14 facts about the world financial crisis "which is not." - Part 1

Foreign trade of Japan: the strongest fall since 2009

The collapse of Japan's foreign trade. Import of the country declining for 19 consecutive months and in July fell in annual terms by almost 25% - this is the strongest decline since October 2009.

Decreased and exports (14%), and it is also the strongest decline since October 2009 a Major factor in the decline was the problem one of the biggest trading partners - China: where the trade balance fell by 44%.

And most importantly - improvements in the near future should not wait. Despite all the efforts of the Bank of Japan, the yen continues to strengthen, and the pair dollar/yen has fallen below the critical level of 100 yen per dollar.

A strong yen negatively affects the earnings of Japanese exporters and undermining the efforts of the authorities to stimulate inflation and economic growth.

On the eve of the Japanese authorities have tried once again to prevent the yen's appreciation. Deputy Minister of Finance of Japan, in charge of monetary policy, Masatsugu of Asakawa said that the government will have to take action if the rapid strengthening of the yen will continue.

This statement is probably a signal of the willingness of the Japanese authorities to resort to direct intervention in the foreign exchange market, says MarketWatch. The last time Japan conducted direct intervention in the currency market in 2011

However, as we have seen, market participants such threats would not scare. The strengthening of the yen also contributes to the release of the minutes of the last meeting of the Federal reserve system of the United States. Market participants saw it as a sign of imminent rate increase and started to sell the dollar. Well, since the yen is a major currency, the dollar falls to her in the first place.

Japan recorded the largest over 7 years, the drop in foreign trade

Japan in July recorded the biggest since 2009 year the decline in foreign trade.

Imports fell 19th consecutive month - by 24.7% yoy. The volume of exports fell by 14%, continuing a continuous decline, which lasts 10 months.

Exports to the US fell by 11.8% in the EU - 6.5% in China, which is the largest trading partner of Japan, and by 12.7%.

Reduced shipments abroad of Japanese cars, ships and steel. These components were the main contributors to the overall decline.

"The situation is a growing concern, especially given the fact that the industry in the United States, Taiwan, and South Korea is restored," said Bloomberg Macaques Kuwahara, a senior economist at Nomura Securities in Tokyo.

Japanese exports losing its appeal amid rising yen - after a nearly two-fold drop from 2011 through 2015, the Japanese currency suddenly shifted to growth, despite the fact that the country's Central Bank continues to pour financial markets with money, spending unsecured emission of 80 trillion yen per year, and giving out loans at an interest rate of 0.05% per annum.

In early trading, the dollar against the yen fell to of 99.65 yen per dollar below the key mark of 100 yen, which, according to traders, may be the pain threshold for the Japanese Central Bank. Since the beginning of the year, the yen strengthened by 16.6%.

It is not excluded that the Bank of Japan has reached a critical point beyond which his policy has no more effect, said Bloomberg strategist at Bank of America Merrill Lynch in Tokyo, Shuichi Osaki.

The Central Bank buys from the banks are mostly government bonds, on its balance sheet, almost half of all the commercially available papers. "Banks simply have nothing to sell, they can't stay completely without bonds, which is necessary, for example, as collateral," says Osaka.

Traders polled by Reuters believe the Bank of Japan may begin direct intervention if the yen will stay at above 100 yen per dollar.

S&P: negative interest rates — a sign of the desperation of Central banks

Negative interest rates imposed by Central banks in Japan and several European countries, affected more than 500 million people and a quarter of global GDP, according to analysts of rating Agency Standard & Poor's (s&P).

In their opinion, the introduction of negative rates is "a sign of the desperation of Central banks", which will lead to "unforeseen consequences." S&P believe that the practice of setting negative interest rates would increase risks and would put pressure on Central banks, which so frightened of the unfavorable political situation in the world.

According to S&P, such rates have had a negative effect on bond yields, as well as on activities of insurance and pension institutions due to the reduction of inflows.

Recall that in March this year the European Central Bank (ECB) lowered the key interest rate from 0.05% to 0%, and the rate on deposits to minus 0.4% from minus 0.3%. The interest rate on loans was reduced from 0.3% to 0.25%. The same interest have introduced some European States, EU and Japan.

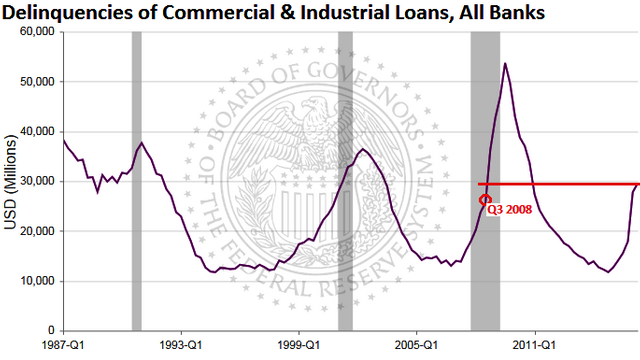

FED: the Level of overdue corporate loans has updated the record with the first wave of super crisis

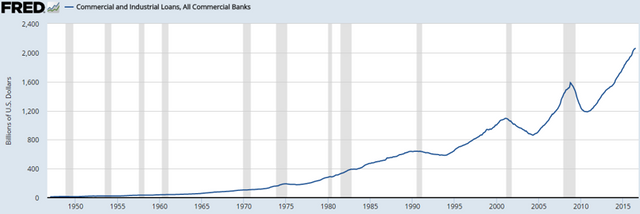

The local minimum on delay in corporate lending (сommercial & industrial loans) came in the 4th quarter of 2014 (the time of turning off the printing press), after which the corporate credit bubble began to deflate. As reported by the fed at the end of the 2nd quarter of 2016 the delay increased to 150% from the end of 2014 (delay = due payment is not received with delay of 30 days or more).

The current level of delay (1.6%) is only slightly less ominous 3rd quarter 2008 (1.76%). It should be noted that the level of corporate debt has increased significantly since 2008, so the damage from the collapse of this debt bubble will be more powerful.

Environment for the mythological "rate hike", as you can see, just great

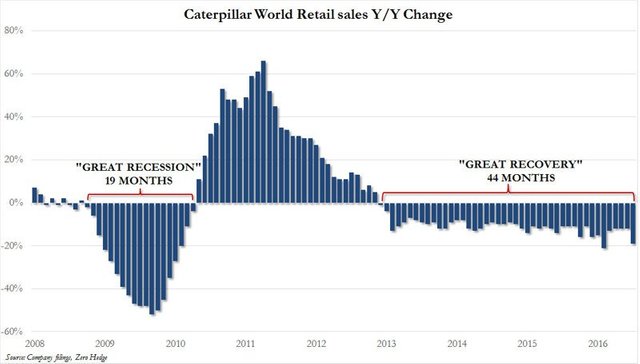

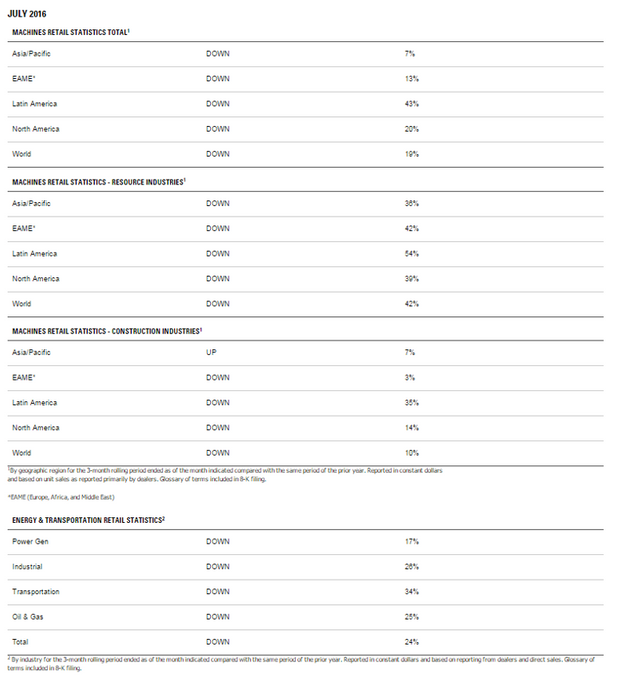

Caterpillar: Sales declined for the 44th month in a row - almost refreshing-month record drop

Caterpillar, a leading engineering Corporation USA, preparing for the 4-year anniversary, its sales are reduced for 44 consecutive months (compared with the same month a year ago). Slowing down is not particularly evident - in July, a drop of nearly set a record with the first wave of super crisis, second only to the fall in February of the same year.

However, anyone interested in the dynamics of sales of leading corporations when there is a stock exchange?

American teachers complain of the curtailment costs (CBS News)

Teachers in the United States have long helped cover the cost of school supplies out of pocket. But the financial burden is becoming heavier on the background of reduced funding of public education.

Eva siefert, who teaches OUT of approximately 300 students in high school and in two primary schools in Naugatuck, Connecticut, said that her budget for school supplies is $1.60 per student per year. 12 years ago, it was $15 per student per year, i.e. a decrease of 10 times.

“I don't know anyone who has not climbed in your own pocket,” she says. - “Most teachers love their students and want to have an environment as safe as possible and as comfortable as possible, so you have at their own expense to buy disinfectant for hands, napkins, crayons, art supplies, folders, or individual books.”

This approach "can-do" laudable, but not always practical in a situation where wages remain relatively modest and where the States, still recovering from the crisis, cut funding of education to close their budget gaps.

“We used to have conspriacies was in the pantry, but now it won't open, and it is necessary to obtain permission from the Director,” explains siefert. Saving mode includes control over the use of copiers: some teachers reprimanded for using too much paper, she added.

Parents are also often asked to help with money or other materials for lessons.

The percentages vary from state to state, but average about 46% of the costs of education are the budgets of the States, 45% - local authorities and the Federal government covers the remaining part.

According to a study by NGO "Center on budget and policy priorities," published earlier this year, a majority of States (31 States) have cut funding for every pupil in 2014. in comparison with 2008. and some States continued this figure to be cut. At least 15 of these States, the decrease exceeded 10 percent.

[The remainder of this article describes how the most advanced school of despair learn to beg on GoFundMe. Here's another interesting observation of the teacher from a poor area ghetto of Boston: Junior high school students fear the onset of summer vacation. “A routine school day very convenient for them. They like to come where they know exactly what will happen.”]

China: the Collapse of passenger traffic

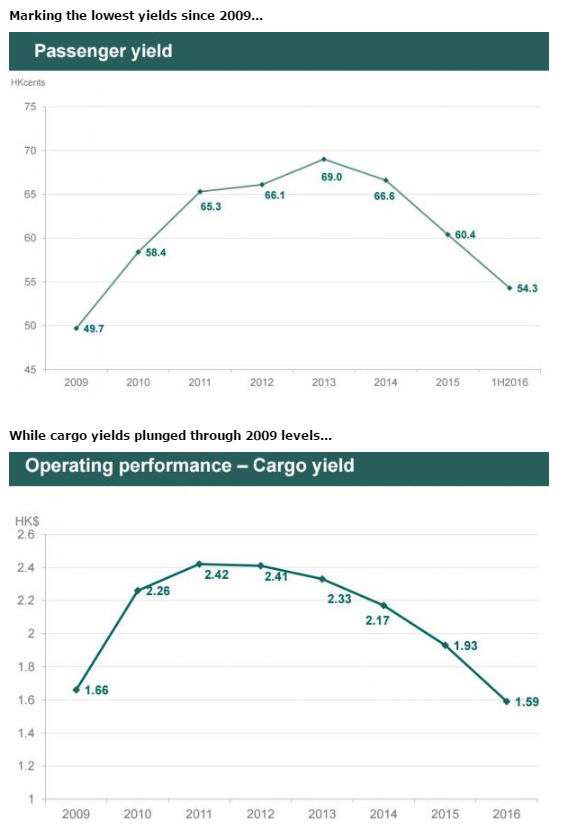

Chinese airline Cathay Pacific reports drop in revenue over the year by 9.3% and profits by 82% due to weak demand, especially in premium segment. In particular, it noted the first since 2009 a decline in corporate orders for Hong Kong in the second half of the year improvements are expected.

The fall of the Chinese exports and imports in dollar terms exceeded forecasts in July

Chinese exports in dollar terms in July 2016 fell by 4.4% in annual terms, while imports fell by 12.5%, according to data published on Monday, the General administration of customs of the PRC.

In June, imports declined by 4.8%, export - by 8.4%.

Analysts polled by The Wall Street Journal on average expected reduction of the value of imports in July by 3.6%, export - by 8.9%.

The trade surplus of China last month rose to $52,31 billion is expected to average $48 billion from $48,11 billion in June.

However, Chinese exports in RMB has accelerated growth in July to 2.9% in June to 1.3% and imports in RMB decreased by 5.7% after falling 2.3% in June.

The trade surplus rose to 342,76 billion yuan with 311,2 billion yuan a month earlier.

European banks waked up and thought about switching to storing reserves in cash

European banks and insurers thinking about keeping cash reserves in cash and not in electronic form in banks. A reason for returning to this practice was the widespread negative interest rates

For European banks and insurance companies keep financial reserves in the form of cash getting financially justified in terms of further easing, writes the Financial Times. In the case of a transition to such a practice will undermine the ability of Central banks to stimulate economic growth through the use of negative interest rates, the newspaper notes.

According to the publication, after a decline in March this year, the base rate of the European Central Bank (ECB) to 0% private Eurozone banks pay not more than 0.4% per annum for most financial instruments. The ECB tried to revive the economy, forcing banks to increase lending to business, and not just keep the money in the accounts. 2014 Bank losses from low interest rates amounted to €2,64 billion, says FT.

German reinsurance company Munich Re, according to the publication, conducted an experiment for the storage of eight-digit amount of euros in cash and recognized costs reasonable. The second largest German Bank, Commerzbank, according to the FT, is already considering a move to storage of cash.

On the one hand, says the FT, if the banks will keep their cash, then they will not effect a further reduction in the basic rate, and they will have no incentive to develop credit. On the other hand, banks will have other costs associated with the storage and transportation of money. According to the bankers, they have appropriate sized areas for the storage of banknotes of €200, which will be the largest denomination banknotes after the cessation of the issuing of banknotes in €500 in 2018.

In addition, banks will have to find insurers ready for a reasonable price to insure the cash from the robbery, earthquakes and other force majeure. According to one of the German bankers, the insurance will cost 0.5–1% of the face value of the stored banknotes. The publication notes that these costs can be justified given the rates of the Swiss Central Bank to minus 0.75 percent.

The FT calculated that if you hold the banknote to €200 in a standard portfolio, then it will fit the equivalent of $2.4 million If to insure it at 0.75% per annum, the cost would amount to $18 thousand Under the double bed with a width of 1.5 m, according to the newspaper, you can keep $100,6 million In this case, the insurance will cost $754,5 million In the RV length of 8 m to accommodate the notes for $7.8 billion, Their insurance will cost $58.5 million Hotel room is medium in size and can score all the bills on $11.9 billion, insurance costs in this case will be $89.25 million

The newspaper notes that the transition to the storage of reserves in cash to private banks will have to obtain permission from the Central banks. If this practice running with a sufficient number of banks, it will lead to an increase in cash money.

Currently in circulation are banknotes of Euro in the amount of €1,087 trillion. Bank reserves that they can claim in cash the regulator, amount to €988,1 billion in Total this cash can be put in 954 988 portfolios under 22 984 beds, 298 RVS or fill its 195 hotel rooms, sums up FT.