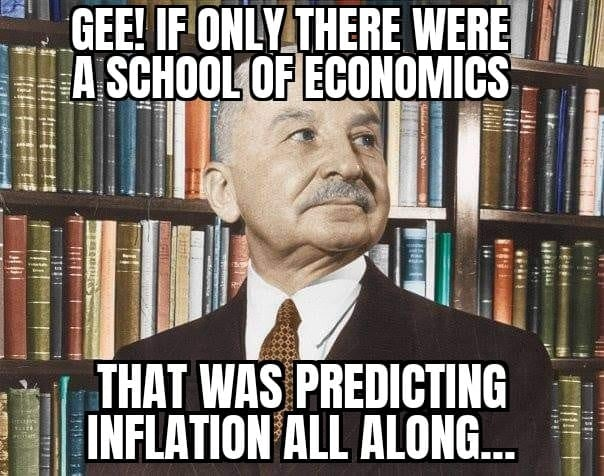

The Austrians (Mises, Hayek, Röpke) were right in their internecine battle with the monetarists of the Chicago (Friedman, Wanniski, Laffer, Sowell) about inflation. The world is about to find out the hard way what Mises and Hayek lived in the interwar years.

When Mises and Hayek worked at the Vienna Chamber of Commerce they saw one week with 1,000% inflation. We simply cannot have the Fed creating all this new fiat money and not have it cause inflation, unless, and this is the sneaky thing Röpke seemed to intuit, inflationary monetary policy is implemented during a time when deflation is what would be the natural corrective to the market. Artificially propping up prices only inflates the bubbles before the burst and delays the recovery after the burst (like we learned with Quantitative Easing under Obama).

Mises book “On the Theory of Money and Credit”, and Rothbard’s “What has government done to our money”, blew my mind.

Most people don’t care because the government and media paint inflation as some strange phenomena. If they ever talk about it’s cause, which is rare, it’s attributed to something like capitalist greed or some other nonsense designed to deflect from the real reason.