After the United Kingdom’s economic woes post-Brexit, it’s quite interesting how most publications blame the downturn on Brexit itself rather than the interest rate cuts mandated by the Bank of England immediately following Brexit. We’ve seen in the U.S., China, and Japan that Quantitative easing and flooding the market with cheap money doesn’t work. Yet many central banks continue the same policies expecting different results.

Quantitative easing is one of their main tools for “managing” the economy. Central banks loan out million, billions, and over time trillions of dollars to smaller banks and investment firms to “stimulate” the economy. They typically do this when interest rates are low. The general idea is the more money in the economy the more people spend and invest. But this glut of currency never makes into the hands of the public. But what it does do is devalue currency in circulation through inflation.

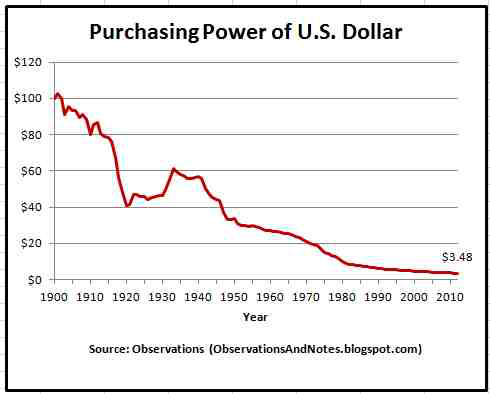

Inflation is a major problem for consumers as it steals purchasing power over time. Let’s say you saved 400,000 dollars for retirement. Within 20 years your cash could lose 10 to 30 percent of its value. In turn the cost of medical care, housing, and food will go up. The pop that used to cost you a nickel is now a dollar fifty. It’s the same for every facet of the economy. Add in taxes and stagnant wages and now you have the ingredients for economic decline. Now consumers have to work more to keep up with the rising prices or have drop their standard of living.

Now this cycle isn’t as unhealthy for the stock market at first glance anyway. All of this excess capital is soaked up by governments, investment firms, banks, corporations, and private investors. They invest heavily in the market driving up valuations beyond normal levels. These bloated securities in conjunction with ease of access to loans cause average people to invest in the market. I think we’re all familiar with what happens next. Somewhere along the way an investor can’t pay back his debt. The bank has to default on the loan. At this point the lending bank calls in its existing loans from other banks, but the other banks are also overleveraged with bad debt and little reserves. Stock prices drop as the cash inflow stops and investors try to sell of any securities they have to make a return on their investments. Before any of this happens the smart money typically super rich investors have already pulled out of the market while average folks, day traders, and retirees with retirement funds lose out big time. This has happened multiple times notable example include The Panic of 1907, the 1929 crash that preceded the Great Depression, and the more recent 2008 housing crisis.

What makes all of this possible is interest. Without it bankers would have no incentive to lend. Low interest rates make lending attractive across the board from investment banks to home buyers. Whereas higher interest rates deter lending. But easy lending also creates a backdoor inflation. As banks lend in excess of their reserves the money supply increases, therefore cheapening the value of currency in existence. So you can buy that car or house you can’t afford but what happens when the market goes bad and interest rates go up? This system incentivises poor decision making instead of efficiency which is necessary for a productive economy. We have finite resources and the better they are utilized the better for society. Instead we have a system based on greed. It would be wiser to do away with for profit lending entirely and bring lending back to being a more personal affair without interest where the integrity of the individual is the only collateral.

But there are options outside of this fiat currency system. The best way to mitigate the dangers caused by central bankers is to borrow as little as possible or not at all. Own real tangible assets like silver, gold, land, and useful skills. Slowly but surely we will take our economic sovereignty back.

Sources:

https://fred.stlouisfed.org/series/WCURCIR/

https://en.wikipedia.org/wiki/Fractional-reserve_banking

https://en.wikipedia.org/wiki/Panic_of_1907

https://en.wikipedia.org/wiki/Wall_Street_Crash_of_1929

https://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%9308

http://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Yes its real . thank you for this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

shipping you a tip for your nice content... :}

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit