Punctuated equilibrium is a theory in evolutionary biology which proposes that evolutionary development is marked by isolated episodes of rapid speciation between long periods of little or no change. These episodes often emerge as a result of unexpected change in the environment which these species inhabit or by their relocation to a new environment. Having in mind this, can we perceive the appearance of the collaborative economy as a new evolutionary step in the worlds’ socio-economical current?

If we try to put the evolution of the collaborative economy on a time scale, we’ll find its most prominent protagonist, like Uber, Airbnb, Kickstarter, Lending Club, TaskRabbit etc. all founded between 2007–2009. What caused this development, what was the environmental change that happened in the worlds’ economy that led to the emergence of the collaborative economy?

The global financial crisis comes as a first clue. How did the global financial crisis managed to give birth to the collaborative economy or at least give it a massive boost? To clarify, forms of collaborative economy existed prior to 2007 with Wikipedia, Open Software, Craigslist, Napster etc. leaving a mark on the way people cooperated among each other. The financial crises just managed to profile this trend in more precise business concepts and push it to the mainstream.The financial crisis in 2007 was the biggest economic crisis since the Great Depression (1929–1939). It left many companies, banks and even whole countries in debt and many even bankrupted. The crisis emerged because of the lack of regulations and monitoring from the governments over the banking sector and ended up by governments bailing out banks and corporations. The official amount of the bailout package in the US was 1.5 trillion dollars, most of it spent by the US government on saving banks, auto industry, insurance companies etc. Caught in-between this great transactions and helping programs stands the household loss of over 13 billion dollars which the Government never compensated i.e the US government. This crisis emphasized the axis formed by governments, banks, corporations (backed up by eminent economist and universities) and revealed its strength, their tight connections and the ways in which these institutions run the reality.

Public awareness regarding the economic reality rose significantly during this period. Newly advanced technologies and social networks only helped in wide spreading the flaws of old establishment as it helped spreading the idea of the new opportunities .

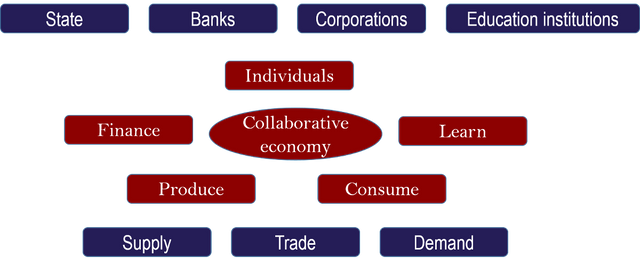

Trust shifted from the state, banks, corporations and institutions in general — towards people.

The old social-economic pillars got publicly exposed and lost the TRUST they enjoyed among people. Citizens lost their trust in the institutional competence to anticipate and prevent black swans to happen. Also emerged, a high level of distrust in the institutional ability to manage these sorts of collapses, since they openly showed inclination toward banks and corporations. So people’s TRUST shifted towards individuals. Even though trust is a concept that is more used in psychology and sociology textbooks, it is a basis for many human interactions including the economic ones.

More revenue streams and less consuming costs.

People needed to survive this crisis and they had to find new ways to cope with it. Missing the feedback expected from the appropriate institutions, survival instinct orientated individuals to a more participative approach in the economic cycle of supply, trade and demand. Trying to diversify the revenue streams and cut consuming costs were the most logical solutions for the households to endure in a time of a big institutional failure in providing a safety net for them.

This new way of comprehending economics and redefining the individual involvement in the processes is the basis of the collaborative economy as can be seen from the definition given by R. Botsman:

“An economy built on distributed networks of connected individuals and communities versus centralized institutions, transforming how we can produce, consume, finance, and learn.”

The definition lacks the trade part of the economy’s building blocks. This part is covered by the internet, the world’s biggest marketplace for material, financial and intellectual goods and collaborative economy’s natural ally. Internet’s decentralized structure perfectly matches the collaborative economy’s distributed networks.

As we can see from the graph and from the definition, in theory collaborative economy has covered the entire institutional and economical aspects for developing a valid ecosystem. Losing their monopoly over the economic processes, money flow and losing the trust and control over the data and knowledge, old institutions and the mainstream media started labeling the collaborative economy as disruptive. The truth is that the economic crisis and its participants are the ones that disrupted the society. Collaborative economy only disrupts the present institutions i.e banks and corporations.This is the first of a series of posts which i’ll be writing on the subject of collaborative economy. Posts will cover the following:

- the evolution of collaborative economy;

- supply, trade and demand aspects of the collaborative economy;

- the future effects collaborative economy will have on world economic processes;

- philosophical and economical concepts that can be perfectly mapped to the settings of collaborative economy;