of cryptocurrencies that almost everyone seems to have missed, including Satoshi himself.

But it’s there, hidden away, steadily gathering power like a hurricane far out to sea that’s sweeping towards the shore.

It’s a stealth feature, one that hasn’t activated yet.

But when it does it will ripple across the entire world, remaking every aspect of society.

To understand why, you just have to understand a little about the history of money.

The Ascent of Money

Money is power.

Nobody knew this better than the kings of the ancient world. That’s why they gave themselves an absolute monopoly on minting moolah.

They turned vivid metal into coins, paid their troopers and their troopers bought things at local stores. The king then sent their troopers to the retailers with a simple message:

“Pay your taxes in this coin or we’ll kill you.”

That’s almost the entire records of money in one paragraph. Coercion and control of the grant with violence, aka the “violence hack.” The one hack to rule them all.

When strength passed from monarchs to nation-states, distributing energy from one strongman to a small crew of strongmen, the electricity to print cash handed to the state. Anyone who tried to create their own cash acquired crushed.

The cause is simple:

Centralized enemies are convenient to spoil with a “decapitation attack.” Cut off the head of the snake and that’s the cease of all and sundry who would dare assignment the strength of the kingdom and its divine proper to create coins.

That’s what took place to e-gold in 2008, one of the first attempts to create an choice currency. Launched in 1996, by means of 2004 it had over a million debts and at its height in 2008 it was processing over $2 billion dollars really worth of transactions.

The US government attacked the four leaders of the system, bringing expenses towards them for money laundering and walking an “unlicensed money transmitting” commercial enterprise in the case “UNITED STATES of America v. E-GOLD, LTD, et al.” It destroyed the enterprise via bankrupting the founders. Even with mild sentences for the ring leaders, it was once sport over. Although the authorities didn’t technically shut down e-gold, practically it used to be finished. “Unlicensed” is the key word in their attack.

The electricity to furnish a license is monopoly power.

E-gold used to be free to follow for interstate money transmitting licenses.

It’s just they have been by no means going to get them.

And of course that put them out of business. It’s a living, respiration Catch-22. And it works each time.

Kings and kingdom states be aware of the real golden rule:

Control the cash and you control the world.

And so it’s long gone for hundreds and thousands of years. The very first emperor of China, Qin Shi Huang (260–210 BC), abolished all other forms of nearby forex and brought a uniform copper coin. That’s been the blueprint ever since. Eradicate alternative coins, create one coin to rule them all and use brutality and blood to preserve that electricity at all costs.

In the end, every system is inclined to violence.

Well, nearly each and every one.

The Hydra

In decentralized systems, there is no head of the snake. Decentralized systems are a hydra. Cut off one head and two more pop-in to take its place.

In 2008, an anonymous programmer, working in secret, figured out the solution to the violence hack once and for all when he wrote: “Governments are good at reducing off the heads of centrally controlled networks like Napster, however pure P2P networks like Gnutella and Tor appear to be conserving their own.”

And the first decentralized gadget of cash was born:

Bitcoin.

It was explicitly designed to withstand coercion and control with the aid of centralized powers.

Satoshi wisely remained anonymous for that very reason. He knew they would come after him due to the fact he was the symbolic head of Bitcoin.

That’s what’s occurred every time someone has come ahead claiming to be Satoshi or when any individual has been “outed” by means of the information media as Bitcoin’s mysterious creator. When fake Satoshi Craig Wright came out, Australian authorities right now raided his house. The professional reason is always spurious. The real reason is to cut off the head of the snake.

As Bitcoin rises in value, the hunt for Satoshi will solely intensify. He controls at least a million coins that have by no means moved from his unique wallets. If VC Chris Dixon is proper and Bitcoin rocket to $100,000 a coin, these million cash will shoot up to $100 billion. If it goes even higher, say a $1 million a coin, that would make him the world’s first trillionaire. And that will only bring the hammer down harder and faster on him. You can be one hundred percent certain that black ops units would be gunning for him around the clock.

Wherever he is, my recommendation to Satoshi is this:

Stay nameless until your death bed.

But resistance to censorship and violence are only one of a wide variety of wonderful facets of Bitcoin. Many of these key components are already at work in a number of different cryptocurrencies and decentralized app projects, most incredibly blockchains.

Blockchains are distributed ledgers, the third entry in the world’s first triple-entry accounting system. And breakthroughs in accounting have always presaged a massive uptick in human complexity and monetary growth, as I laid out in my article Why Everyone Missed the Most Important Invention in the Last 500 Years.

But even triple-entry accounting, decentralization and resistance to the violence hack are not the true strength of cryptocurrencies. Those are basically the mechanisms of the system, the way it survives and thrives, bringing new abilities to the human race.

The closing characteristic is one that Bitcoin and present day cryptocurrencies have only hinted at so far, a latent feature.

The true power of cryptocurrencies is the power to print and distribute money without a central power.

Maybe that appears obvious, however I assure you, it’s not. Especially the 2d part.

That power has usually rested with the divine proper of kings and nation-states.

Until now.

Now that proper returns to its rightful owners: The people.

And that will blow open the doorways of world commerce, sowing the seeds for Star Trek like abundance economics, leaving the Old World Order of pure scarcity economics in the pages of history books.

There’s simply one problem.

Nobody has created the cryptocurrency we genuinely need just yet.

You see, Satoshi understood the first phase of the maxim, the strength to print money. What he overlooked was the power to distribute that money.

The 2nd section is really the most quintessential part of the puzzle. Missing it created a quintessential flaw in the Bitcoin ecosystem. Instead of distributing the money some distance and wide, it traded central bankers for an un-elected team of miners.

These miners play havoc with the system, preserving again a lot needed software program enhancements like SegWit for years and threatening pointless difficult forks in order to pressure down the charge with FUD and scoop up extra cash at a depressed price.

But what if there used to be a extraordinary way?

What if you may want to sketch a device that would completely alter the economic panorama of the world forever?

The key is how you distribute the cash at the moment of creation.

And the first team to recognize this probability and put it into action will alternate the world.

To recognize why you have to appear at how money is created and pushed out into the gadget today.

The Great Pyramid

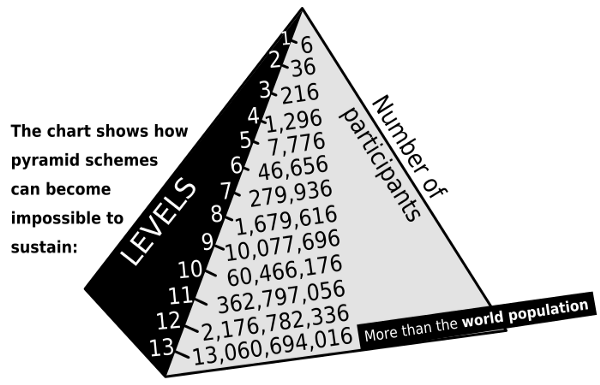

Today, money starts at the top and flows down to everyone else. Think of it as a pyramid.

In fact, we have a famous pyramid, with a 0.33 eye, on the dollar itself.

One of the most cliched arguments against Bitcoin is that it’s a Ponzi or “pyramid” scheme. A pyramid scheme rests on the original creators of the machine roping in as many suckers as possible, paying them for enrolling human beings in the gadget as a substitute than via providing goods and services. Eventually you run out of people to deliver in and the total things collapses like a residence of cards. A Ponzi scheme is basically the same, in that you dupe the unique investors with pretend returns on their preliminary investment, a la Bernie Madoff, and then get them to rope in more suckers because they’re so elated by means of the massive returns.

The irony of route is that fiat currency, i.e. government printed money like the Yen or US dollar, is closer to a pyramid scheme than Bitcoin. Why? Because fiat cash is minted at the top of the pyramid by means of central banks and then “trickled down” to all of us else.

The only problem is, it doesn’t trickle down all that well.

It moves out to a few big banks, who both lend it to people or give it to people for their labor. In fact, having a job or getting a loan are the important strategies that people at the bottom of the pyramid get any of the money. In other words, they exchange their present day time (with a job) or their future time (with a loan) for that money. It’s just that their time is a limited aid and they can solely exchange so lots of it before it runs out.

Think of economics as a game. Everyone in the machine is a player, looking to maximize their advantage and the advantage of their team (a company, their household and friends, etc.) to get more of the money. But to start the recreation you need to in the beginning distribute the money or nobody can play. Distributing cash sets the playing field.

Now if you had been in charge of the money, how would you distribute it to the network? You’d favor to hold as a whole lot of it for your self as possible, so you’d set the guidelines to maximize your personal non-public advantage. Of direction you would! That’s what every person in their proper thinking would do, maximize their very own power to maintain it for as lengthy as possible.

That’s precisely what the kings and queens of the historical world did, and that’s what state states do today. As Naval Ravikant said in his epic series of tweets on blockchain, today’s networks are run with the aid of “kings, corporations, aristocracies, and mobs.” “And the Rulers of these networks [are] the most effective people in society.”

That’s why every single device in the records of the world has distributed the money in one way:

From the top down.

Because it maximizes the advantage of the kings and mobs at the top.

Unfortunately, that potential most of the cash by no means really leaves the top. It stays proper there, as wasted and frozen conceivable that’s by no means realized. There is little to no incentive for the cash to move. Since cash is power, hoarding it is actually hoarding more energy and nobody would willingly supply up that power.

In other words, the game is rigged.

What we want is a way to reset the game.

Up until now, our potentialities regarded very dim.

For example, we may want to skip a law, like a Universal Basic Income (UBI). That would provide everyone a circulate of money, pushing it out throughout the entire enjoying area and giving greater human beings a hazard to take part in the system. If extra people can participate, we liberate all types of hidden and untapped value.

How many gorgeous inventors never managed to create their subsequent leap forward because they were stuck riding a bus seven days a week to feed their family, with no hope of free time or any clear course to digging themselves out of debt? How many fantastic writers went to their graves never having written their incredible novel? How many budding scientists by no means determined the therapy to cancer or coronary heart disease?

The hassle with all of the plans before now, from UBI to socialism (high taxes on the prosperous to unfold the wealth throughout the game) is that to redistribute the money after it’s already been disbursed is nearly impossible. The human beings with that cash rightfully resist its redistribution. And as Margret Thatcher said “The hassle with Socialism is that ultimately you run out of other people’s money.”

But what if the money is NOT already distributed?

What if we don’t have to take it from anyone at all?

That’s the neglected probability of all of today’s cryptocurrencies. Cryptocurrencies are creating new money. And in contrast to credit markets, which only pretend to expand the cash supply, by using lending it out 10x with fractional reserve lending, cryptocurrencies are literally printing money. And they aren’t loaning it to people, they’re giving it to them for their service to the network.

It’s like microloans, without the loans.

As Naval said: “Society gives you cash for giving society what it wants, blockchains supply you cash for giving the community what it wants.”

So rather of giving all the money to a small team of miners, what if we could do better? A lot better?

We can.

I outlined one way in the an article about the Cicada project, How We Deliver a Universal Basic Income Right Now and Save Ourselves from the Robots. The Cicada sketch flips the thought of mining on its head. Everyone on the community is a miner and no one can have extra than one miner.

Miners are drafted randomly to keep the community walking smoothly. You would possibly be on foot along, getting coffee and your phone gets referred to as on to tightly closed the network for a few minutes. After that it goes proper again to sleep. As a reward, you may win new cash for doing nothing but having the application on your phone. Simple right?

Because absolutely everyone is subsequently drafted, all and sundry receives paid, in essence creating a UBI right now.

And that’s simply one way.

If you suppose about it you can come up with dozens. Oh and don’t get caught up with wondering the only way to do this is with an ID. Lots of methods to randomly draft miners besides that too. The key is to free your thought of the “Satoshi box” and suppose different.

What we honestly want is to completely gamify the delivery of money, distributing it a ways and vast at the second of creation.

Give it out as rewards for using apps, or as disbursed mining fees, or as shared cuts of the mining costs to companies that supply cost to the community are simply a few greater methods to do it right. Those are just the tip of the iceberg. There are thousands of ways however we just haven’t been thinking about the hassle the right way.

In other words, we missed the real power of Satoshi’s creation: the distribution of money.

The first gadget that surely gamifies the transport of cash will rocket to exponential growth, upending the contemporary gadget for good. That will set the preliminary playing field dynamically and permit players who in no way would have gotten into the recreation to compete. The greater humans who can participate, the extra environment friendly and treasured the network becomes.

“Networks have “network effects.” Adding a new participant increases the value of the community for all present participants.”

Right now, we’re not including new contributors fast adequate to the cryptonets of tomorrow. The machine is nonetheless prone to the violence hack. Gamified cash is the answer to exponential growth.

If the system can grow large enough, fast enough, it will become an unstoppable juggernaut, and the rest of the economic universe will need to come over to the new playing field.

Once the Amazons and Google’s of the world join the enjoying field, their self-preservation intuition will kick in and they’ll choose to shield and make bigger it. And this new network will behave differently. Instead of beneficial just the people at the top, who’ve been rigging the regulations in their favor for the reason that the beginning of time, the sport will totally reset with a new set of rules.

What’s best for the whole network, not just the few players at the top, is best.

“Blockchains are a new invention that allows meritorious contributors in an open community to govern besides a ruler and without money. They are merit-based, tamper-proof, open, vote casting systems. The meritorious are those who work to boost the network. Blockchains’ open and advantage based markets can replace networks formerly run by way of kings, corporations, aristocracies, and mobs.”

Those that join the network and assist it grow will thrive and flourish with it. It will amplify their personal value, making it grow faster than at any factor in history. Every ounce they give to the system will enlarge their personal rewards.

By c0ntrast, economies that stand in opposition to the network, trying to cripple it with arbitrary rules, will pay a heavy price. The machine will stretch throughout the globe and only the most essential policies will take root, because in order to upgrade a disbursed system, you need sizeable consensus across the network. Since humans can normally only agree on big, critical solutions, no self-defeating, narrow-minded guidelines will be allowed.

Let’s say that a usa decides to avoid ICOs to their residents altogether or make cryptocurrencies illegal. Instead of killing the network, the rules will blow returned on their creators. Only their personal humans will suffer, as they won’t be in a position to take part in the explosion of new doable that ICOs deliver to the table, draining money out of the financial system into rival economies. Even worse, if they make cryptos illegal, they’ll certainly force that cash underground, which will maintain them from getting tax from their citizens, which will starve them of revenue.

As the gadget spreads it will put people back in manipulate of their own monetary power. No one will be capable to take your cash from you. And that is a properly thing.

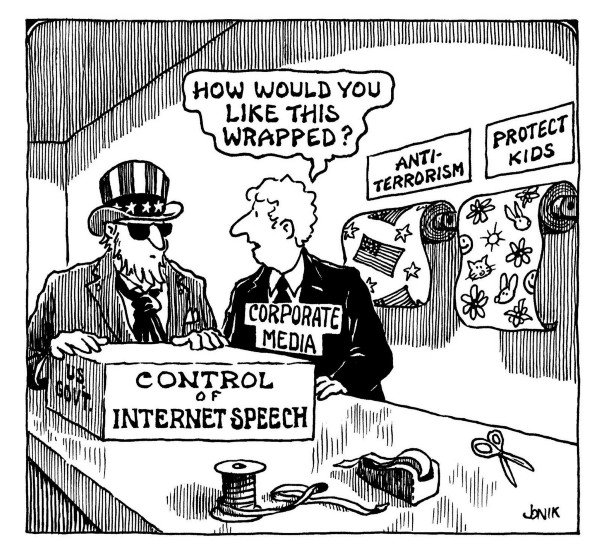

Of course, no longer every person thinks so. Some people continually worry that humans will do awful things with this power, like commit crimes. But humans will always do terrible things. They do these matters now and they always have. Crippling the system for all and sundry just to get these human beings is the height of insanity. It has by no means labored and it in no way will.

Still, some humans will in no way accept as true with that.

They have faith their central powers unquestioningly. All you have to do is wrap up your argument in “protecting the children” or “fighting terrorism” and you can commonly idiot half of of the humans half of the time about any terrible coverage you want.

Yet I’ve found that human beings who see central systems as the reply to everything have generally lived in a secure central device for their entire lives.

A few days in an unstable device would change their minds very quickly.

Don’t believe me?

Imagine you lived in Syria right now.

Your central infrastructure is destroyed, as is your money. You don’t desire the war, however there’s nothing you can do about it. Now your residence is gone, your friends and household are dead, your banks are bombed out and you’re forged out, adrift, homeless and penniless. Even worse, no person wants you. The world has shifted from open borders to constructing partitions everywhere. You’re now not welcome anywhere, you can’t continue to be where you are and broke.

But what if your cash used to be nevertheless there, recorded on the blockchain, ready for you to down load and restore a deterministic wallet and give it the proper passphrase to restore it?

How much less complicated would it be to start your existence over?

Cryptocurrencies ultimately offer a way for us to control our own destiny. For the very first time in the history of the world, we have a way to generate and distribute money except a central power. People will have manipulate over the cash they rightfully earned.

And even better, alternatively of setting the enjoying area so the recreation is constantly rigged, we can set the game up the way it used to be continually supposed to be played, with open opposition and bendy regulations in a dynamic gadget that approves everybody to compete.

But we want to suppose big. We want to find a way to distribute the money some distance and huge besides taking it from every body else. Do that and we exchange the recreation forever.

Thanks for reading! :) If you enjoyed this article,please:

DONATIONS:

bitcoin: 1PiirLZcRCcFxq2ARZYechzPffakZ8pmLQ

You have obviously put a lot of research and thought into this article. I think that it is possibly quite brilliant. But it is impossible for a reader, or at least me, to completely follow your ideas.

In what language was this article originally written? It seems to have been machine translated from another language into an English which is inadequate to fully transmit your thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This article is plagiarized, unfortunately.

Here is the source:https://hackernoon.com/why-everyone-missed-the-most-mind-blowing-feature-of-cryptocurrency-860c3f25f1fb

Dawn linked to this in basecamp, that's why I recognized it. It seems to have been translated to another language, and translated back.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not indicating that the content you copy/paste (including images) is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community and may result in action from the cheetah bot.

Thank You! ⚜

If you are the author, please reply and let us know!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i'll be honest i really enjoyed the post even if the title felt a little misleading but i guess it did it's job to get me in. i've been considering these things for a while now about the mobility of a wrist band that generated a small amount of a blockchain currency of value based on kinetic movement - i.e taking part, in a location on a task that you get credits for. really good to read the legacy of money! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This article seems to be a copy of this article by Daniel Jeffries on medium. Can @steemcleaners please look into this?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the investigation man. Changing my upvote to a flag.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's a shame, but I stumbled across the medium-post a few days ago and even bookmarked it, so you can guess how I gaped, when I saw the same post uncredited over here...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here is the original source of the article:

https://hackernoon.com/why-everyone-missed-the-most-mind-blowing-feature-of-cryptocurrency-860c3f25f1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Missed the point of your title

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @neno13! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Re-steem did work out for you. I fought your post through steemit Facebook share. Keep it up mate you are making some decent posts with a lot of work put on them. Hopefully you will get your audience. I am not gonna lie that a lot was lost in translation but you look like you canvercome that. Great post overall.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting, I want that app on my phone now!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've had enough warnings. !cheetah ban

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay, I have banned @neno13.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just did, text looks identical. You're a liar.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Open up their links that accuse me of seeing you lie @cheetah

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit