Taxes make money possible through the force of government. How does that make any sense?

This article is a follow-up to an article I wrote titled What Is Money? Real vs. Financial Assets. As the title suggests, in the first article I outlined the difference between real and financial assets, and I left a cliff-hanger how taxes are used to create stable currencies. I will be doing that now.

In the Beginning, Government Demanded Taxes

I will be using the term "tax instrument" to refer to financial instruments that are backed by the force of the federal government (focus on US government, though this applies to any government which creates its own currency). A tax instrument consists of a "tax asset" and a "tax liability", just like a financial instruments consists of a financial liability and a financial asset. Example: I get a car loan from a bank. The amount I owe the bank is the financial liability, and the amount the bank is owed is the financial asset.

The following is the process of creating and fulfilling a tax instrument, and the conclusions we can draw from its effects:

1. The Decree

First, the government declares a tax. This tax can be anything to government wants it to be. Gold, silver, iron dipped in vinegar, paper notes, electronic ledgers—anything.

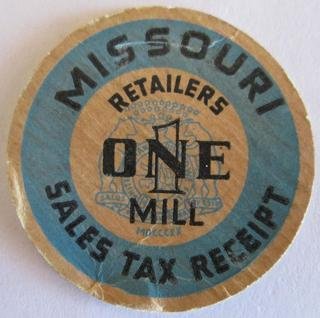

The government will then create a unit to measure this tax. Dollars, marks, gilder, francs, yen, euros, crowns—they’re just different measurement methods for measuring tax liability (just like feet and meters are different units for measuring length).

The government’s tax demand is thus measured in the unit it creates.

2. Taxes are a Financial Instrument

Taxes, like other financial instruments, create and asset and a liability. The people under the government’s jurisdiction now have a tax liability, which means the government has tax assets. The only way for the people to extinguish this tax liability is to pay with the appropriate unit of measure (dollars, euros, etc.), which I will commonly refer to as tax tokens.

Additionally, just like other financial instruments, all tax assets and all tax liabilities add up to zero and are created from nothing. The amount that the private sector is obligated to the pay the government is exactly the amount the government can expect to be paid. Likewise, the amount of tax tokens the government is obligated to accept as payment for taxes is exactly the amount that exist in circulation.

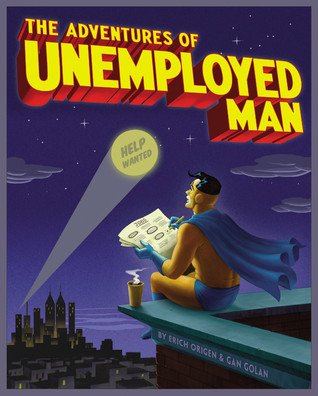

3. The Unemployment Phenomenon

The people, who need this tax token in order to avoid punishment for not paying their taxes, suddenly become unemployed. In order to get tax tokens, they need to become employed somewhere that pays in these tax tokens.

Even if the tax demanded is a specific material (like gold), generally speaking the gold must be a coin minted by the government with the government’s seal. Making coins with the government’s seal without license from the government is a punishable offense known as counterfeiting.

4. Creating Something from Nothing

The government then spends this money, which it created out of nothing*, into the private sector that needs it in order to pay their taxes.

Why would the government do this? What the hell is the point of collecting taxes if the government can just create tax token out of nothing? Because people need it to pay their taxes, they are willing to work for it. It is as clever as it is diabolical. The King, who theoretically has the ability to take whatever he wants from his subjects by force, can instead buy those things with money he created from nothing. It’s a violent transfer of goods and services from the private sector to the public sector, and the private sector will simply bring these things to him in order to get their tax tokens. It’s evil-overlord brilliant.

*Even if the money is made out of a resource like gold, the seal is what makes it acceptable as a tax payment and is the part which is “created out of nothing”.

5. The Birth of Money – Par Clearing

Now something strange happens. Possibly as an after-effect of the King’s greed and ego problem, there are now tax tokens circulating in the private sector which have a specific definition and a specific value. If the King issues and demands dollars for taxes, one dollar extinguishes one dollar of tax liability, and is equal to one unit of itself.

If we go back to the example of the mortgage, we saw that the mortgage could be paid in whatever we wanted. Gold, mowed lawns, beautiful virgins, tobacco, anything. However, the problem with these are they are real assets, and real assets are unclear in value. Is one beautiful virgin as valuable as the next one? The power of abstraction is it can create liquidity—one dollar is worth exactly as much as the next one, by law. There is never any ambiguity of its value to the King: an asset of one dollar extinguishes one dollar of tax liability.

This allows us to measure our medium of exchange, the mortgage, in the clearest and most universally valued thing available: the tax token.

The private sector, now armed with a universal currency, can engage in advanced economic activity. It can use the universal unit of measuring value (the tax token) to measure assets and liabilities in the same way we can use the universal measure of length (the meter) to measure distances.

This is why money (a financial asset) is more advanced than a system of barter (real assets). In the case of the state-originated money, a universal measure of value can simply be declared by threat of violence. Systems of barter are ultimately subject to the lack of uniformity and the volatility of the market. The “market demand” of money is largely controlled through taxes.

But! The libertarians and Austrian economists protest—this universal measure of value can be accomplished with gold due to its useful features. Gold is malleable, it doesn’t rust, it’s easily divisible, and can be (nearly) exactly measured by its weight!

Further!—they cry—Government currency is just as vulnerable to market forces on foreign exchange markets.

These are excellent points to bring up. However, and we will be exploring this more later when we get to the Pyramid of Money, the real question that needs to be taken into account when choosing a material for money, is should an advanced and modern society be limited in its ability to create financial assets, which by definition are generated from nothing, by what it can mine out of the ground?

It’s also important to point out that historically, when governments used gold and silver as money, that money was still fiat—it was valued by decree. The historical ratio of 12:1 for silver to gold was by state decree, not by market forces. Even when the US was on the gold standard, gold was measured in US tax tokens (dollars). An ounce of gold was defined as being worth 36 US dollars. Again, this was due to state decree, not market forces. There is no evidence in history of gold spontaneously arising as money in the free market. It was the material that the money was carried on—not the money itself.

6. The Glory of the Deficit

There is another difference between tax-based financial instruments (a.k.a. “money”) and private sector financial instruments. In the case of the mortgage, if the borrower doesn’t pay, there is someone who loses out. If the lender is a bank who extended the loan, the bank is out its initial principle and its potential interest. If the mortgage was done via seller financing, where the buyer simply owes the seller money to compensate him for the value of the home, if the buyer stops making payments, the seller loses out on the value of his house, plus any potential interest from him financing it himself.

In both of these cases, the is a real loser if the financial instrument, the mortgage, isn’t extinguished per its agreed-on terms.

But this isn’t the case for the government’s financial instruments. When the government demands a tax of its citizens, this creates a tax liability for the citizens and a tax asset for the government, but the government doesn’t lose out on anything if the citizen doesn’t meet the obligations of his tax liability by paying tax tokens. The government can create as many tax tokens as it wants; it doesn’t need the money back. The government doesn’t lose out on anything if the tax instrument isn’t extinguished. Yes, the government needs to tax in order to make its tax tokens valuable in the first place, but doesn’t need those tax tokens in order to spend.

In fact, if the government were to tax all the money back it created and extinguish its financial instruments, the private sector wouldn’t have any money to use at all.

What this means is that, because the government doesn’t lose out on anything by the tax payer “defaulting” on tax instruments, it NEEDS to not cancel them out if it wants the private sector to have a functioning economy.

The conclusion is so bizarre it is easy to mistake it for a contradiction:

Government debt IS private money.

8. Completed Mosaic

This is the science of money: how a society makes a universally-accepted measure of value. It needs to be done through financial instruments, and taxation is a financial instrument which is the easiest way to guarantee uniformity of value. Tax instruments, like other financial instruments, add up to zero:

For the taxpayer, one dollar is an asset, which extinguishes the taxpayer’s liability of owing taxes to the government.

For the government, one dollar is a liability, because the government is obligated to accept it for tax payments.

I want to point out here that I’m not claiming that government is required to create a uniform and universally-accepted currency. Private currencies are a fascinating subject, but beyond the scope of this article. For the sake of understanding money as it exists now, I am focusing on state-created money. If we are ever to learn how to create private, functioning currencies, we need to understand how currencies work in the first place. Because the state has had a monopoly on the creation of money since the inception of money, state money is the only factual example to draw our understanding from.

This article is an ongoing work to help promote and understand the Modern Monetary Theory, particularly geared to those who have conservative, libertarian, or Austrian economic backgrounds. If you found this article interesting and would like to learn more, feel free to check out my Youtube series MMT for Conservatives.

-Dylan Lawrence Moore

@volsci

Follow, re-steem, and share. Thanks!

Follow me on Youtube!

In several American colonies hemp was legal tender and you could use it to pay your taxes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup! The government can choose anything it wants for you to pay your taxes with.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

maybe people wouldn't complain so much about them if you could pay with your lawn clippings.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yea but then their money wouldn't be worth anything.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by CrazyRogue from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit