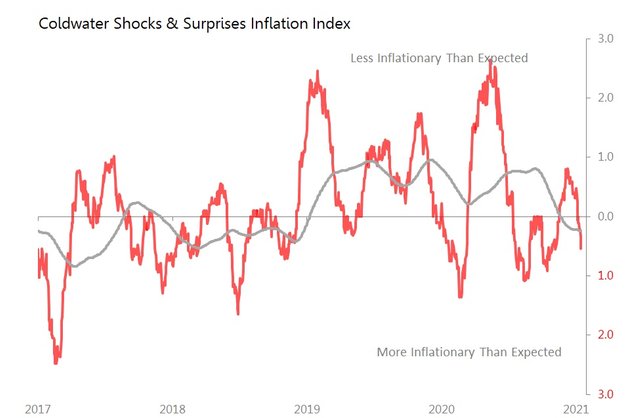

Near-zero or negative interest rates give the official view that inflation is certainly dead, and that deflation is all we can expect. The Coldwater inflation shocks & surprises indexes begs to differ: it is now signalling more inflationary pressure than assumed on both a 4wk and 12m basis for the first time since 2018.

The first two weeks of the year have reported on 28 direct price indexes. Of those, only one showed inflationary pressures less than expected, whilst seven reported more inflation than expected, and 20 were neutral. Today we saw US import and export prices rising more than expected; yesterday Germany's WPI was more inflationary than expected; and on Monday it was China's PPI which did the damage. In other words, the inflation signal is coming from all over the globe.

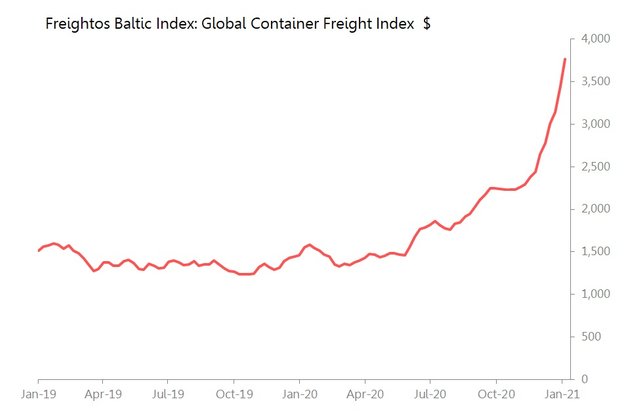

In the short term, there's certainly more to come, since the CRB commodities is up 5.1% since the beginning of the year, Brent crude is up 8.2%, and in the 4skt to 8th Jan, freight rates were up 35.3%.

So it's maybe not surprising that US bonds (10yr yields 1.1% and rising) are getting a kicking.