Before the USD held the throne, as the global reserve currency, the British were the world’s most dominant military power and they controlled the seas, as well as global politics.

The GBP, their currency, was sound as a rock.

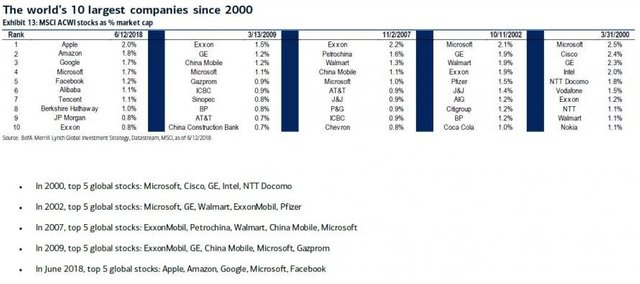

But, as with anything else, you don’t stay on top for good, no matter how talented you are. Look at the changing list of the world’s top ten companies, and you’ll realize we live in an ever-changing world, whose one main constant is that it is always evolving.

Courtesy: Zerohedge.com

Right now, the world is making a massive migration, one, which happens every few hundred years, but it is as critical as oxygen to your future and to your livelihood, to be fully aware of it.

The world is moving east, toward China.

330 million Americans are no match for 1.4 billion Chinese concerning productivity. The transfer of wealth from west to east is no small feat and happened last during the days of the Ming Dynasty, hundreds of years ago.

It brought prosperity to Europe and impoverished China – this time might be different because the American way of life, with its enterprise system, has proven to be a great wealth creator, unleashing human potential through competition.

China is following this path, opening the door to foreign investors, making its stock market more robust and more stable.

You need to figure out how to capitalize on this, since big money, the billionaire type, is there.

I’ve invested over the years in parking lots at China’s major cities, as they are suffering from an acute shortage of space for vehicles, and even in ways to help tens of millions of permanent bachelors and bachelorettes find their significant others because the male/female ratio is completely out of whack – the One Child Policy has made demographics a huge problem.

Now, with cryptocurrencies and blockchain technology, there are new ways to add value to the new Chinese economy.

As a professional in a related industry, an entrepreneur or an investor, our job is not to fight the trend, but to adapt to it.

1.4 billion people are entering the global economy, most of which have never enjoyed wealth before 2018. Their appetite is great, so stay alert to opportunities because the cumulative wealth of the world is growing by leaps and bounds.

The biggest problem China faces is that it loaned Washington over $2T, so it has a vested interest in seeing the U.S. flourish.

This is why war is unlikely between the two countries, though the media has been duping the average person to think it’s possible. The truth is, just as in the days of the Cold War, that over-hanging fear allows both governments to keep growing larger, militarize, and expand their reach.

Pure Blockchain Wealth sees the U.S. succumbing to Chinese dominance, starting in 2025, and truly forking over the crown by 2035.

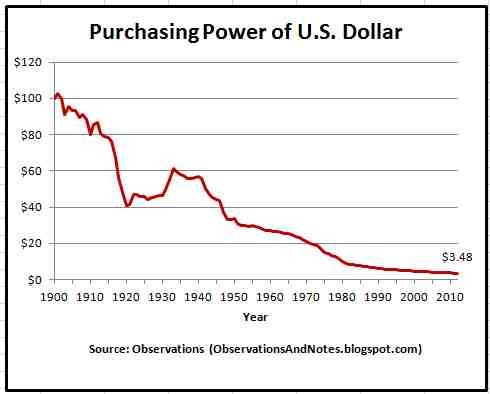

Therefore, the USD becomes a risky asset class to own outright. Don’t get me wrong – if you own a property worth $100,000 and the USD loses 30% of its strength, it doesn’t mean your house is worth less, but it does mean that any cash savings has far less purchasing power.

This is what you must be aware of – the erosion of the USD’s artificial value, since any country, which has $21T in Federal debt, doesn’t deserve to have a strong currency.

We’re living in an era of fiat currency debasement, which comes from the term “Base Metals.”

In the days of gold and silver coins, emperors would mix base metals, the cheaper copper and lead metals, to trick the public.

You can fool people for a while before hysteria finally kicks-in.

Don’t sit on massive cash hoards – deploy cash into assets, which produce cash flow, or buy non-productive assets, which retain value, such as precious metals, collectibles or art.

Whatever you do, don’t allow the government and the elite bankers to suck you dry.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com